2020 State of Logistics: Truckload

Truckload supply and demand all jumbled up

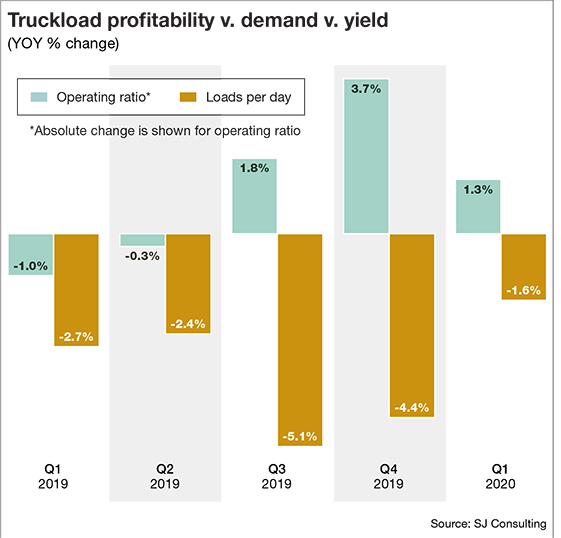

The headlines have been astonishing: spring tonnage was down double-digits year over year; Class 8 truck sales dropped nearly 50% compared with last year’s levels; and U.S. trailer sales fell to an all-time low of 5,700 in April compared with nearly 15,000 a year earlier.

This tranche of statistics is being caused, of course, by the impacts of the COVID-19 pandemic—and it’s causing an ill feeling among nearly all segments of the $340 billion truckload sector.

“There are places where there’s demand and no supply, and then there are places where there’s supply and not much demand,” says Avery Vise, vice president of trucking for FTR, an Indianapolis-based research firm. “It’s all jumbled up.”

Whenever there’s a typical downturn in freight volumes, shippers can usually enjoy lower rates that accompany smaller volumes. However, this current freight market has gone so soft that the question shippers, carriers and analysts alike are asking is: How long can this go on?

USA Truck, a large truckload (TL) carrier based in Van Buren, Ark., that posted $522 million in revenue last year while ranking as the nation’s 66th-largest trucking company, had already lost $4.2 million before taxes in the first quarter—and that was right before the heaviest impact of the government-

imposed economic shutdown.

Typical of most large TL carriers, USA is already sounding the alarm for the so-called “peak season” that usually runs three months. In short, the carrier believes it won’t be much of a peak.

“In the trucking industry, revenue typically follows a seasonal pattern for various commodities and customer businesses,” USA Truck said in a recent financial filing with the Securities Exchange Commission (SEC). “While peak freight demand has historically occurred in the months of September, October and November, no assurance can be provided that our current year experience will reflect this.”

“In the trucking industry, revenue typically follows a seasonal pattern for various commodities and customer businesses,” USA Truck said in a recent financial filing with the Securities Exchange Commission (SEC). “While peak freight demand has historically occurred in the months of September, October and November, no assurance can be provided that our current year experience will reflect this.”

Vise and other analysts expect recovery in the TL marketplace to come in “fits and starts.” Dry van, the largest TL segment, is already recovering from its March-April trough, but “is not really accelerating,” he says. “There will be a recovery but it’s going to be inconsistent.”

Of course, there will be winners and losers. Any carrier hauling paper products for shippers like Proctor & Gamble, or those with large e-commerce capacity, will probably recover faster than carriers with large manufacturing and retail bases, adds Vise. Trucking companies focused on moving foodstuffs under contract for retail chains are doing better than most, analysts say.

The problem is overcapacity. The shutdown of the automotive supply chain created additional capacity in the spot marketplace. Some shippers enjoyed shopping the spot market for bargains, and that further eroded contract volumes.

“There’s plenty of capacity in the truckload market,” says Brian Thompson, chief commercial officer for SMC3, a data provider that helps optimize freight transportation across the supply chain. “Rates are relatively low, especially the spot rates, while contractual rates are not as low.”

Unlike LTL, where as much as 90% of freight moves under contract rates, TL pricing “is much more transactional,” Thompson says, “changing daily and weekly.”

Jim Gattoni, Landstar’s president and CEO, operates what collectively is the 4th-largest TL concern, using mostly owner-operators. Like most large TL carriers, Landstar saw dispatched TL volumes in the final week of March “decrease significantly” because of the economic shutdown.

“Shelter-at-home mandates and the closing of manufacturing facilities significantly affected demand for transportation by many industry segments we service,” says Gattoni. “We expect those conditions to persist throughout the second quarter of 2020.”

Like most large TL carriers, Gattoni said that its first quarter results and operating trends “will in no way provide any indication” regarding what second quarter operating results may be in what he called “this highly unpredictable market.”

Article Topics

Motor Freight News & Resources

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics XPO opens up three new services acquired through auction of Yellow’s properties and assets More Motor FreightLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources