Based on various data trends, several industry analysts, including those on Wall Street, are predicting the U.S. is heading toward a freight recession — that is, a period of declining freight volume, declining spot/contract rates, and declining tender rejection rates.

“Bank of America sounding the alarm on collapsing freight demand” is the headline of an April 25 FreightWaves article by Rachel Premack. This follows another FreightWaves article published last month titled, “Just 3 years after 2019’s trucking bloodbath, another is on the way.”

However, not everyone agrees that a “trucking bloodbath” is coming.

“I’m becoming increasingly frustrated by industry reporting talking about things like, ‘Demand for truckers is at 22-month low’ where the only data point is a survey by Bank of America of 44 (yes, you read that right, just 44) shippers,” wrote Jason Miller, Associate Professor at Michigan State University, in a LinkedIn post on Monday. He shares data from the Census Bureau and Federal Reserve Board, which leads him to conclude that “the preponderance of evidence points against there being a severe downturn in the demand for truck transportation.”

How would you characterize the current truck transportation market? Do you believe a freight recession is imminent?

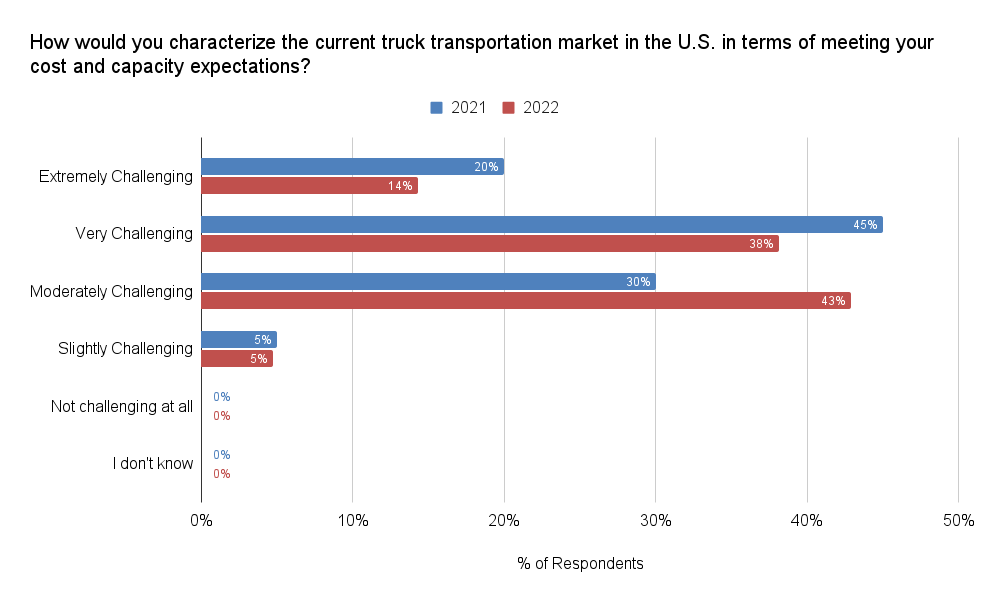

We asked members of our Indago supply chain research community to share their perspective last week. A little over a half of our member respondents (52%) characterized the current truck transportation market as either “Extremely Challenging” (14%) or “Very Challenging” (38%). This is down from April 2021 when we asked the same question. At that time, almost two thirds of our member respondents (65%) characterized the truck transportation market as “Very Challenging” (45%) or “Extremely Challenging” (20%).

“Recent changes have represented an about-face in terms of spot rates and available capacity,” said one Indago supply chain executive. “I expect continued favorable progress (for shippers) but do not think a freight Armageddon is coming.”

Here are some other value-added comments from Indago members, who are all supply chain and logistics professionals from manufacturing, retail, and distribution companies:

“It takes time for everything to work through the system. In our sector, CPG, with shortages, the consumer is buying when it is available and pantry loading. We are still seeing very strong demand for our products requiring more capacity. If another sector is slowing down, that would free up capacity for us, but it isn’t instant. Pricing has stabilized and capacity seems to have stabilized for the short term.”

“I believe the freight market is not quite heading toward a recession as volume continues to be elevated thanks to continued e-commerce demand and lack of capacity. I only see current rates declining as a slight reset to market rate highs, and unless the broader economy experiences a recession, I don’t see freight markets seeing a meaningful recession.”

“Looks like the peak season is over and capacity is starting to loosen up. I doubt there will be a recession as the rates are still historically high.”

In short, the general consensus from our Indago member respondents is that the freight market is softening a bit, especially compared to this time last year, but not collapsing. Of course, our sample size is small too, but it shows that different groups of shippers, from different industries, have different views of the market. Therefore, you need to rely on multiple sources of data and information (including your own) to piece together what’s happening in the market, which will continue to change, as always.

Do you believe the U.S. is heading toward a freight recession? Do you see market conditions (in terms of capacity availability and rates/costs) improving or getting more challenging in the weeks and months ahead? Post a comment and share your perspective.

There is a wildcard you need to keep on your radar, which will likely play a role in the weeks and months ahead: the current lockdowns in China due to COVID-19. As reported by Reuters last week, “Growing COVID-19 flare-ups are snarling China’s logistics chains, clogging highways and ports, stranding workers and shutting countless factories. The disruptions are already spilling over into global supply chains.”

Translation: more sand is being tossed into the gears of global supply chains, which will impact all modes of transportation in the weeks and months ahead.

Join Indago

If you’re a supply chain or logistics practitioner from a manufacturing, retail, or distribution company, I encourage you to learn more about Indago and join our research community. It is confidential, there is no cost to join and the time commitment is minimal (2-5 minutes per week) — plus your participation will help support charitable causes like JDRF, American Logistics Aid Network, American Cancer Society, Feeding America, and Make-A-Wish.

You can also follow us on LinkedIn to stay informed of our latest research results and news.