The electronic logging device mandate’s many impacts inside the trucking business and culture, and with respect to broader highway safety, are no stranger to the pages of Overdrive, “litigated” as it were in numerous forms. With four-plus years now under the mandate, it’s not hard to find an owner-operator who feels the ELD mandate has hurt safety and productivity in trucking, but what if it's also hurting rates?

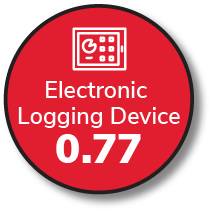

Overdrive’s “State of Surveillance” survey respondents rated ELDs’ cost-benefit ratio at 0.77, with ELD users rating the costs significantly higher than the benefits derived. Among all survey respondents, just a fourth felt ELD benefits exceeded costs, and among independents and small fleets with authority, that number was even lower, at 18%.

The ELD mandate's impacts formed the jumping-off point for Cornell University prof Karen Levy's "Data Driven" examination of what she called the "new workplace surveillance," but it's not just employer-employee relationships that are feeling impacts.

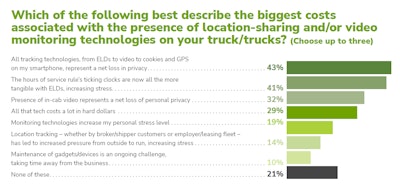

Asked to assess some of the bigger potential costs, further, ELD-related privacy drawbacks and pressure-cooker hours drawback were among the most commonly named in Overdrive's State of Surveillance survey. Download the full survey for a larger view of the results via this link.

Asked to assess some of the bigger potential costs, further, ELD-related privacy drawbacks and pressure-cooker hours drawback were among the most commonly named in Overdrive's State of Surveillance survey. Download the full survey for a larger view of the results via this link.

As ELD use has become a mainstay for a significant portion of independents and small fleets, as a general rule the last holdouts on the shift to e-logs prior the mandate, ubiquitous location tracking has been part of the result, with new wrinkles for business-to-business relationships with brokerages and/or other customers.

Broadly among ELD users responding to Overdrive's State of Surveillance survey, most rated costs of the devices higher than benefits. Measures derived from the survey that are less than 1 equate to more costs than benefits.

Broadly among ELD users responding to Overdrive's State of Surveillance survey, most rated costs of the devices higher than benefits. Measures derived from the survey that are less than 1 equate to more costs than benefits.

“It’s my belief that if they didn’t know where we were, they wouldn’t be able to control the rates,” she said. “If everybody turned off their location services on their phone,” and stopped posting their available trucks on the boards, independent carriers would retain greater leverage, she said. Brokers on the load boards wouldn’t know if there are more trucks than loads at any given location.

“Let’s say they didn’t know where we were for six months,” she said. “How could they control market rates when they don’t know where trucks are?”

Desiderato extends that thought to an old capability load boards have built into their architecture, too. Posting truck availability is “pretty much telling [brokers] I’m sitting here and desperate for a load," she said. "I think it’s better for them to post a load and not know if a truck is around.”

In 2018, spot rates rose immediately post-ELD mandate, with what Levy and others have called a kind of de facto "work to rule" action -- with truckers following hours of service rules to the letter with an ELD in-cab, availability to haul widely suffered, pushing rates up. The spot market picture has been markedly mixed since then, with massive swings up and down outside the usual seasonal cycles. If Desiderato's right, location tracking could well be having an impact there, yet other owners see at least some benefit to tracking technology when it comes solidifying customer relationships, and reaping the rewards of those with better service.

Load location tracking -- owners benefit, but worry over intrusions

Eagle Express small fleet owner Leander Richmond, like almost 7 in 10 owner-operators and drivers who took Overdrive’s recent State of Surveillance survey, is by now no stranger to ELDs, nor the live load tracking they can enable. Tracking demands from brokers and shippers were growing more commonplace prior to the implementation of FMCSA’s ELD mandate. Today such demands are almost a foregone conclusion, according to Richmond.

At Eagle Express, it’s customary for him and his 10-plus-truck fleet to provide a tracking link through its Samsara ELD system when requested for any load.

The benefits are clear. Assuming the tracking link is used by the receiver (not always the correct assumption), Eagle Express can deliver more-accurate arrival-time updates for load and/or (more usual) unload prep. That can save time and otherwise necessary calls and communications to and from driver, carrier and customer. If a broker’s involved, the broker can help deliver the same benefit working with the receiver to deliver updates.

Yet Richmond’s long felt it’s important to keep close control of just when that tracking starts and stops, and how much information is delivered to his customers and freight-partner brokers. Ten years ago, when he began buying trucks, he made a commitment not to put the burden of customer management on his driver, given personal experience with brokers who take advantage, for instance through changes to delivery locations farther out than what was agreed to during the rate negotiation. “Everything goes through us,” he said, making reference to himself and other back-office personnel, “and we’re responsible for our employees and any deal that we make.”

Eagle Express owner Leander Richmond

Eagle Express owner Leander Richmond

“Can you tell the driver to stop calling us,” the broker told Richmond, who got a bit of a laugh out of it at the time, but at once decided “no more” when it comes to direct access to operators by brokers while they’re out on the road. OTR drivers “don’t need the interruption, and if they’re driving they don’t need to be on the phone anyway,” of course.

After cycling through four different providers in the course of a year as the ELD mandate came into play, Richmond settled on Samsara and has been using its system for four years. He can tick off added benefits of using the platform, including an integration with his fuel card provider, Wex, for access to his company’s ELD data. “When the driver goes to get fuel … and swipes the card or goes to use the Wex app,” Richmond said, the card company “will have access to all of our trucks’ location” as a way of preventing fraudulent purchases, as somewhat frequently occurs for all manner of credit card holders today.

A recent discovery of an attempted purchase in North Dakota with stolen card data, when the Eagle driver holder of the card was in Texas, provided something of an object lesson. “If my driver had purchased fuel that morning,” Richmond said, “the guy in North Dakota would have been rejected immediately.” The purchase in that case was in fact ultimately rejected, fortunately, given the card company’s increasing sophistication identifying fraud.

Another ELD benefit: The same company handles Eagle Express’s IFTA filings, utilizing the data reported through the system.

A recent experience with ELD systems integration, however, proved a step too far for Richmond. It came by way of a longtime dispatcher’s interaction with Eagle’s usual representative with large broker C.H. Robinson. The rep was attempting to get Eagle involved in the broker’s Carrier Advantage Program, then recently updated. Robinson dubs its CAP a "loyalty program." It’s not exactly akin to a rewards program for frequent purchases at a truck stop, but does share some attributes.

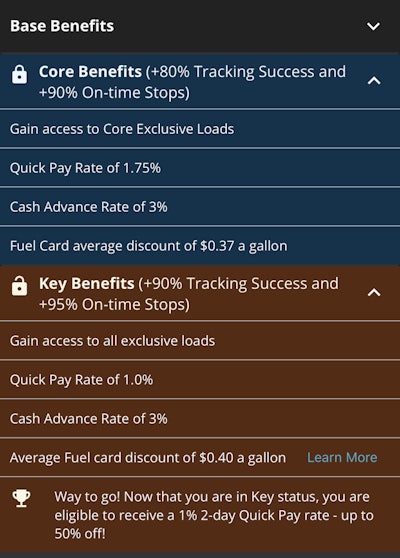

It’s attempting to incentivize and reward a couple outcomes -- on-time deliveries and the enabling of tracking, possible whether or not owner-operators working with the broker are utilizing an ELD or not.

ELD mandate-exempt owner-operator Howard Salmon, who runs exclusively with a Robinson broker, enables tracking with the push of a button via the C.H. Robinson carrier app on his smartphone.

Independent Howard Salmon with his 1999 Kenworth W9Courtesy of Howard Salmon

Independent Howard Salmon with his 1999 Kenworth W9Courtesy of Howard Salmon

- First access to “exclusive” loads – C.H. Robinson has touted this benefit as the ability to see available loads before the entire universe of carriers working with the broker

- A 1% 2-day-quick-pay rate

- 3% on cash advances

- And an average 40-cent/gal. fuel discount

Not that he utilizes much of these, though the option is there. (He relies mostly on person-to-person interaction with a central broker for loads, and lately is doing a great deal better on most fill-ups via the Mudflap app for diesel.)

“I don’t see anything wrong with what it is,” Salmon said of the program, and in general terms he feels confident about his ability to control the tracking enabled in the app.

For small fleet owner Richmond, though, with a firewall between his operators’ personal phones and brokers, integration between Samsara and the C.H. Robinson system was proposed as the optimal solution to continue on the work Eagle had done for the broker mostly on just a single account -- for years now, he said.

This screenshot from Salmon's C.H. Robinson app also outlines benefits of the second-tier Core status in the CAP program.

This screenshot from Salmon's C.H. Robinson app also outlines benefits of the second-tier Core status in the CAP program.

GMH Transportation-leased owner-operator Philip Rindelhardt, hauling today in this 2000 Kenworth W900, notes similar reticence to tracking requests from brokers, particularly when they come to his personal and business smartphone. “If they want to track the load, they can track the trailer or they can call me up and ask me where I am,” he said. He draws the line at tracking apps or services on his phone.

That hasn’t always been the case for him, he said, but “I’ve had bad scenarios where they track my phone and I’ve had to reset my phone” and jump through some other hoops “to get my phone back to where it needed to be.”

Suprise Trucking owner Bryon Stoll, a two-time semi-finalist in Overdrive's Small Fleet Championship, said he’ll add a tracking app to his phone if a broker requires it, but he’ll delete the app as soon as he’s completed the load. “I don’t like all those tracking apps on my phone, but we have to use them,” he said. “I don’t keep them on my phone. I’ll ask which one they need… install it, use it, and get rid of it. A lot of [drivers] don’t like those tracking apps, but it’s part of the job.”

Owner-operator Debbie Desiderato understands the need for tracking on loads, but once a load is off the truck, location services should be turned off, she said. “It’s nobody’s business where I am, and where I am should have nothing to do with what the load is going to pay. Is it going to pay less because I’m already there?”

Independent owner-operator Debbie Desiderato

Independent owner-operator Debbie Desiderato

Keeping control of your tracks, using to advantage

Eagle Express’s Leander Richmond isn’t keen on brokered freight market dynamics himself as a general rule, though he’d valued his relationship with the particular, local-to-his-area C.H. Robinson broker he’d dealt with for reasonably-paying step-deck conestoga freight. But then he saw the Samsara notification he got after the integration with his ELD system was initiated by C.H. Robinson to enable his fleet’s CAP participation. That notification showed access being requested not just to location data. Samsara was telling him that the integration would give the broker the ability to read all drivers’ information, camera media, equipment details, hours of service, DVIRs, safety scores and other data, and the list goes on.

Richmond noted he reached out to his broker “and said, ‘You can have tracking,’” as Richmond put it. “If you want it all, you can pay for the ELD,” such was the extent of the access. Given the nature of the Carrier Advantage Program, live tracking such as that offered by Richmond should be enough to satisfy the program metrics of on-time performance and percentage of successfully tracked loads. Yet to date there’s been no follow-up from his broker there about a potential fix.

C.H. Robinson’s Cody Griggs, consulted for this story, oversees the carrier technology program and said that, “whatever the carrier may have seen in the course of integrating his ELD, it’s only track and trace updates that actually come to us,” and only during the course of a load hauled.

As evidenced by Salmon’s experience, without an ELD, carriers have numerous options to participate in CAP,, Griggs added, to which all carriers who onboard with C.H. Robinson are now automatically enrolled.

“Whatever tech they’re already using,” Griggs said, “whatever tech they’re comfortable with, carriers have plenty of choices. They can use our Navisphere Carrier app or website or our Navisphere Driver app, all of which are free. They can use other third-party driver apps, any one of more than 150 ELD/GPS providers, or an [Electronic Data Interchange] or [Application Programming Interface] connection.”

Small fleet owner Richmond’s standoff with the broker over the issue, nonetheless, remains. And that’s ultimately a book of business no longer available to Eagle Express – a cost “hard to really measure,” he said. He’s moving on, he added. “I have a business partner who told me a long time ago – even if you have one truck, you better act like you have a thousand.”

Fortunately, business has picked up for the 13-truck fleet with more than one direct shipper customer, with whom he will in fact share his operators’ direct phone numbers on an as-needed basis. He has confidence they’re not likely to burden the driver with unnecessary phone calls, and maybe actually use the tracking link sent their way.

Too many brokers don’t bother and just continue on with old habits of routine check calls, he said, something echoed by owner-operator Salmon, in fact.

“People do call” often enough, Salmon said, yet he’s been on something of an education initiative in that regard. When the broker asks for a 20 update, he’ll say, “Did you look at the app lately?”

Pictured is owner-operator Salmon's 1999 Kenworth, fresh off a polish job from A Cut Above in Wildwood, Florida.

Pictured is owner-operator Salmon's 1999 Kenworth, fresh off a polish job from A Cut Above in Wildwood, Florida.

Sometimes the broker has in fact looked at the app, he said. Perhaps trust in these technologies is equally dim on the broker side of the equation. “I’m trying to teach them to use the app first. if you can’t get the [location] verification there, then call me,” Salmon added.

When it comes to location information and tracking technology, Salmon views it simply as a tool, ultimately: “If anyone wants to be afraid of something, go ahead, but I don’t see anything wrong with what it is. It helps you out all the way around." He'll use it to advantage when he can. --Alex Lockie contributed to this report.

All the features in Trucking's State of Surveillance:

Podcast -- Truckers 'canaries' in the tech mine: Inside story around 'Data Driven' book on ELD mandate, rise of 'new workplace surveillance'

Video monitoring, in two parts:

**Can AI transform the prying eyes of in-cab cameras for the better?

**In-cab and out, camera options expand amid push-pull of privacy concern, regulatory attention

ELDs/smartphones and location tracking -- Broker intrusions on the rise with ubiquitous location tracking capability

Truck and trailer telematics -- Telematics beyond ELD systems: Promise, redundancy and real expense/uptime benefits

Data mining -- The third parties following you around freight networks: Brokers looking more like carriers with 'data driven' decision-making

Smartphones/GPS -- Counterpoint to some truckers' tech reticence: 'If you use a smartphone, you embrace it'

Roadside inspections -- 'Nothing to hide, nothing to fear,' right? Get ready for Level 8, automated inspections

Podcast -- FMCSA offering 'kinder, gentler' approach to safety scoring? Not if automated inspections go live