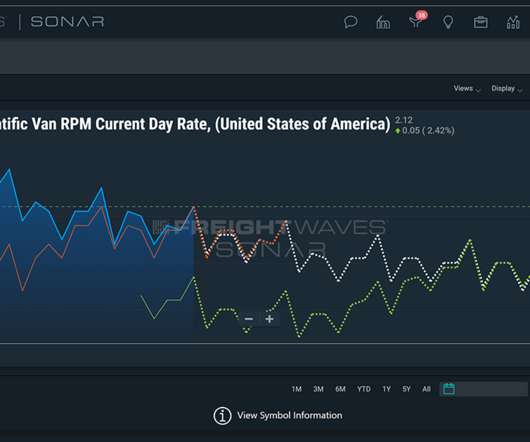

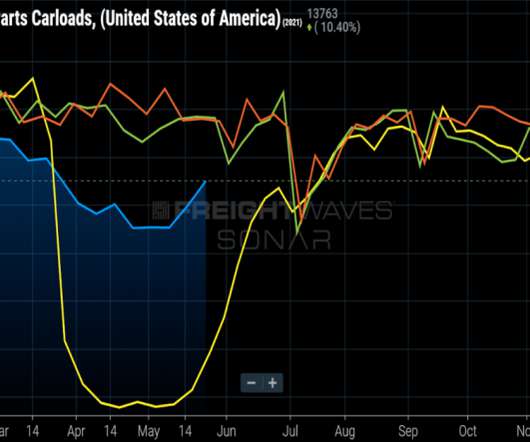

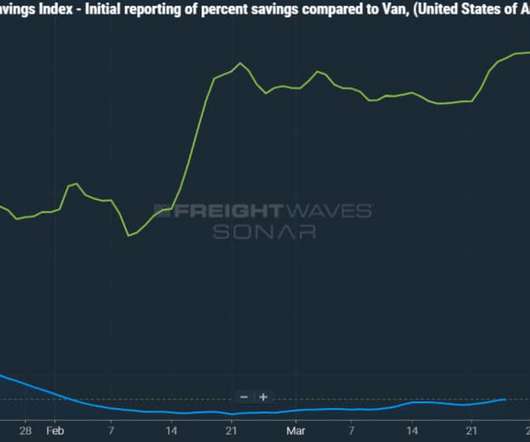

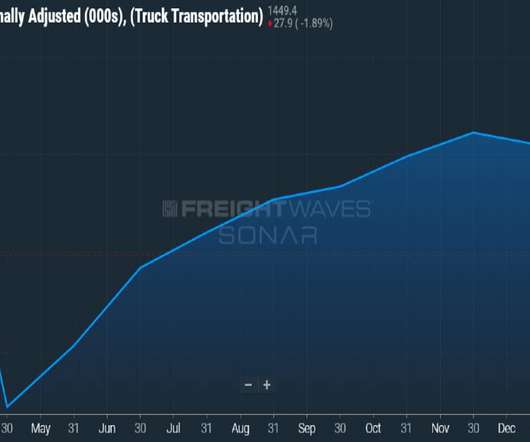

Using SONAR to Understand Local Markets and Seasonality

FreightWaves SONAR

APRIL 30, 2024

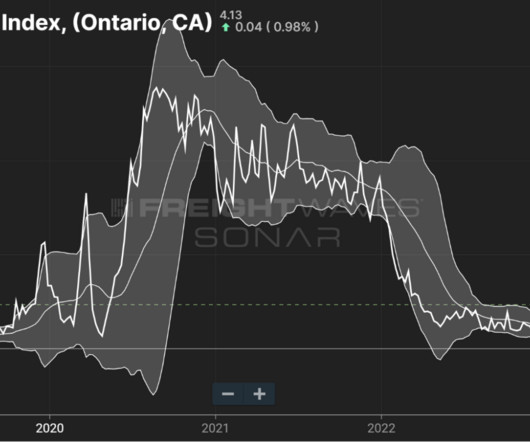

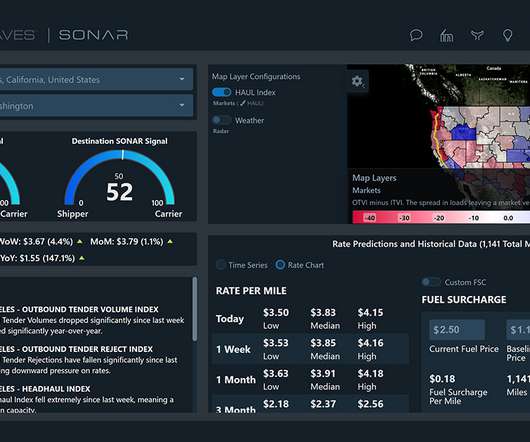

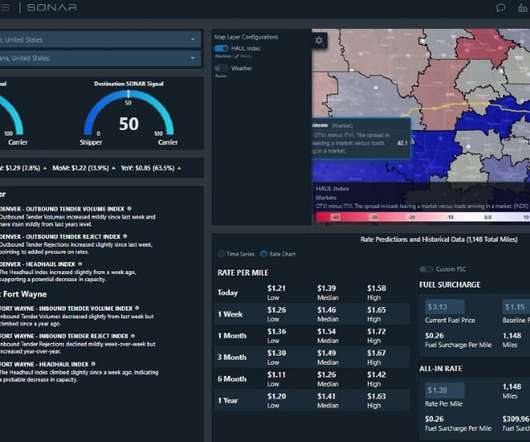

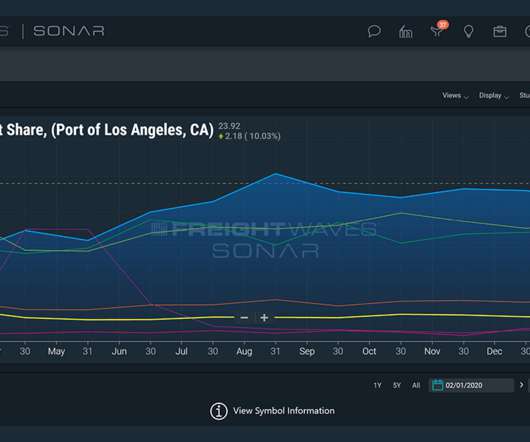

While very few industry players need to worry about all of these markets all the time, taking stock of the national-level information from your own dashboards alongside key market areas (KMAs) can fully empower decision making in an ever-changing market. Take one of the biggest markets in the land: Ontario, California.

Let's personalize your content