Evaluation the ROI of Operating a Foreign Trade Zone (FTZ)

If your company is still not utilizing the FTZ program, now is a good time to consider how it can benefit your company and your local economy.

Over that time, it has helped thousands of U.S. manufacturers and distributors save millions of dollars each year. And today, importers and exporters are finding new ways to use the program in an era of trade shifts, supply chain disruptions, and increasing tariff rates.

Recently, there have been many changes to the program that have both increased the benefits of using an FTZ as well as making them easier to apply and operate. So, if your company is currently not utilizing the FTZ program, now may be a good time to consider how it can benefit your company and your local economy.

Benefits abound

Because import duties are not paid on goods brought into a U.S. foreign trade zone until those goods are removed and transported into the U.S., there are a variety of benefits a company receives, including correction of inverted tariffs, a reduction of certain import and export related taxes and administrative costs, deferral of duty payment, and in some cases complete elimination of the duty.

A company may also receive a benefit on domestic inventory and equipment if your state has ad valorem taxes on these materials. To know if the FTZ program is something to include in a company’s supply chain, we need to look at some of these benefits more closely.

Inverted duty relief. Import tariffs are generally set up to favor manufacturing here in the United States. That is, the duty on components is less than the duty on finished products, so companies have an incentive to make their goods here in the United States. But there are 18,000 different tariffs in the U.S., and sometimes they accidentally work in the opposite direction.

We call those tariffs “inverted” because they favor production of finished goods outside the U.S. That’s where the FTZ program steps in to give U.S. manufacturers the same duty benefit as a factory in another country.

In an FTZ, imported components can be integrated into a finished good, and the duty paid on those imports—but not on any domestic input material or domestic value-add—is calculated at the rate of the finished good rather than the higher component rate. This is a major benefit of FTZs, and manufacturers with imported components should do the math to see if this benefit applies to them.

Duty deferral. Import duties on goods made or stored in an FTZ aren’t paid until the goods are actually shipped to a customer here in the United States. This means companies can defer the payment of duties until the merchandise is sold, matching expense with revenue.

This is a major benefit for both manufacturing and distribution companies, especially those subject to anti-dumping, Section 301, or Section 232 additional tariffs on their imported merchandise.

The cash flow benefit of FTZs is in high demand now due to supply chain disruptions resulting from the global pandemic and other factors. Companies require more inventory on hand to hedge against these disruptions, and the benefit of paying duty only once a customer in the U.S. has paid for the goods instead of paying it up front when the goods first arrive in the U.S. helps companies retain cash for operational needs.

Duty elimination on exports. Finished goods brought into a warehouse operating as an FTZ can be exported to any country without paying any U.S. Customs duties or fees. This benefit is one of the original reasons the foreign trade zone program was set up in the first place.

Imported components that are manufactured into finished goods in an FTZ can also be exported outside of North America without paying any U.S. Customs duties or fees. In fact, FTZs are the only way a U.S. factory can avoid paying anti-dumping, section 301, or section 232 additional Customs duties on their merchandise for export.

Fee savings. Another benefit of utilizing an FTZ relates to the fact that most foreign trade zones are permitted to make a single U.S. Customs entry for all the merchandise entered during the week. For large importers, this can dramatically reduce federal and other fees paid with each Customs entry because most zones will only file 52 entries per year when operating a zone.

Some FTZs also opt to self-file rather than pay outside providers to do the filing because the zone operation brings them much closer to the data used for the preparation of each U.S. Customs filings.

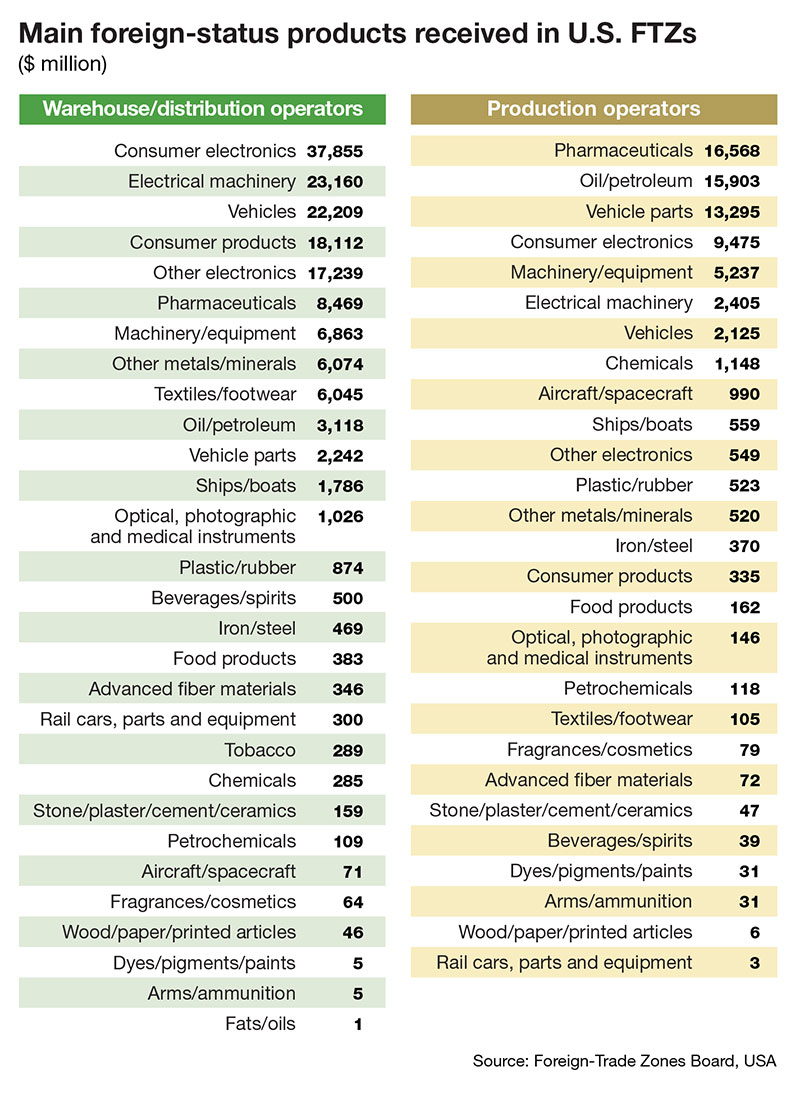

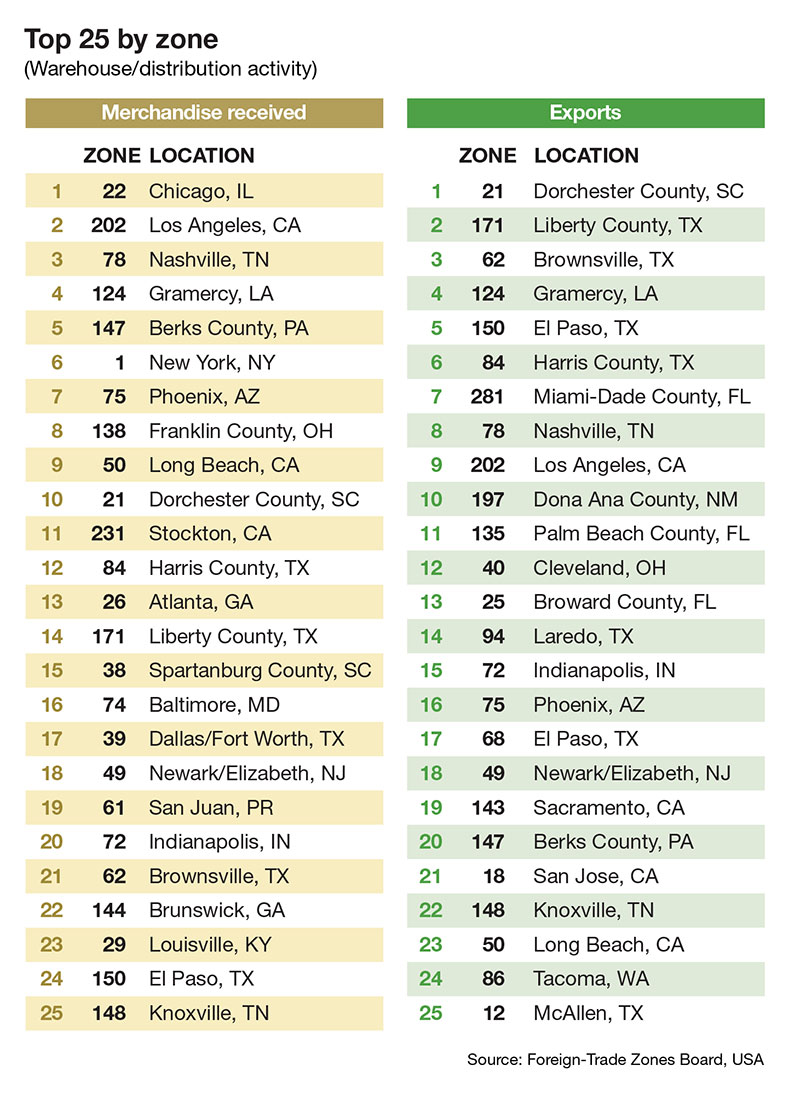

With all these benefits, companies are reassessing the best way to include a foreign trade zone in their importing process. The U.S. Foreign Trade Zones Board Annual Report to Congress released on August 3, 2021, showed some interesting statistics.

