2022 Supply Chain Disruptions Study

New survey reveals the top pain points that logistics and supply chain management professionals continue to manage through, including higher freight costs, capacity constraints, severe labor shortages, and port slowdowns—all disruptions that are still forcing shippers to re-engineer their supply chain operations.

After a multi-year stint of dealing with the impacts of the pandemic, supply chain shortages, transportation capacity constraints, rising costs and a persistent labor shortage, logistics managers are now facing a host of new roadblocks as they finish out 2022 and look ahead to 2023. Warehouse bottlenecks, vehicle backups at inland hubs and dock worker contract negotiations were just some of the newer issues that companies were grappling with by midyear.

To learn more about these challenges, how they’re affecting organizations and how companies are overcoming them, Logistics Management decided to survey its readers for a 2022 Supply Chain Disruptions Study. Most (55%) of the respondents were vice presidents, general managers, logistics/distribution managers, supply chain managers or operations managers. The bulk of them work in manufacturing (43.8%), wholesaling (13.4%) or third-party logistics (10.7%), and represent industries like food, beverage and tobacco; industrial machinery; automotive and transportation equipment; and chemicals and pharmaceuticals.

This majority of the 2022 Supply Chain Disruptions Study respondents work for companies with less than $50 million in revenues and 16.1% have employers with over $2.5 billion in annual revenues. The rest fall somewhere between those two ends of that spectrum. The same variation can be seen in the companies’ employee count, which ranges from less than 100 (for 40.2% of those responding) to more than 5,000 (21.4%). Most of the companies (63.4%) ship less than 9,999 domestic and international shipments annually.

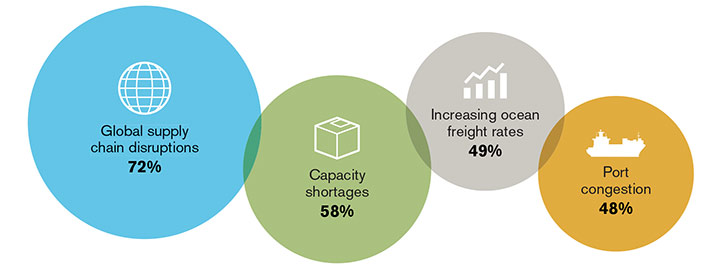

What is your organization handling on an ongoing basis with the state of your global supply chain?

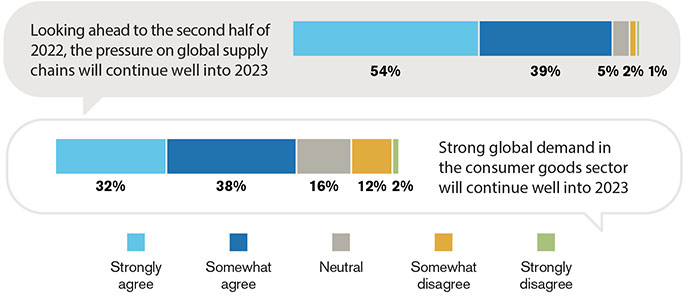

How much do you agree with the following…

The state of the global supply chain

Global supply chains have faced more than their fair share of challenges since the pandemic emerged in early-2020, and the stressors haven’t let up yet.

According to the survey, 71.8% of companies are dealing with global supply chain disruptions right now and 57.7% are trying to work through ongoing transportation capacity shortages.

Nearly half of those surveyed (49%) are facing challenges with increasing ocean freight rates and about 48% say port congestion is one of their biggest obstacles in 2022. Russia’s invasion of Ukraine has also affected global supply chains. Asked how the invasion has affected their strategies, nearly 60% of readers say their operations have either been highly or somewhat affected by the war while 40.4% have seen no such impacts.

These results align with what Logistics Management has been reporting throughout the year and paint a picture of a global supply chain environment that’s still working to stabilize itself in the face of an ongoing pandemic, high demand for products, a persistent labor shortage and continued upticks in e-commerce sales.

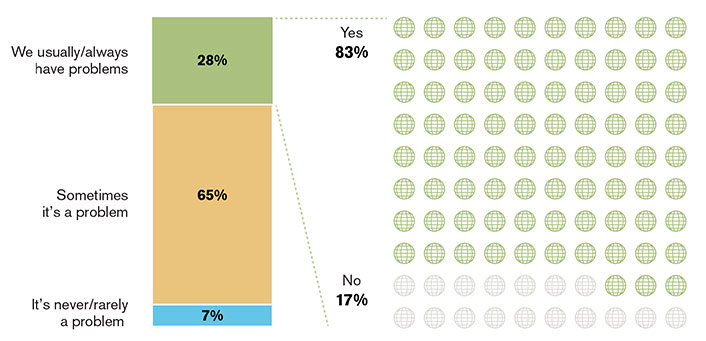

How do you currently view the state of your global freight network? / Has the last two years forced your company to rethink it’s overall global supply chain operations?

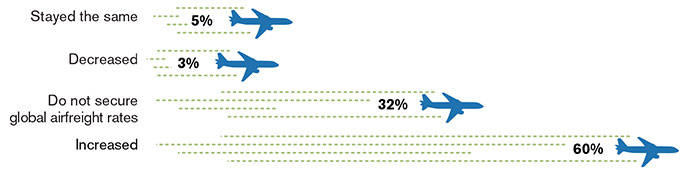

How have the global disruptions over the past year affected your global airfreight rates?

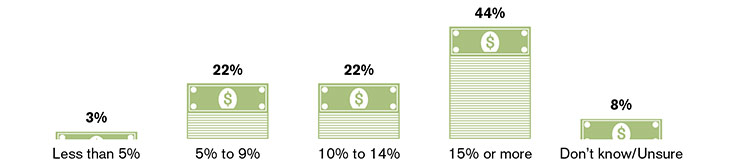

How much did your global airfreight rates increase from 2021 to 2022?

Source: Peerless Research Group (PRG)

Readers aren’t expecting any immediate relief to their ongoing challenges. Looking ahead, more than 93% of survey respondents either “strongly or somewhat agree” that the pressure on global supply chains will continue well into 2023. Asked whether strong global demand for consumer goods will also continue into next year, 70% of readers either “strongly or somewhat agree.”

Outside of North America, most companies have realized the biggest global disruptions in Asia (64.7%), Europe (12.1%), Central America (2.6%) and South America (2.6%). More specifically, the disruption in these countries tends to take place at ports (for 80.6% of respondents), trade in general (43.9%), during the customs clearance process (20.4%) and on the road (10.2%).

Assessing supply chain performance

The events of the last 2.5 years have forced 82.6% of companies to rethink their overall global supply chain operations. In assessing the performance of their global supply chains, nearly 96% of survey respondents say their networks are either “usually, always or sometimes” a problem. Just 4.2% of the companies surveyed have global supply chains that are either “never or rarely a problem.”

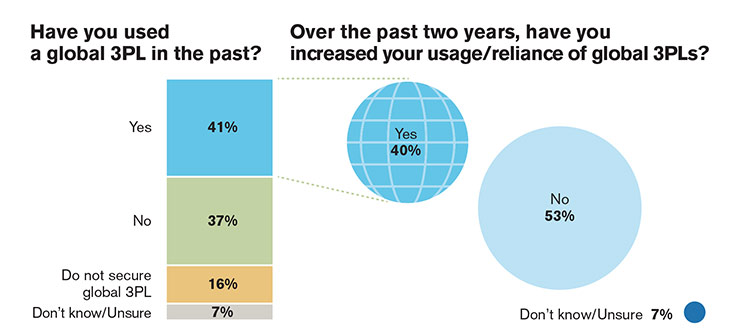

Have you used a global 3PL in the past? Over the past two years, have you increased your usage/reliance of global 3PLs?

Source: Peerless Research Group (PRG)

Global freight networks are also creating headaches for logistics, supply chain and operations managers right now. According to the survey, just over 92% of companies rely on global freight networks that are either always, usually or sometimes a problem. Just 7.6% of respondents either rarely or never have problems with their global freight networks.

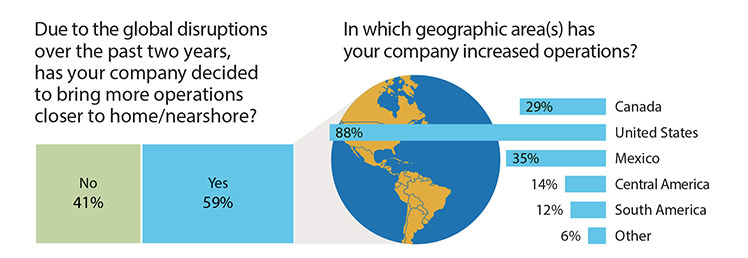

To offset some of the challenges brought on by the pandemic and resultant supply chain disruptions, some companies have been moving their manufacturing and/or sourcing closer to home.

According to the survey, more than half (52.3%) of respondents have used this approach over the last two years while 36.4% have not (11.4% are unsure of whether their companies have done this).

As they bring more operations closer to home using a reshoring or near-shoring strategy, the geographic area(s) where companies have increased operations include the U.S. (87.9%),

Mexico (34.8%), Canada (28.8%), Central America (13.6%) and South America (12.1%).

Freight rates continue to rise

Along with the port congestion, container shortage and transportation delays that keep shippers from getting their goods on time, companies are also dealing with escalating ocean freight rates. By mid-2022, in fact, ocean shipping freight costs were up to eight times their pre-pandemic levels—and even higher for some routes.

According to the study, more than 70% of respondents have seen their ocean freight rates escalate over the last year. Just 4% say those rates have stayed the same and 2.4% have seen decreases.

Asked exactly how much their ocean freight rates increased from 2021 to 2022, readers who reported an increase say they’re currently paying 15% higher rates (50.6% of respondents), are shelling out 10% to 14% more (25.3% of readers) and 10.3% of respondents have seen their rates increase by 5% to 9%.

Companies using airfreight have also been paying more for transportation this year. Asked how global disruptions over the past year have affected their airfreight rates, nearly 59% of companies have experienced increases, 4.1% are paying the same that they did one year ago, and less than 1% have seen their airfreight rates go down. Between 2021 and 2022, 44.4% of respondents saw their rates jump by 10% to 14% and an equal percentage experienced rate hikes in the 5% to 14% range.

Ocean and air capacity trends

The global supply chain disruptions severely affected transportation capacity in 2021, driving up rates and forcing companies to rethink their strategies, find alternatives and seek out new modes. The situation has eased slightly this year, but the constraints remain, according to the survey findings. For ocean freight, 37.2% of companies are dealing with decreased capacity while 36.4% say that shipping capacity has either stayed the same or increased this year.

Asked to specify how much their ocean freight capacity increased compared to 2021, 54.6% of companies say it expanded by anywhere from 10% to 15% or more. Another 18.2% say capacity has loosened up by 5% to 9% and 13.6% feel the increase was less than 5%. Of the readers who reported ocean freight capacity decreases this year, 60% say the decrease falls into the 5% to 15% or more range, while 17.8% have watched capacity contract by 10% to 14%.

According to the survey, 19.3% of respondents have witnessed decreases in airfreight capacity this year, although nearly 40% say it has either increased or stayed the same (compared to 2021).

Nearly all companies (88.2%) reporting airfreight capacity increases say those improvements fall into the 10% to 15% range (or higher). Of those reporting airfreight capacity decreases, most (66.5%) say the declines range from 10% to 15% or more and 21.7% have seen decreases of 5% to 9%.

The role of the global 3PL

Overall, the global third-party logistics (3PL) market, worth about $1 trillion in 2020, is estimated to reach more than $1.75 trillion by 2026, according to Mordor Intelligence. This translates to a growth rate of 8% for 2021-2026.

Factors affecting that growth are the increasing number of companies that use 3PLs for major transportation and logistics services—while 3PLs are also increasingly being used to grow e-commerce. In response, third-party providers continue to find creative solutions and expand their service portfolios.

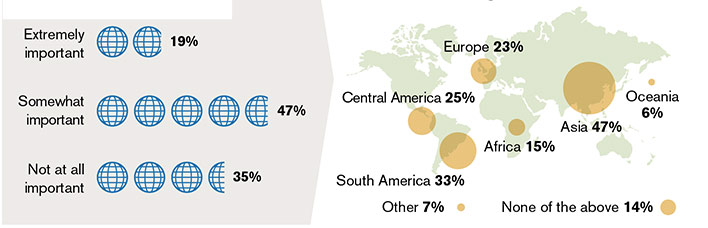

How important have emerging markets become in your global sourcing strategy? Which emerging market(s) have you considered as channel(s) for growth?

Source: Peerless Research Group (PRG)

According to the 2022 Supply Chain Disruptions Study, 40.5% of companies have used a global 3PL in the past, while 37.1% have yet to enlist the help of a global 3PL. Over the last 2.5 years, more than 40% of respondents have increased their usage of and reliance on global 3PLs, while 53.2% have not. Just over 79% have engaged such a partner for freight forwarding over the last 2.5 years and most companies (66.7%) work with just one global 3PL for these services.

Expanding their global reach

Despite the supply chain challenges brought on by the pandemic, companies continue to think globally. In fact, 65.6% of survey respondents say that emerging markets have become either an extremely or somewhat important component of their global sourcing strategies.

Another 34.5% don’t consider emerging markets to be key to their global sourcing strategies. When asked which countries they’ve considered as channels for their growth, 46.6% say Asia is a core target for their organizations.

Some of the other markets that companies view as having good growth potential are South America (32.9%), Central America (24.7%), Europe (23.3%), Africa (15.1%) and Oceania (5.5%), the latter of which encompasses Australasia, Melanesia, Micronesia and Polynesia.

Article Topics

Motor Freight News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates Preliminary March North America Class 8 net orders see declines National diesel average heads down for first time in three weeks, reports EIA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ More Motor FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources