Sometimes the answer to “Why?” is “I don’t know.”

In some cases, nobody knows why. It just is, and the more you try to find a different answer, the more lost you become.

That’s all I have for today. Don’t ask me

Why?

—

Moving on, here’s the supply chain and logistics news that caught my attention this week.

- Logistics Operators See a Shipping-Market Rebound Taking Shape (WSJ – sub. req’d)

- Mexico overtakes China as the leading source of goods imported by US (ABC News)

- UK admits ports could be overwhelmed under post-Brexit rules (Financial Times)

- Uber Freight releases pilot for scheduling API, a first under new industry standards

- Blue Yonder Acquires Flexis, a Leader in Manufacturing and Supply Chain Planning Technology

- Updates to FourKites’ Dynamic Ocean Help Customers Quickly Mitigate Disruptions and Combat Fees with Greater Accuracy

- Smart label startup Sensos raises $20 million Series A (CTech)

- Logistics Hiring Ticks Up Despite Soft Freight Demand (WSJ – sub. req’d)

US Imports from Mexico > Imports from China in 2023

As reported by Paul Wiseman for ABC News, “For the first time in more than two decades, Mexico [in 2023] surpassed China as the leading source of goods imported by the United States.” Here’s more information from the article:

Figures released Wednesday by the U.S. Commerce Department show that the value of goods imported by the United States from Mexico rose nearly 5% from 2022 to 2023, to more than $475 billion. At the same time, the value of Chinese imports tumbled 20% to $427 billion.

Is this the beginning of a trend or was 2023 just an outlier year? We’ll have to wait and see, but no doubt, Mexico is benefiting from the strained US-China trade relations over the past few years.

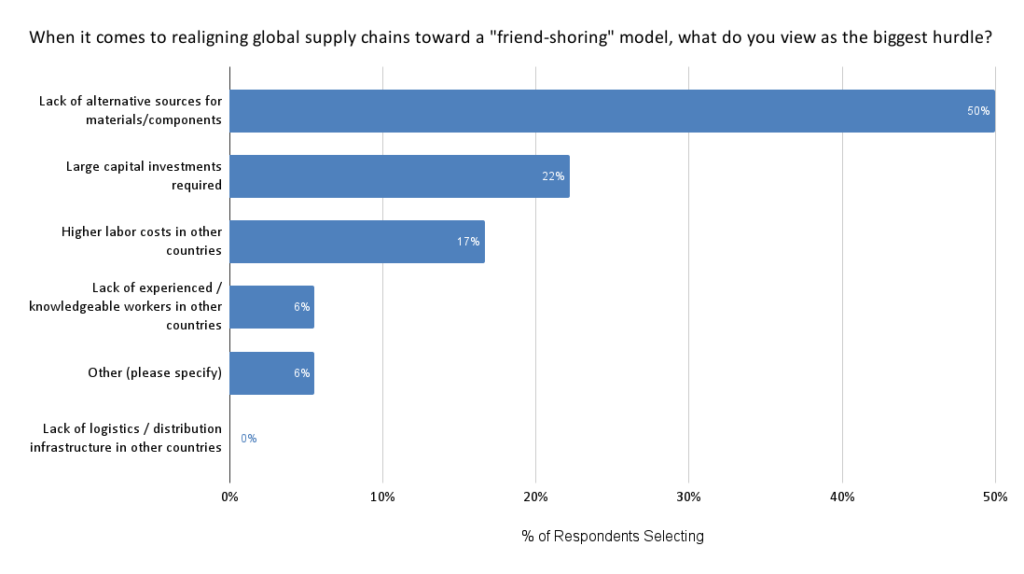

Back in May 2022, we asked members of our Indago supply chain research community — who are all supply chain and logistics executives from manufacturing, retail, and distribution companies — “Is your company looking to take a ‘friend-shoring’ approach to your global supply chain? What is the biggest challenge?”

At the time, only 22% of the respondents said their companies were taking a “friend-shoring” approach to their global supply chains. The following comment by an Indago executive highlights the general feeling among many of our members at the time:

“I think as with all ‘X-shoring’ ideas there are positives and negatives. Friend-shoring might eliminate risks such as trade wars, IP theft, higher barriers to trade or higher taxes, but as we have seen with the centralization of trade and major industries around China, the knowledge, investment, technology, and experience needed to produce many products will likely take quite a bit of time to be moved to friendly allied nations. This would also need to be a longer term strategy with some offset or support from the government to ensure it is taken up by major businesses.”

In fact, when it comes to realigning global supply chains toward a “friend-shoring” model, “lack of alternative sources for materials / components” topped the list of challenges, selected by 50% of the survey respondents.

That said, as Ben Enriquez from Uber Freight highlighted in an April 2023 Talking Logistics guest commentary titled, “Nearshoring To Mexico Is Booming: What Shippers Need To Know To Keep Up”:

Nearshoring to Mexico is gaining traction among shippers at a rapid rate. To keep up with the demand, Mexico will open 25 new industrial parks by the end of 2023, spurred by the $35 billion in total foreign direct investment from 2022. On top of that, 88% of US-based small and medium-sized businesses are reshuffling their supply chains to utilize suppliers in Mexico this year. Nearshoring will continue growing well into 2024, and if shippers aren’t already considering this strategy, they risk falling behind in the market.

Is Mexico playing a bigger role in your supply chain? Post a comment and let us know!

And with that, have a happy weekend!

Song of the Week: “Shout” by Tears for Fears