Ocean Cargo Update: Reversal of Fortune for Rates?

Over the past nine years, the number of global ocean cargo carriers operating in multiple trade lanes has dropped from 21 to 12—yet the container industry remains only marginally competitive. Shippers, meanwhile, are demanding better service in all vessel deployments.

There are some signs that the ocean carrier industry is moving towards a recovery from overcapacity and low freight rates, say some leading experts. But even the most optimistic forecast comes with more than a few caveats.

Recent news has surfaced indicating that the percentage of the idled global container fleet has decreased, and many carriers have recently reported positive operating profits.

But a more measured analysis comes from the consultancy AlixPartners, which has produced a body of research suggesting that there may still be more problems than solutions in the short term.

AlixPartners’ recently released “2018 Global Container Shipping Outlook” posits that if the industry addresses the dual challenges of rising costs and oversupply—mostly driven by fleet expansion—there may be some rate restoration this year.

According to the report, logistics managers may soon see impacts resulting from the industry’s reconfiguration into two tiers: the five large global players and about two dozen much smaller players, many of which compete either as specialists or exclusively in niche markets. Keep in mind that the industry giants have already absorbed the traditional second tier of midsize carriers.

“As controlling power within the industry stabilizes,” the report states, “it becomes more important than ever for carriers to step up their efforts to improve their performance, discipline their investments, and sharpen their strategies for succeeding through scale or specialization.”

The report also notes that it’s vitally important for carriers to curb their “voracious appetite” for new vessels and increase scrappage to reduce the current margin-crushing balance of supply and demand. However, fleet capacity is once again on the rise. Estimates of growth in fleet capacity in 2018 range anywhere from 4% to more than 5%, compared with 3.3% in 2017.

Esben Christensen, global co-head of AlixPartners’ maritime practice, says that he has his doubts about a reversal of fortune, however. “Some carriers may feel they’re in a bit of a ‘damned if you do, damned if you don’t’ situation,” he says. “If a carrier doesn’t have these mega ships than it won’t be able to compete with the top players.”

As one example, he points out that Hyundai Merchant Marine (HMM) announced that it will order 20 “eco-

friendly mega containerships,” 12 with capacity to carry more than 20,000 twenty-foot equivalent units (TEUs) and eight with 14,000-TEU capacity as part of its plan to grow its fleet’s carrying capacity to 1 million TEUs.

“Fleet expansion will negatively affect the supply and demand situation,” adds Christensen, “which potentially will keep the revenue side of the business depressed, making the pie smaller for everyone over this time period.”

Dysfunctional trends

According to the Paris-based consultancy Alphaliner, carriers have ordered 20 new ships with a combined capacity of 440,000 TEU since last September. While analysts there have yet to comment on this worrying trend, other experts have been highly critical of the industry.

Dan Smith, principal with ocean industry consultancy The Tioga Group, finds far too many impediments to recovery absent a radical change in its business culture. “A rebound might be simple if there were any prospect of rate discipline,” he says. “But, even with anti-trust immunity, rate discipline only works if capacity is tight or major players are willing to hold capacity off the market and forgo short-term revenue for long-term gains.”

Neither of those conditions looks likely, adds Smith, as all the carriers are in financial distress and none of the individual firms or alliances appears willing to lay up large portions their fleets. “Not only are they not laying up much of their capacity, but they continue to expand capacity faster than trade has been growing,” he says. “And if forwarders and shippers are going to benefit from volatility it’s because carriers remain dysfunctional when it comes to pricing.”

Furthermore, says Smith, mega-vessels do not deliver economies of scale unless they’re well utilized, adding that driving “slot” costs down does not help if you can’t fill the slots. “And the notion that carriers can significantly improve profitability by reducing back office costs seems to me like a forlorn hope,” he says. “It’s too much like balancing the budget by cutting back on office supplies. I also wonder where carriers are going to get the money to invest in technology if they’re going broke buying new ships.”

Giving small shippers leverage

In anticipation of the new surge in ocean carrier consolidation, a new partnership was recently forged between two prominent global supply chain consultancies and launched this past spring.

Chainalytics and Drewry Supply Chain Advisors have partnered to create the Ocean Buying Group, a venture that the organizations say promises to provide logistics managers with procurement solutions to enhance purchasing power.

“In the past two years, we have seen the ocean industry consolidate fast, with mergers and acquisitions, limiting competition and leverage,” says Philip Damas, head of Drewry’s logistics practice. “At the same time, rates go up or fluctuate wildly, leaving smaller shippers behind.

Furthermore, says Damas, this new strategic partnership may deliver an ambitious ocean freight procurement platform that will enable medium- and small-scale importers and exporters to collaboratively achieve “big shipper” rates and terms direct with ocean carrier. At the same time, logistics managers would benefit from shared intelligence for better commercial decisions.

Damas adds that Drewry and Chainalytics can leverage their network of offices in the U.S., Europe and Asia to build the critical mass needed to generate the cost reductions and the efficiencies much faster.

“We have worked as fast as we could to bring the solution to the market before shippers enter into new trans-Pacific contracts in May,” says Damas. “Chainalytics is the market leader in truckload transportation benchmarking and Drewry is the market leader in ocean transportation benchmarking, so our cooperation also includes the development of benchmarking for intermodal transportation, alongside the Ocean Buying Group.”

According to Damas, the Ocean Buying Group uses some of the methods of freight forwarders, shipper associations and private equity groups (combined buying), third-party logistics providers and cost benchmarking providers (market analytics). “However, we are the first to combine all these features and make them work for small and medium-sized shippers,” he adds.

Smith also takes issue with AlixPartner’s advice to carriers to use their leverage and buying power to bargain for lower rates with terminals. “Never mind that many terminals are operated by carrier subsidiaries,” he adds. “How then are ports and terminals going to keep pace with infrastructure demand? As long as there is pervasive overcapacity, nothing else matters very much.”

More focus on digitization necessary

The ocean cargo industry has moved beyond the “digitization tipping point,” and is on the verge of advancing from innovation to action, according to INTTRA, a neutral electronic transaction platform serving the ocean cargo industry.

To support this contention, INTTRA recently unveiled an ocean shipper survey to gain some understanding of their business challenges and appetite for digital transformation. Among the key findings was that the great majority of respondents felt that information technology (IT) innovation initiatives that focused on process automation and digitalization were well under way.

At the same time, shippers may have to come to terms with a paradox. Nearly half of the respondents said that they lacked IT resources “in-house.” Another 42% said they were challenged by their company’s “lack of prioritization,” and 40% cited budget constraints.

Cathy Morrow Roberson, president of the research firm Logistics Trends and Insights, observes that the survey was consistent with news she’s hearing in the marketplace.

“There’s quite a few automation and digitization projects underway, and I expect the number of these efforts will continue to grow,” she says. “I further believe that the current challenges that the ocean freight market faces will subside with the completion of these projects.”

However, she allows, prioritization, budget and the right talent are all important in order to realize automation and digitization goals. “Having a strategy that includes measurable efficiency gains and cost savings will be necessary when sharing with the C-level,” she adds.

