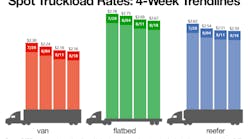

Shippers posted 5% fewer loads during the week ending Aug. 18, leading to lower national average spot truckload rates on the DAT network of load boards.

The number of available trucks increased 1%, DAT said.

Rates continued to retreat. The national average van rate fell 2 cents to $2.16/mile, the flatbed rate slipped 2 cents to $2.67/mile, and the reefer rate declined a penny to $2.50/mile.

The national average price of on-highway diesel moved down 1 cent to $3.21 per gallon. Spot rates include a portion for a fuel surcharge, meaning a change in fuel price can affect overall prices to move freight.

Van trends: The number of van load posts on DAT load boards dropped 5% while truck posts increased 1% compared to the previous week. That pushed the national van load-to-truck ratio down to 6.5 available loads per truck.

Van rates were softer. On the top 100 van lanes last week, rates were higher on only 23 lanes while 74 declined and 3 were neutral. Notably, the average van rate from Los Angeles — a major market for imported retail goods — declined 7 cents to $2.63/mile. Rates were lower on several outbound lanes:

- Los Angeles to Seattle fell 13 cents at $2.92/mile

- Los Angeles to Denver dropped 8 cents to $3.07/mile

- Los Angeles to Atlanta also decreased 8 cents to $1.95/mile

Reefer trends: Load posts on DAT load boards were in line with the previous week's totals and truck posts edged up 1%. The reefer load-to-truck ratio edged down to 8.3 loads per truck, and rates responded: prices were lower on 38 of the top 72 reefer lanes last week.

While the national picture appeared unsettled, produce continued to drive demand in specific markets. For example, with apple season underway in the Upper Midwest, the average outbound rate from Grand Rapids, MI, increased 27 cents per mile to $3.64/mile last week — by far the largest gain of any major reefer market. The rate was buoyed by two important lanes:

- Grand Rapids to Atlanta surged 47 cents to $3.58/mile

- Grand Rapids to Madison, Wisconsin, increased 41 cents to $3.43/mile

Flatbed trends: The national load-to-truck ratio for spot flatbed freight fell for the 10th week in a row. Load posts were down 7% last week while truck posts held steady. The national flatbed ratio was 27.4 loads per truck.

DAT Trendlines is generated using DAT RateView™, an innovative service that provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. RateView's comprehensive database is comprised of more than $45 billion in freight bills in over 65,000 lanes. DAT load boards average 993,000 load posts per business day.

For the latest spot market load availability and rate information, visit dat.com/trendlines and join the conversation on Twitter with @LoadBoards.