As we approach the conclusion of 2023, the maritime shipping industry faces challenges that have impacted ocean carriers with declined profits and increased price-driven competition. Despite this, beneficial cargo owners (BCOs) who consistently shipped throughout economic fluctuations have found solace in the lowest rates witnessed in years. Ports have become more efficient, trucking issues have resolved, and carrier reliability has returned to pre-Covid levels.

We will be entering 2024 with bigger unknowns than in 2023. However, here is my take in terms of what to expect for ocean shipping and in the broader shipping industry.

1. Rate Levels

Overall, average rate levels for Transpacific Eastbound (TPEB) trade will be slightly lower than their current levels due to access capacity, continuing weak demand, and slower growth in the world economy. Carriers may adopt strategies like slow steaming and blank sailings to manage capacity. Service reliability will be affected due to these strategies, influencing overall freight rates. Service reliability will go down due to more idling, slow steaming, and increased blank sailing programs. New supply levels will be much higher than the expected demand.

2. Changing Carrier Behavior on Pricing

The gap on the pricing policies amongst the carriers will further change. There has been unspoken unity in the pricing policy over the past few years amongst the carriers, but this is subject to change. Some carriers are being more aggressive than others due to their huge capacity to sell to weaken the market and some are positioned better than others.

This would reflect on the pricing and profitability of the carriers which is moving towards returning to pre-pandemic levels. Ongoing geopolitical uncertainties and regional conflicts will be here to stay for the foreseeable future, but its impact on rates will be minimum.

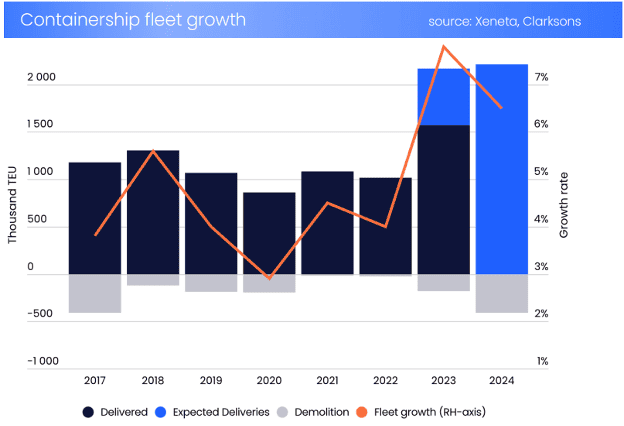

Chart: Container ship fleet growth over the past 6 years, along with a 2024 projection:

3. Carrier Consolidation

2024 will be the year when the more independent, smaller operators begin to struggle financially which may bring in the possibility of further consolidation amongst the carriers. Also, after years of successful cooperation, carrier alliances are breaking up. In order to survive the upcoming crisis, scalability and global reach will be key points once again. Still strapped with excess cash from the pandemic area, most carriers are still in a good shape. But, with declined profits and revenues, we may see some strategic mergers.

Chart: Average EBIT margins of main container carriers from the first quarter of 2014 to the second quarter of 2023:

4. The Port Situation: U.S. East Coast vs. U.S. West Coast and Potential Volume Shifts

U.S. West Coast ports will increase their popularity after losing volumes to U.S. Gulf and East Coast ports. Now that labor issues are over and there are potential disruptive issues facing U.S. East and Gulf Coast ports such as expiring port worker contracts, Panama Canal draft issues, and Suez Canal security concerns, after the first quarter of the year, the shift may accelerate unless there are some improvements on these issues. There will be tremendous pressure for carriers to keep decent service levels due to increased transit times to U.S. East Coast ports because of the shift at the transshipment ports. This is posing a risk for U.S. East Coast ports which had benefited from the issues related to U.S. West Coast port labor negotiations.

5. Shifting Strategic Sourcing Partners

There is undeniable hype about shifting trade volumes from China to elsewhere. Already Vietnam has benefited from this shift, but can other countries, particularly India do the same? Struggling with infrastructure problems, reliability issues and limited service offerings for the U.S. West Coast, India’s expected increase might not happen immediately. But, the trend is there and benefiting from a great workforce, India will certainly be in the top few countries that supply to the U.S. China’s undeniable presence is there and will continue to be there for the foreseeable future.

6. Green Shipping

According to Alphaliner, global container lines reduced greenhouse gas emissions by approximately 12% in the first seven months of 2023. The industry may witness the establishment of regulatory frameworks in 2024. A clear pricing mechanism for green fuel and an end date for building fossil fuel-only vessels would be positive and visible actions which will encourage broader industry stakeholders for the decarbonization efforts.

7. Technology

I’ve been at the forefront and have followed the technological advancements that skyrocketed during the pandemic era, thanks to huge influx of venture capital investments into the shipping and logistics industry. While the progress will continue, it is hitting a plateau.

Advanced real-time tracking has become more widespread and it will continue to be so as the cost of accessing that technology is more widespread now which brought down costs. It will be perceived as no longer a value-added service but as part of the service offering from logistics companies. Usage of AI, predictive programs, and supply chain visibility systems that connect the carrier with BCOs or other stakeholders will become more common.

The big question here is how ready are the small to midsize BCOs to embrace these improvements as from our observations there have been mixed signals. AI still remains the biggest potential disruptor. AI has been in use for some time now especially on managing manual tasks, document management and other repetitive tasks, but its potential and real effects are still a big unknown to the industry just like any other industry.

As we navigate through uncertainties such as the war in Ukraine, Middle East unrest, Panama Canal draught, Suez Canal security concerns, incoming supply injections, and unknown demand levels, 2024 is poised to be a transitional year, where a return to seasonality may begin and may set the stage for positive developments in the years ahead.