Article 7: Hedging Fuel Prices Ahead of Increased Volatility

This 7th article in the “A-Z” of trucking freight futures series explains how market participants can hedge fuel cost volatility risk as part of their overall trucking rate hedging program.

Logistics Management and Lakefront Futures’ Trucking & Derivatives Group are currently publishing a series of articles on the “A-Z” of trucking freight futures.

Previous articles in the series:

- Article 1: The Trucking Paradigm Shift & the New 3-Dimensional Market

- Article 2: Trucking Freight Futures 101

- Article 3: Hedging Applications for Trucking Carriers, Shippers & 3PLs

- Article 4: Trucking Spot Market Vs. Freight Futures Market Pricing & Price Discovery

- Article 5: Trucking Freight Futures – Hedging Strategy, Position Sizing & Trade Execution

- Article 6: Trucking Freight Futures - Off-Exchange Block Trade Market Making

While trucking freight futures help market participants hedge the “linehaul” portion of trucking rates, fuel costs are another major cost of trucking. For trucking carriers, it is one of the largest operating expenses.

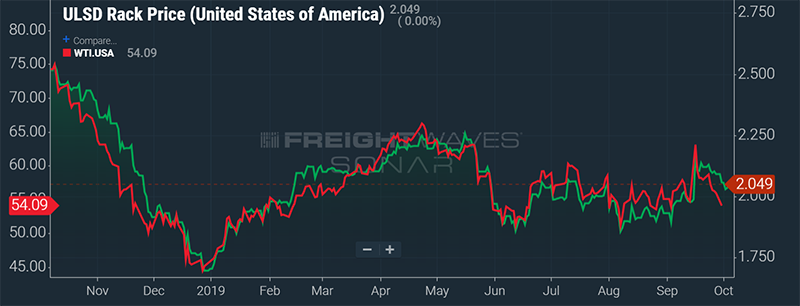

The graph shows the price of ULSD (Ultra Low Sulfur Diesel) plotted against the WTI crude oil spot price and illustrates two major points: 1) that the price of ULSD is very correlated to oil prices and 2) that both oil and ULSD prices are very volatile.

Logistics Management and Lakefront Futures’ Trucking & Derivatives Group are currently publishing a series of articles on the “A-Z” of trucking freight futures.

ULSD Price Volitilaty Drivers

As shown in the graph of Ultra Low Sulfur Diesel (“ULSD”), ULSD prices move in tandem with oil prices. In that regard, anything that impacts oil prices will impact the price of ULSD given their strong correlation. In addition to changes in oil prices, ULSD prices are also impacted by factors specifically related to ULSD such as the pending IMO 2020 mandate.

There is no shortage of global factors impacting supply & demand for oil that are in flux and causing significant price volatility. From geo-political concerns in Libya and Iraq, uncertainty with the outcome of the US - China trade wars, trade sanctions against Iran & Venezuela, terrorist activities on the biggest exporter of oil to Asia – Saudi Arabia, to statements by oil ministers, etc. The market has been in a trading range since June as the bears and bulls have been battling it out for which side has the correct outlook.

