State of Logistics 2021: Full speed ahead

In a year of unprecedented disruption, U.S. business logistics costs fell 4% as shippers found new ways of moving freight. Like the supply chains they serve, logistics managers must now fundamentally rethink and redesign their solutions—and how they do will define their future success.

At first everything stopped. Then, as supply chains began to slowly click back into gear, there were massive network disruptions followed by sudden, unforeseen spikes in demand patterns that found some industry sectors barely hanging on for survival. Finally, there were hints of

an upcoming boom.

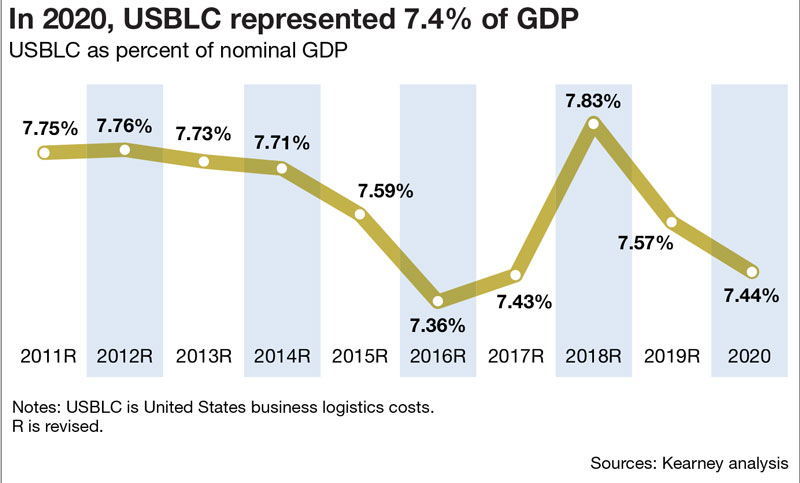

In the end, U.S. business costs, buffeted by a pandemic-decimated year of “chaos” worldwide, fell 4% to $1.56 trillion—that amounted to 7.4% of GDP, nearly an all-time low.

The 32nd annual State of Logistics report, produced by consulting firm A.T. Kearney, in partnership with the Council of Supply Chain Management Professionals (CSCMP) and Penske Logistics, dives into the previous year in logistics—in this case, one like no other. Entitled “Change in Plans,” the report details a year of unprecedented disruption in the logistics industry, as professionals grappled with changing consumer demands at the same time transportation networks were scrambled.

“This story of the year 2020 is one of adaptation under the most severe conditions in memory,” says Michael Zimmerman, partner with A.T. Kearney and the report’s author. “Systems strained and sometimes broke.”

According to the report, no logistics professional was able to simply stay the course in 2020, and “conditions ahead will require even greater adaptability and nimbleness.” The global pandemic caused global supply chains to suddenly stop early in 2020, and as they started up again they had to be rerouted, often facing capacity shortages, huge price increases and unexpected bottlenecks.

At the same time, stay-at-home consumers increased demand for last-mile deliveries, and logistics proved essential to fighting the pandemic, even before the delivery of vaccines. “Yet the pandemic made shippers’ and carriers’ assets less efficient and destroyed any idea of predictability,” states the report.

Even with service outcomes largely deteriorated, the report concludes that the logistics sector proved to be “remarkably effective given the disruptions.” And while some shippers and carriers are profiting from pandemic-related moves made last year, others are laying groundwork for the future through greater e-commerce activity and the need for more resilient, nimble supply chains.

Now, let’s take a look at how logistics management professionals made it through the year.

The numbers by mode

Given the unpredictable nature of 2020, it was remarkable that U.S. business costs were so low. Logistics represented a mere 7.4% of GDP, a decline from recent years, and near the all-time low of 7.36% of GDP in 2016. By comparison, in the final year before trucking deregulation in 1980, business logistics costs were slightly above 19% of GDP.

Of course, last year’s ratio was helped because the national economy shrank by 3.5% to $20.94 trillion while logistics costs shrank 4% to $1.56 trillion.

“Most logisticians will be surprised by this drop, as they were certainly expecting a rise,” says Zimmerman. “But inventory sales ratios hit 20-year lows in May, so there was far less inventory generating cost in the system.”

The Kearney report labeled the current economic recovery as “K-shaped.” Some sectors, such as grocery, home improvement and e-commerce, are booming. Others, such as hospitality, travel and restaurants are just now beginning to recover.

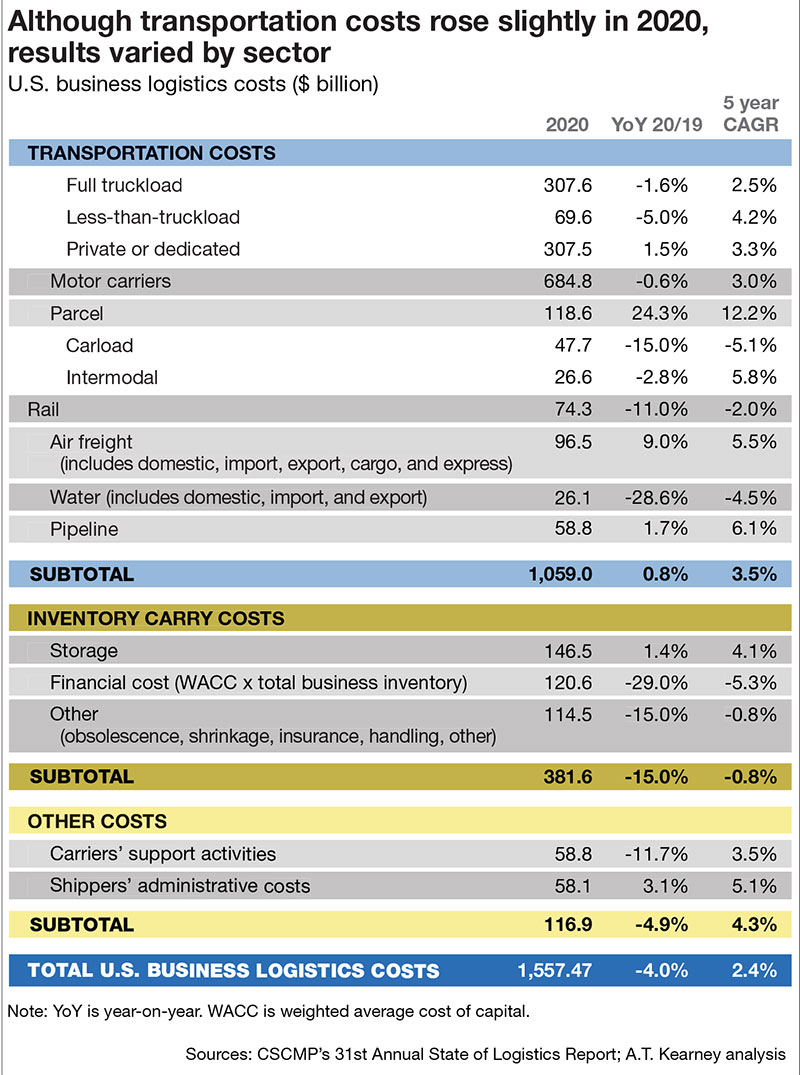

While transportation costs rose by 0.8% last year, that was far less than the 4.7% growth in 2019, and 10.4% rise in 2018. That transportation increase was largely driven by the 24.3% boom in parcel and last-mile services, mostly represented by UPS, FedEx, and some less-than-truckload (LTL) carriers.

Costs of how much it took to move freight broken down by mode came in as follows.

- Motor carriage, the largest mode, was down 0.6% due to reduced capacity in the pandemic.

- Air freight costs increased by 9%, as capacity was decimated by the cancellation of passenger flights, which carry about 50% of all cargo in the hold.

- Ocean was down 28.6% due to a combination of one-time reclassifications in underlying calculations methodology, a likely drop in exports and domestic water traffic and lower container prices.

- Rail was down 11% overall, driven by a 15% reduction in traditional carloads, while intermodal fared slightly better.

What drove the unpredictability?

The explosion in e-commerce (some of which was picked up in-store, but nevertheless proved a boon to trucking companies) resulted in a 33% growth rate to $792 billion—some 14% of all retail sales.

According to the report, terms such as direct-to-consumer (DTC) and buy online, pick up in-store (BOPIS) became common retail language, adding that they are “accelerations of existing trends” and are likely to become permanent. Thus, shippers must adjust their delivery offerings and solutions, managing both capabilities and consumer expectations to create a better match while developing new ways to pay for these services and control their costs.

Trucking, the biggest segment of U.S. logistics spending, fell slightly for the year 2020. But a fourth-quarter recovery suggests that continued economic growth would keep rates high through 2021—until new trucks and drivers can increase available capacity. However, despite industry efforts to bring more capacity into the market, the report authors contend that it still won’t be enough to bring truck rates down in 2021.

All things considered, there were distinct winners in ground transport. Andrew Moses, senior vice president of sales and solutions for Penske Logistics, says the demise of “middle-mile” transport was overstated. “That has not just come back, that has come roaring back,” says Moses. “There is quite a bit of stress among carriers behind the scenes and among carriers trying to keep up with this market.”

And the recent bidding war by Canadian National and Canadian Pacific railroads over the Kansas City Southern, the smallest of the five U.S. Class 1 rails, demonstrates the still-high potential for a large, integrated north-south North American rail operation. In the meantime, volumes are predicted to rise in intermodal. “Intermodal is getting investment dollars as it has inherent advantages,” adds Zimmerman.

Uneven demand levels between rising imports and sagging export levels created havoc in ocean shipping rates last year. And now ocean carriers are still struggling with balancing those uneven demand levels this year.

Matthew Hill, head of North American import market for Maersk, says that last year was “a tale of two halves” due to those uneven demand levels. “It was a completely different second half of last year,” he says. “Exports did take a hit throughout last year, and that continues to be a challenge. We continue to prioritize equipment on the import side.”

Rethink, redesign, reshore

The rapid disruption of supply chains last year is leading to needed alterations. In fact, the report suggests that logistics professionals change their ways and methodologies, especially across the global arena. “Navigating multi-shoring has clearly surged on the priority list of the logistician,” states the report.

Before the pandemic, U.S. companies were planning more reshoring and nearshoring, moving some manufacturing operations to Mexico to be closer to the U.S. market and away from other countries, especially China. This was amplified both by U.S.–China trade disputes and the recently concluded United States–Mexico–Canada Agreement (USMCA). Those plans are still moving—and quickly.

Vietnam has also become a hotspot for companies seeking to avoid tariffs, although evidence of trans-shipment may result in measures to prevent such practices. Kearney’s 2020 Reshoring Index shows that as the pandemic roiled import/export dynamics, a once binary choice over China or the United States has evolved into multifaceted strategies about right-shoring.

“The resulting complex logistics networks will require providers to become much more creative to meet or beat the speed and efficiency of routing from China,” the report concludes. In other words, after years of talk about diversifying supply chains, the pandemic showed shippers the necessity of being able to quickly switch methodologies.

However, the report warned that the path to realizing that value involves not only creative vision—such as new north-south configurations to meet multi-shoring demands—but also well-executed operational investments.

In conclusion, the report states that 2020 forced logistics professionals to constantly change their plans—and they should expect more this year and beyond. “Logistics in many cases is the “tail wagged by the dog,” says Zimmerman, adding that supply chains have been thrashed about not just by the pandemic, but by natural disasters and environmental disruptions.

“In 2021, shippers and carriers should plan for optionality in the face of instability,” says Zimmerman. “Logistics is due for another wild ride during 2021.

Take a deeper look into the State of Logistics in each of these topics:

- Less than Truckload (LTL)

- Truckload

- Air Freight

- Intermodal/Rail Freight

- Ocean Cargo

- Third Party Logistics (3PL)

Article Topics

Global Trade News & Resources

Baltimore suing ship that crashed into bridge, closing port, costing jobs UPS reports first quarter earnings decline Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations More Global TradeLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources