The state of Connecticut's Class 8-only vehicle miles tax, called the Highway Use Fee, took effect on January 1 of this year with the first reports due at the end of January, and already fleets, owner-operators, and state representatives have voiced confusion and anger on numerous aspects of the new tax.

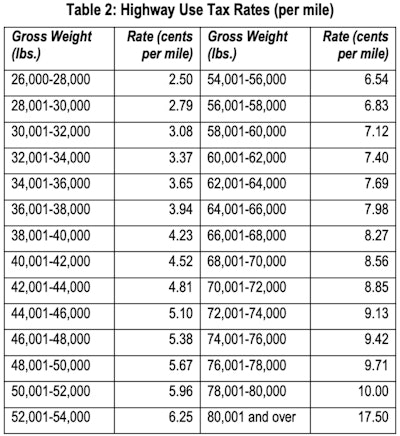

The HUF requires any carrier who operates a combination truck in Classes 8-13 (as defined by the Federal Highway Administration) and weighing 26,000 lbs. or more (aside from some milk haulers) to pay between 2.5 and 17.5 cents per mile traveled on any road in Connecticut. Carriers that do operate eligible vehicles, no matter what state or states they're registered in, must register with Connecticut's Department of Revenue Services (DRS) and file monthly reports to pay the applicable tax.  Connecticut's rate table for all combination-truck gross weights

Connecticut's rate table for all combination-truck gross weights

On February 28, the first tax bill, covering the month of January, came due.

By early March, House Republicans had already proposed a bill to strike down the tax by July 1. In Connecticut's upper house, a Democrat introduced a bill to exempt trucks transporting agricultural commodities and machinery.

Dave Palumbo, owner of 100-truck dry bulk hauler Palumbo Trucking, told the state legislators he'd paid around $5,000 in HUF for January alone.

[Related: Trucking groups sound off as Connecticut truck VMT tax signed into law]

Interviewed more recently, he estimated his company was looking at a total outlay of "$150,000 to $170,000 for the cost of the tax and the overhead, plus the employee I had to hire to calculate it and cover all the mileages every day and compute the tax."

Furthermore, Palumbo called the tax "discriminatory" in how it targets not just trucks, but specifically combination units Class 8 and above in the FHWA classification system.

"Are tractor-trailers the only ones doing damage to the road? What about triaxle dump trucks or cement mixers? They can weigh 75,000 pounds," he said.

The tax also puts Palumbo's fleet, almost entirely FHWA Class 8 tractor/dump trailer combos, in long-term jeopardy, as he's already reporting losing customers to competitors with Class 7 trucks and lower.

"I have a customer right now that I'm going to lose" as he's getting outbid "by a considerable amount" from a competitor running straight tri-axle dump trucks.

Palumbo's fleet of red Peterbilts might have helped attract drivers, but now it's proving a disadvantage thanks to the new tax.

Palumbo's fleet of red Peterbilts might have helped attract drivers, but now it's proving a disadvantage thanks to the new tax.

Not only does the tax put Palumbo at up to a 10-cent-per-mile disadvantage to competitors, it's "very, very difficult" to navigate and calculate, with carriers recording their miles and weights, he said. With the level of complexity and competitive disadvantage, Palumbo doubts carriers will be lining up to pay the new tax.

"You're supposed to file and register with the state, but if you're not registered with the state itself, who is going to stop you" from simply refusing to file? he asked. "Who is going to audit it? Are they going to hire more state employees? That was the big question that arose when I was at the capital. We're basically on the honor system."

One Connecticut-based owner-operator said he's simply not registered and wouldn't pay the tax. This operator had gone to lengths to register the truck out of state and avoid loads with pickups in Connecticut to maintain deniability.

One of Connecticut-based fleet owner Dave Palumbo's trucks on a job site. Palumbo says Connecticut's new tax will cost $150,000 this year and he had to hire help to deal with the "very, very confusing" details.This and other Palumbo Trucking photos courtesy of the company

One of Connecticut-based fleet owner Dave Palumbo's trucks on a job site. Palumbo says Connecticut's new tax will cost $150,000 this year and he had to hire help to deal with the "very, very confusing" details.This and other Palumbo Trucking photos courtesy of the company

Another Connecticut owner-operator, Joe Bielucki, took the opposite approach and likely overpaid in January.

"The confusing part of the 10-cent tax is they say on the website it goes by gross weight, not gross registered weight, the weight of the vehicle at the time it's passing through the state," he said.

Rather than get into the nitty gritty with Connecticut's reporting system, Bielucki said he'd rather just pay up.

"My argument is this -- I'm paying for the full 80,000 lbs. both ways. Some people are going to say 'this guy is an idiot,' but I've been audited by every agency for payroll, fuel tax federal and state, and the highway administration, and when they start to audit this, how are you going to prove your exact weight on every day you say you're traveling through Connecticut?" he asked. "What if they call you in for an audit?

"I don't mind being the crazy guy in the room. I just can't believe they're going to leave that much money on the table." He added that he'd already budgeted in a full 10 cents per mile into his rates during the last round of negotiations with his biggest customer.

[Related: Holding the line: Owner-op's playbook to push back on cheap freight]

We reached out to Connecticut's DRS, who confirmed that bobtailing semis, as long as they're under 26,000 pounds, are not eligible for the tax, and that the DRS will not ask for scale tickets or documentations of weight.

"I've heard three carriers in particular say 'screw it, how are they going to catch me and if they do, I'll worry about it then,'" said Palumbo. "There's a lot of unanswered questions. I don't think it was thought through long and hard enough," he said of the tax.

On the same day Connecticut House Republicans proposed striking down the tax, Governor Ned Lamont spoke about reducing state income taxes to fight inflation.

“We still have some lingering inflation, we still have issues to deal with, still have the high cost of energy. I like to think that an extra 20 or 30 bucks in your paycheck starting January 1 of next year will make a real difference," said Lamont at a press conference, according to the CT Mirror.

But Palumbo said that, for sure, the HUF would result in increased prices for his customers.

"I’m gonna pass it on to the end user." he said. "Every taxpayer in Connecticut is going to pay this." His concrete powder-hauling business counts the state of Connecticut, with its many infrastructure projects, as a customer.

The mirror cited Lamont's office as saying that for January, nearly "90% of the first-month mileage reports and 76% of the revenues came from out-of-state truckers," and that "$4.3 million in first-month revenues -- $3.3 million from out-of-state carriers and $1 million from in-state -- was well below the projections calculated by the legislature’s Office of Fiscal Analysis."

Connecticut's DRS spokesperson projected on Tuesday that they expect HUF to raise $45 million in 2023, making January's numbers slightly above expectations. The spokesperson did not comment on how the agency would enforce the tax.

For Palumbo, the prospect of having to lay off employees or even close up shop has crossed his mind as the tax burden sets in. "I gotta be honest, I don't know where it's gonna go," he said of his business. "I haven't gotten this out to all my customers yet. If these customers just can't afford it, then I can't do any business. Where do you draw a line in the sand?"