[WHITE PAPER] Shippers pay more for packaging while paper and packaging companies face rising input and freight costs

FreightWaves SONAR

JULY 26, 2021

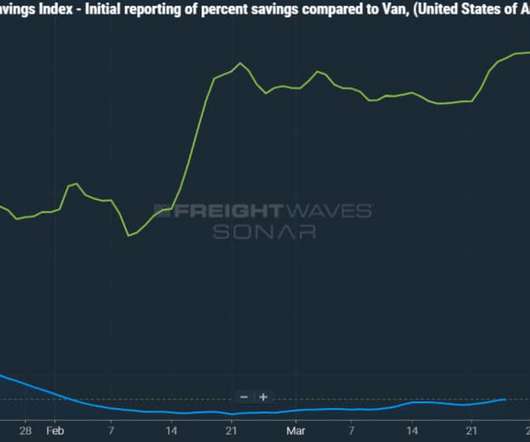

One year ago, we wrote a white paper in which we estimated that the top five paper and packaging companies in the U.S. Despite the revenue declines posted by the industry in 2020, we believe that industry freight spend is just as high as pre-pandemic levels due to growth in packaging demand and higher freight rates.

Let's personalize your content