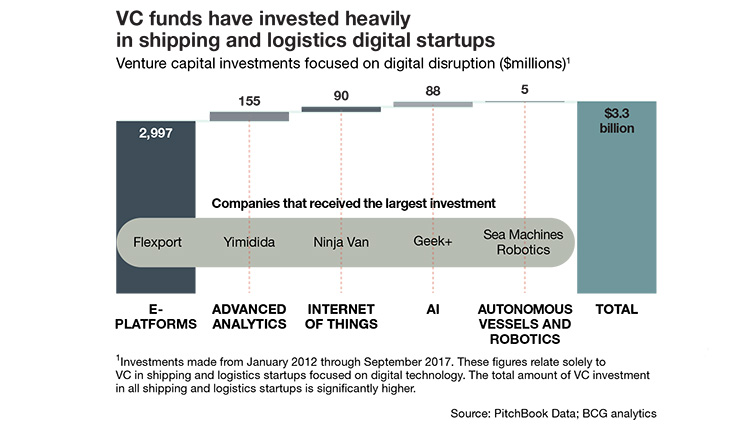

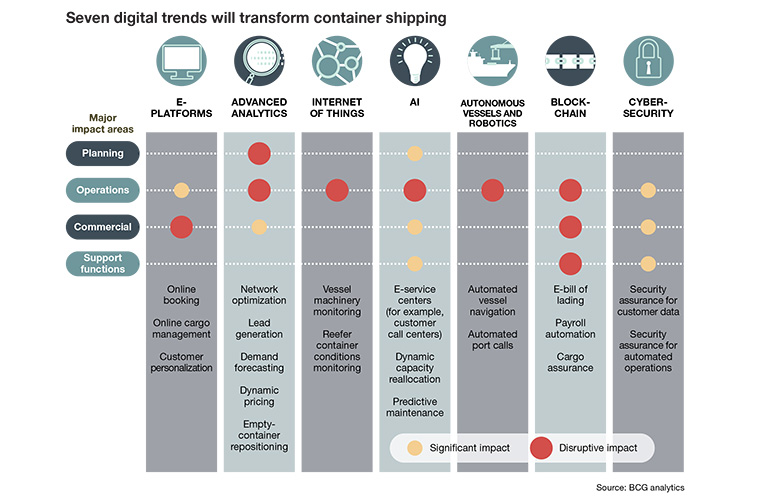

Given the complexity of today’s global ocean cargo networks, a new era of digitized transparency cannot come too soon, posits a new report by Boston Consulting Group (BCG). The report titled “Digital Imperative in Container Shipping” notes that a new sense of urgency is largely driven by the emergence of well-financed startups ready to challenge ocean cargo stalwarts with innovative digital solutions.

According to BCG, Flexport is chief among the leaders in introducing online booking, pricing, empty containers and autonomous shipping. And looming in the wings, as always, is the massive Internet retailer, Amazon.

As BCG researchers point out in the report, if a handful of other upstart models succeed, traditional ocean carriers run the risk of losing direct contact with some of their most profitable customers. Most likely to abandon ship are small and midsize freight forwarders and beneficial cargo owners (BCOs). “In this scenario, the carrier’s role could be reduced to providing commoditized ocean freight services,” the report concludes.

However, the world’s largest ocean carrier, Maersk Line, is not standing still. Last January, A.P. Moller-Maersk took steps to help overhaul global trade by unveiling a joint venture with IBM to create an industry-wide, paperless platform that’s aimed at speeding up trade transactions, boosting transparency for supply chain managers and potentially saving them billions of dollars.

“The future of the whole supply chain needs to be discussed at the highest levels,” says Omar Shamsie, president for Maersk Line North America. “Our competitiveness needs to come under a magnifying glass so the whole industry and authorities can address new ways of narrowing the ever-increasing gap with imports and update itself in the face of digital disruption.” •

Article Topics

Ocean Freight News & Resources

2024 State of Freight Forwarders: What’s next is happening now Baltimore bridge recovery efforts continue with opening of new channel Q1 sees a solid finish with strong U.S.-bound import growth, reports S&P Global Market Intelligence Baltimore suing ship that crashed into bridge, closing port, costing jobs Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans More Ocean FreightLatest in Logistics

S&P Global Market Intelligence’s Rogers assesses 2024 import landscape Pitt Ohio exec warns Congress to go slow on truck electrification mandates Q1 intermodal volumes are up for second straight quarter, reports IANA Supply Chain Management Software: Build the foundation, deliver the value 2024 State of Freight Forwarders: What’s next is happening now Ryder opens up El Paso-based multi-client facility logistics facility Autonomous mobile robots (AMRs) on a mission to automate More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources