[WHITE PAPER] SONAR Customers Outperform

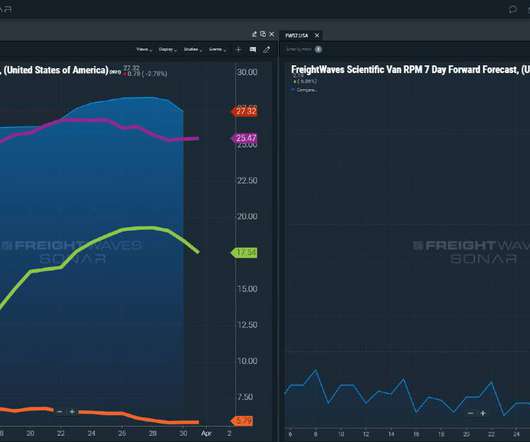

FreightWaves SONAR

OCTOBER 1, 2021

In this report, we put forth an interesting, and admittedly imperfect, way to demonstrate SONAR’s value: publicly traded carriers and freight brokers that use SONAR have outperformed those that do not. It follows that the most efficient users of capital in the freight industry find SONAR to be a worthwhile investment.

Let's personalize your content