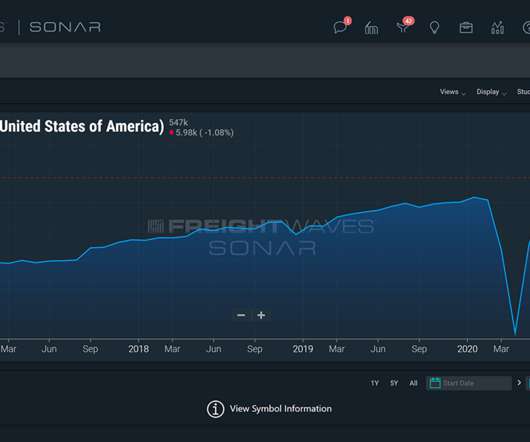

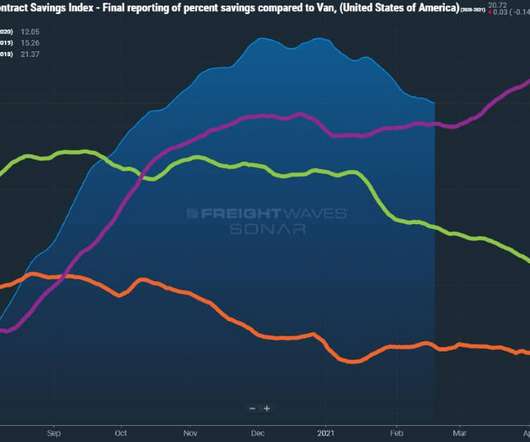

High-quality freight data is vital for supply chain automation

FreightWaves SONAR

JULY 17, 2023

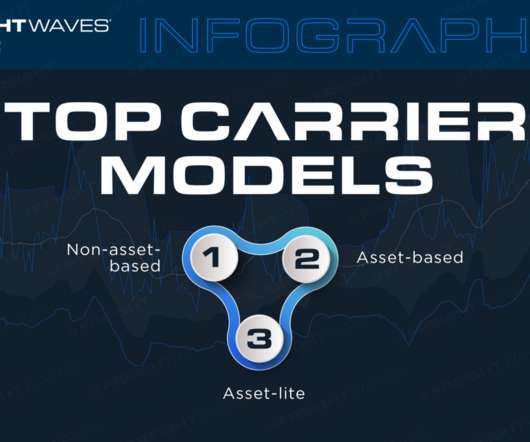

Third-party supply chain and freight market data has become an important tool for retailers, manufacturers and suppliers who want to redesign their networks, improve strategic planning, benchmark their transportation spend and the service they’re getting in return, and measure the efficiency of their facilities.

Let's personalize your content