In 2020, the period the report analyzed, a record number of more than 470,000 persons were directly employed at some 3,400 firms that used FTZs. Approximately 59% of shipments received in FTZs involved domestic-status merchandise, showing that the program encourages U.S.-based manufacturing that incorporates a large amount of domestically sourced inputs while benefitting the local economy.

And a wide array of industries uses the FTZ program, including oil refining, automotive, electronics, machinery/equipment and pharmaceuticals. In fact, for the first time, pharmaceutical was the largest industry accounting for zone production activity in 2020.

The process

Unlike economic zones or free zones of other countries, a U.S. foreign trade zone does not require a company to move operations to a designated facility to achieve these savings.

First, you must apply to have your facility designated as an FTZ. The designation application must be filed by the Grantee to the U.S. Department of Commerce through the FTZ Board. The Grantee is the local representative of the Department of Commerce, helping to administer the program by ensuring the FTZ is being used for the public good in their local area.

If your facility is within the Grantee’s Alternative Site Framework service area, this process will take less than 30 days. If not, a Traditional Site Framework application will take three months to five months for approval as long as U.S. Customs and Border Protection (CBP) agrees to service the location.

Next, CBP activates all or a portion of your designated FTZ site or subzone. Activation requires a written application to U.S. Customs describing the specific activities you wish to perform in the zone. The process will involve a site visit by CBP to inspect the area to be designated and the procedures that the operator plans to use to ensure compliance.

After the process is completed, CBP issues a letter of activation outlining which activities can take place in the zone.

And, if there are plans to conduct production in the zone, a production notification must also be filed with the US Department of Commerce. If approved, this will allow the zone to perform manufacturing and kitting. As the U.S. government has improved the program, the areas of complexity in the process of starting up a new zone site has morphed.

It used to be that the application process was very complex, requiring a lot of documentation and preparation time, and waiting months to hear if your application was approved or if CBP would activate or even support your zone. Now, that application process has been enormously streamlined, making it much easier for companies to join the program.

On the other hand, CBP electronic filing requirements have gotten more complex and new procedural rules have been put in place. The Automated Commercial Environment (ACE) system from Customs and the documentation systems used by other federal agencies that regulate imports have evolved and data requirements have increased.

Zone operations have also become more complex as companies have incorporated more sites, with varying ERP and WMS systems, all of which are networked together to collect the data needed to operate the zone.

The critical path in setting up most new zones has flipped from the application process to the technology implementation, and so, too, has the skill set needed for bringing a new zone live. Companies used to need more advice in navigating the government application process.

Now, new zones are far more likely to need assistance in navigating the operational design process and systems implementation process. Therefore, leveraging experience in actual FTZ operations is more important than ever when setting up your new FTZ for long-term success.

If an importing company does not wish to go through the process to designate their own facility as an FTZ, it may also choose to use a site operated by a third party to process the goods and receive the cost savings outlined above.

By activating a warehouse through which their customers transport their goods, for example, a third-party logistics (3PL) provider can provide a bonded supply chain to their clients and save them money, usually for a service fee.

Explore new FTZ opportunities

For many U.S. importers and exporters, the FTZ program is unknown despite all of its benefits. For companies that outsource the import compliance process, this may be due to a service provider not being aware of the opportunity.

Programs such as bonded warehouses and drawback receive more educational focus by Customs and Border Protection and the logistics community. While also available for duty deferral, these programs don’t offer the same cash flow benefits or have greater restrictions on what operations can be performed on the imported goods.

Any company importing goods into the U.S. should look at the benefits of the FTZ program.

Evaluate the current circumstances to see if it’s the right time to join the program.

Events such as the pandemic, supply chain disruptions, and changing tariff landscape have created new opportunities, and evaluating the return on investment of operating an FTZ is a good idea, even if a company has done so in the past.

While the foreign trade zone program certainly is not new, there are new business scenarios that support including an FTZ in your duty mitigation and economic development toolkit.

Article Topics

Global Trade News & Resources

Baltimore suing ship that crashed into bridge, closing port, costing jobs UPS reports first quarter earnings decline Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations More Global TradeLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources