The best supply chain teams invest in technology as part of their continuous holistic operational improvements, not simply in reaction to temporary crises. Investing in technology to improve the capabilities of your supply chain team as part of a strategic initiative yields better results throughout all phases of the freight market cycle.

Retailers, manufacturers and suppliers were caught off guard by supply chain congestion, unreliable suppliers and unpredictable demand during the COVID-19 pandemic. Very few prognosticators could have predicted the epidemiological course of the disease, the way that public policy responses to the disease changed over time or how those policies affected consumer behavior. No one saw that coming.

But some firms were prepared to deal with the unexpected and had built responsiveness and resilience into their supply chains — incorporating not only technology, but also redesigning roles and creating organizational structures to improve the agility of their teams. These companies could see the effects that the pandemic had on the supply chain develop in real time: from sudden stockouts at retail locations to increased demand, tighter transportation capacity, supplier delays and finally an overwhelming surge of imports that clogged ports and intermodal ramps.

Multiple streams of data from internal operations — like inventory, freight bills paid and service metrics from visibility providers — were aggregated in data lakes and presented in dashboards so that leaders could monitor a dynamic situation and make decisions accordingly. Still, blind spots popped up. When lengthy queues of container ships formed outside of the Port of Los Angeles, U.S. retailers needed to find new ports of destination for their containerized freight and required insight into port conditions in unfamiliar markets. Again, leading supply chain teams were prepared and could integrate new data sets into their advanced planning systems.

Many other companies were caught off guard and were unequipped to react at a fast enough cadence to navigate the pandemic successfully. Different business units experienced disruption at different moments and, without integrated reporting processes, failed to work in a coordinated fashion. One sports equipment company let inventory languish on delayed container ships, missing out on deliveries and sales, and then overcorrected, paying up for air cargo shipments from Asia to leapfrog the ports just as demand was waning again.

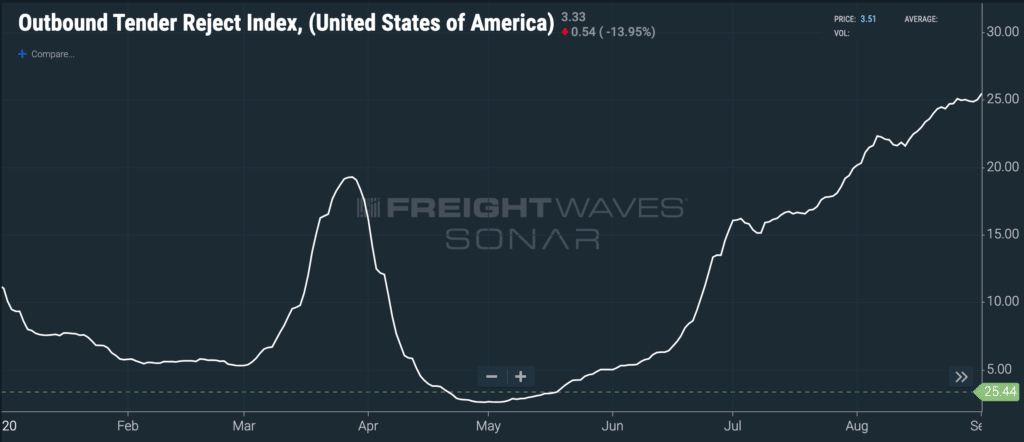

During the pandemic, freight costs soared as underlying freight market conditions quickly made the previously agreed-upon annual contract rates obsolete, carriers failed loads, and hot freight found its way into a rapidly tightening spot market. June 2020 was an especially volatile time: When the month started, truckload carriers were rejecting about 5% of the loads tendered to them by shippers, but by the end of the month, the rejection rate had climbed to 16%.

(The percentage of shipment tenders rejected by truckload carriers. Chart: FreightWaves SONAR. To learn more about FreightWaves SONAR, click here).

In just a matter of weeks, U.S. trucking capacity went from loose to tight, and the spot market flipped from a deflationary environment to an inflationary one. Spot rates jumped back above contract rates and pulled carriers away from their awarded freight as they pursued more lucrative opportunities. In many cases, 3PLs were a buffer between the shipper and the freight market and attempted to deal with it as best they could; but often the effect was that retailers, manufacturers or suppliers only gradually came to understand the full scope of what was happening.

Many reactive shippers only took the problem seriously once they reviewed their own freight bills paid, which were completed at least 60 days after shipments were delivered. By the time they had an inkling that something was wrong — that their awarded freight contracts were falling apart, that their freight was being moved by random spot market carriers, and their costs were soaring — it was already fairly late in the game.

On the other hand, companies that had real-time data integrated into their transportation management systems and enterprise resource planning systems were able to work with transportation providers to provide flexible pricing in return for increased visibility into cost and service. One major retailer effectively abandoned the ports in Southern California to move thousands of containers through the Port of Houston, into the center of its distribution network, in order to avoid congestion and re-accelerate freight flows in its network.

Companies unprepared for disruption suffered consequences: lost sales, squeezed margins and spiking supply chain costs. In some cases, CEOs lost their jobs over failing to deal with supply chain issues, as was the case with Peloton.

The pandemic made it crystal clear that leading supply chain teams were ones that put the right data into the hands of people inhabiting roles empowered to communicate across business units and coordinate swift action. Laggards had no centralized ways of connecting supply chain data to sales and operations or making organization-wide decisions in response to supply chain conditions — they tended to muddle through and underperform their peers.

To learn more about how FreightWaves SONAR can provide your supply chain team with the data analytics and insights it needs to navigate the next disruption, click here and schedule a consultation.