November 15, 2023 Update

Freightos

NOVEMBER 15, 2023

Blog " * " indicates required fields Email * Email This field is for validation purposes and should be left unchanged. Asia-US East Coast prices (FBX03 Weekly) climbed 3% to $2,421/FEU.

Freightos

NOVEMBER 15, 2023

Blog " * " indicates required fields Email * Email This field is for validation purposes and should be left unchanged. Asia-US East Coast prices (FBX03 Weekly) climbed 3% to $2,421/FEU.

Freightos

NOVEMBER 7, 2023

Blog " * " indicates required fields Email * Phone This field is for validation purposes and should be left unchanged. Asia-US East Coast prices (FBX03 Weekly) climbed 7% to $2,357/FEU.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Freightos

DECEMBER 19, 2023

Blog " * " indicates required fields Email * Name This field is for validation purposes and should be left unchanged. Asia-US East Coast prices (FBX03 Weekly) were level at $2,509/FEU.

Freightos

DECEMBER 28, 2023

Blog " * " indicates required fields Email * Phone This field is for validation purposes and should be left unchanged. Asia-US East Coast prices (FBX03 Weekly) were level at $2,505/FEU.

Envase Technologies

MARCH 27, 2023

Envisions was a tremendous success, blending a user conference, networking opportunities, tech demos, and an awful lot of fun. One of the trends the HTA Newsletter called out from the show was our dedication to building products and services that address the very real needs of our customers.

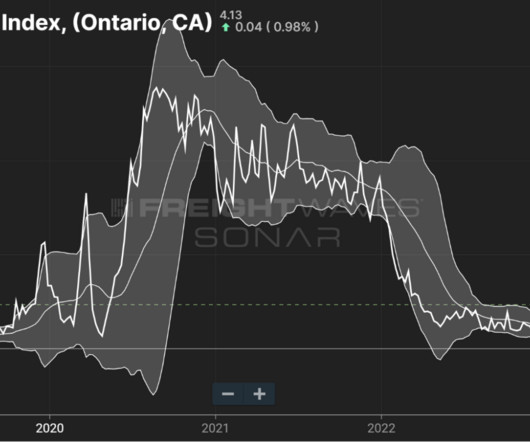

FreightWaves SONAR

APRIL 30, 2024

National market trends are good for understanding where we are in any given freight cycle, but they say little about specific markets where companies operate daily or need to plan around in the future. Understanding this, SONAR provides a plethora of tools and insights around both individual market granularities and national trends.

Freightos

JANUARY 15, 2024

Blog " * " indicates required fields Email * Phone This field is for validation purposes and should be left unchanged. And the answer lies in how their 2023 went too. It converged with a trend of both airlines and ocean liners investing far more heavily in their fleets over the past fewyears.

Let's personalize your content