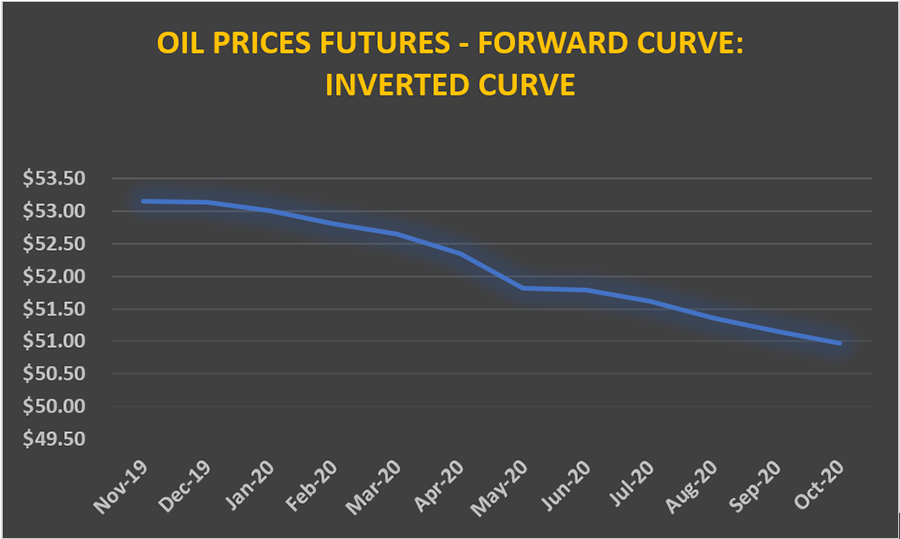

While softened global demand has kept oil prices from gaining any significant price traction, analysts expect increased price pressure and tightness as we approach year end from increased demand and lower supply which would change the forward curve from inverted to normal going into 2020. In addition, the IMO 2020 mandate goes in effect in January. At this point, no one knows for sure whether the increased demand will cause ULSD prices to spike.

Fuel Hedging Options

While price direction of fuel is uncertain, what is certain is that fuel prices will continue to be very volatile and reactive to a variety of issues that impact perceived supply/demand conditions around the world. In that regard, trucking carriers should consider having an effective hedging program in place prior to January 2020.

The good news is that the fuel derivatives market provides a variety of ways for market participants to hedge their exposure to fuel cost volatility. Given the correlation of ULSD with Oil prices, market participants can hedge against oil prices or ULSD prices. There are a multitude of ways to hedge fuel costs:

- Futures: A futures contract is a standardized contract, between two parties to buy or sell a specific quantity and quality of a commodity at a price agreed to today but for payment at a specified time in the future. Fuel users such as trucking carriers would hedge the risk of increased fuel costs by going “long” on the ULSD futures contract (s). If fuel prices increase, its fuel costs will increase but the profit from its long position would offset its increased fuel costs. If fuel costs decrease, the consumer’s net fuel cost would be the retail price + the loss of the futures position.

- Options: Options are like an insurance policy. An option is a contract which provides the buyer of the contract the right, but not the obligation, to purchase or sell a particular futures contract (s) at a specific price. A call option provides the buyer of a call option with a hedge against rising prices. Conversely, a put option provides the buyer of the put option with a hedge against declining prices. Unlike futures or swaps, the call option buyer will have a hedged position but if fuel moved down, they would not incur a loss aside from the option premium that was paid. It is the best of all worlds.

- Swaps: A swap is an agreement whereby one party (i.e. trucking carrier) exchanges their exposure to a floating fuel price for a fixed fuel price, over a specified period(s) of time – basically swapping cash flows. A swap locks in the purchase price at a future date for the fuel user. The obvious downside is that if the price drops, the fuel user will be paying much more than the market price for fuel due to their losses on the swap position. Many fuel hedgers like swaps over futures as they serve as a better hedging tool as most fuel swaps generally settle against the monthly average price vs day such as with futures contracts.

- Other Fuel Hedging Strategies – there are other hedging strategies that can be used for hedging fuel prices, including using a combination of futures and options or collars. A collar hedge uses multiple call and put options to hedge the user from increased fuel costs and at the same time limits their downside. There are a variety of collar hedges including more complicated strategies such as three and four-way collars to hedge fuel.

Call Options - Insurance Policy for Fuel Costs

The airline industry has been hedging their fuel costs for a while. Unlike many other airlines that use swaps to hedge the risk of increasing fuel costs, Alaska Air has been very successful using an insurance like derivative – call options. It provides them the hedge against increased fuel prices but if prices move down, there is no hedging loss aside from the option premium paid – the fuel user is still able to benefit from the reduced fuel prices. If fuel prices do increase, the user would exercise its call option on the futures contracts and be long on the futures contract with a below market fuel price. The profits of the long futures position can then help offset most of the increase in fuel costs.

Example Hedge

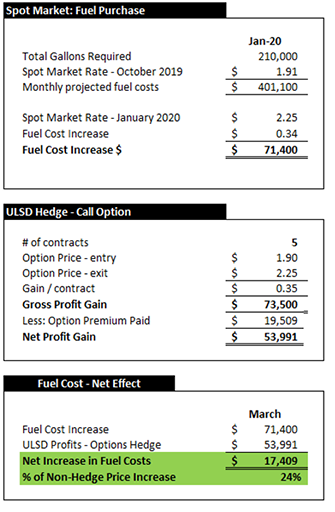

In the adjacent example, a trucking carrier wants to hedge the fuel price of 210,000 barrels of diesel fuel in January 2020. It buys 5 call options on the ULSD January 2020 futures contracts at a strike price of $1.90 (each underlying futures contract is based on 42,000 gallons). The current ULSD spot rate on 10/10/2019 is $1.91. Their net spend on fuel at today’s spot market prices are $401,100. If fuel prices in January increase by $.34 to $2.25, the carrier’s fuel cost will increase by $71,400 above the $401,100 they are currently paying. However, in the hedged scenario, the carrier would exercise its call options and then close out the long futures positions for a profit of $53,991 ($73,500 less the cost of the premium for 5 options - $19,509) which would help to offset the $71,400 increase in fuel prices. Instead of having to pay an additional $71,400, the carrier’s cost is increased by only $17,409 – only 24% of the fuel price increase.

In the adjacent example, a trucking carrier wants to hedge the fuel price of 210,000 barrels of diesel fuel in January 2020. It buys 5 call options on the ULSD January 2020 futures contracts at a strike price of $1.90 (each underlying futures contract is based on 42,000 gallons). The current ULSD spot rate on 10/10/2019 is $1.91. Their net spend on fuel at today’s spot market prices are $401,100. If fuel prices in January increase by $.34 to $2.25, the carrier’s fuel cost will increase by $71,400 above the $401,100 they are currently paying. However, in the hedged scenario, the carrier would exercise its call options and then close out the long futures positions for a profit of $53,991 ($73,500 less the cost of the premium for 5 options - $19,509) which would help to offset the $71,400 increase in fuel prices. Instead of having to pay an additional $71,400, the carrier’s cost is increased by only $17,409 – only 24% of the fuel price increase.

Conclusion

The price of oil and diesel fuel will continue to remain very volatile. In addition, while the ramifications of the pending January 2020 IMO mandate are unknown, the ULSD market might have increased volatility until the market can understand how the mandate changes ULSD supply & demand conditions. To keep their fuel costs from increasing due to higher prices, trucking carriers should have an effective hedging program in place prior to the end of the year. Call options are one of the best ways to hedge fuel costs as they are like an insurance policy and do not have the risk of hedging losses if fuel costs decrease. Lakefront Futures Trucking & Freight Derivatives group will provide a complimentary assessment of a market participant’s exposure to fuel prices and various hedging options that can be used to minimize increases in their fuel costs.

Logistics Management will be launching a new section in both its weekly digital and monthly print publications to reflect the new 3-dimensional market – “Trucking & Freight Markets 360o”. This section will provide a comprehensive snapshot of the trucking spot, forward and futures markets along with the diesel/derivatives market. The content will be provided by Gary Saykaly who is the head of Lakefront Futures’ Trucking & Freight Derivatives Group which helps market participants hedge trucking rate and fuel cost risk – [email protected].

Past performance is not necessarily indicative of future results. The risks associated with trading futures and options are substantial. Futures and options trading are not suitable for all investors.

Article Topics

Motor Freight News & Resources

2024 State of Freight Forwarders: What’s next is happening now What’s next for trucking? TIA rolls out updated version of framework focused on fighting freight fraud National diesel average is down for the third consecutive week, reports EIA Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory More Motor FreightLatest in Logistics

2024 State of Freight Forwarders: What’s next is happening now Ryder opens up El Paso-based multi-client facility logistics facility Autonomous mobile robots (AMRs) on a mission to automate Equipment batteries get a jolt What’s next for trucking? April manufacturing output takes a step back after growing in March 2024 Parcel Express Roundtable: Lower volumes, pricing shifts, and network changes define the market More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources