2022 Rate Outlook: Up, Up, and Away

Irrespective of mode, rates will be escalating, with carriers controlling capacity and exercising leverage like never before. Given the shortage of manpower and labor pools across the spectrum of global logistics, managers will be struggling this year.

Crafting the annual Logistics Management (LM) rate forecast has never been easier. Soaring inflation, tightening cargo capacity, and a shrinking labor market only add up to one thing for today’s global logistics managers: the triple whammy.

Indeed, industry analysts advise logistics managers to expect a steady escalation of rates and expenses. The good news? A different mindset may now transform our freight transport culture and strategic planning.

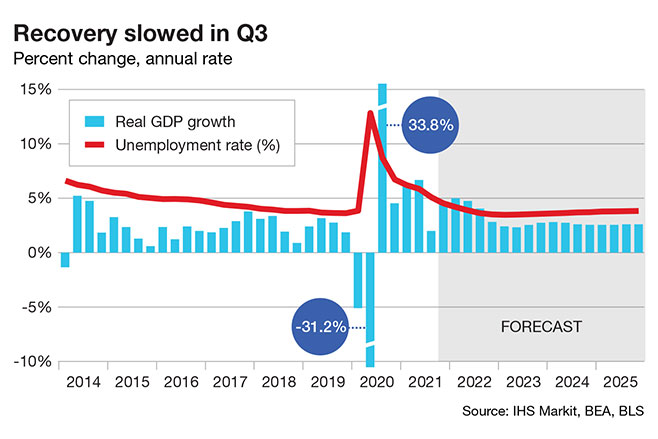

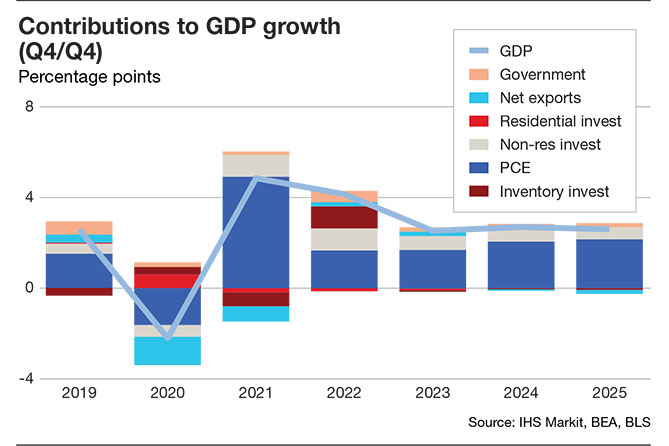

Late last year, analysts at IHS Markit revised their 2021 U.S. real GDP forecast up to 5.7% based on some surprising, late-year bursts of trade activity.

“GDP growth will surge to 7.1% in 2022, driven by a rebound in vehicle production and unexpected strength in exports and inventory investment,” says Joel Prakken, chief U.S. economist and co-head U.S. economics at IHS Markit. “The transition from COVID-19 to endemic will support continued expansion into 2022, even as pandemic-era fiscal support wanes.”

Chris Varvares, co-head of U.S. economics at IHS Markit, notes that near-term price and cost pressures will push inflation to 3.7% in 2022, after which he expects inflation to subside close to the Fed’s long-run 2% objective.

Both analysts contend that too little is yet known about the Omicron strain of the coronavirus to directly adjust their projections of growth and inflation. However, the forecast does incorporate asset values and oil prices that reflect the “new uncertainties.”

Energy picture uncertain

Meanwhile, Goldman Sachs forecasts that oil prices could rise to $150 per barrel in 2022 under a full economic reopening scenario. By contrast, Deutsche Bank forecasts that prices will average just $60 per barrel.

Derik Andreoli, principal at Mercator International and a frequent contributor to LM, contends that this dichotomy reflects much uncertainty about both global oil demand—which is a function of economic activity—and supply, which is increasingly subject to non-market forces.

“This wide range of [oil] price forecasts reflects unprecedented circumstances brought about not only by the COVID-19 virus and its many and growing number of variants, but also the various governmental, cultural, and personal responses,” he says. “These responses have had profound impacts on both the U.S. and global economy.”

Andreoli says that inflation has certainly extended to oil and fuel prices, and seems unlikely to ease even if the economy remains partially open. “This might be the best outcome from an oil price perspective because Goldman Sachs is right,” he says. “If the economy fully reopens, employers will face rapid wage rate inflation, and the velocity of money would increase.

For Andreoli, the best energy scenario would be for the economic reopening to occur slowly and smoothly, “as this appears to be the only way to avoid a significant run-up in the price of oil and all other commodities.”

Ocean: Paying more for less

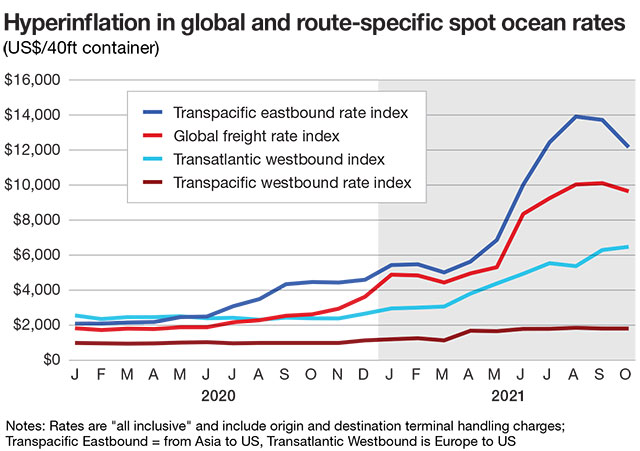

Shippers may also expect a second year of big increases for ocean contract rates, says Philip Damas, director and head of the supply chain advisors practice at London-based Drewry.

“Challenges of securing ocean capacity amid current logjams and prospects of hugely inflated ocean freight costs in 2022 are forcing logistics buyers to consider radical options,” he says.

According to Damas, freight rates will not normalize until the systemic market disruptions in container shipping, caused by the pandemic, are reduce significantly. “The crisis has turned the ocean transportation sector into both a seller’s market and an inefficient, unreliable sector,” he says. “Furthermore, shippers pay much more for a deteriorated service—a change which many logistics managers find hard to explain to their company’s leaders.”

Drewry does not see the planned measures to open gate operations at the West Coast ports 24-hours-a-day as a sufficient enough solution to calm the current systemic gridlock. Analysts contend that it will take infrastructure and fleet investments by the public and private sectors, improvements in productivity, and possibly programs to attract more truck drivers to the sector—at higher wages—to reduce the backlog of shipments and then solve the container supply chain problems.

“At Drewry, we have told our beneficial cargo owner customers to plan for another year of container supply chain shortages and very elevated ocean rates,” concludes Damas.

Trucking: Simple tactics needed

Satish Jindel, principal of SJ Consulting, which closely tracks the trucking sectors, advises logistics managers to begin analyzing truckload pricing because they have implications for intermodal as well. Furthermore, it’s by far the largest market in domestic freight transportation.

Jindel also notes that, despite disruptions from the pandemic and resulting changes in demand levels from shippers, leading less-than-truckload companies are able to gain rate increases in the mid- to high-single digits due to tight capacity. “And that’s needed by carriers,” he says. “Shippers should realize that these increases are helping transport providers reinvest in drivers, equipment and technology needed to support the demand.”

According to Jindel, shippers can save on total transportation spend by applying some simple, tactical planning that requires getting rid of some past practices. “Drilling right down to how a pallet is loaded is key,” he says. “I tell our clients to stop building pyramids and leaving air spaces between cartons loaded on a pallet, for example, and concentrate on loading cargo in cube configurations that utilizes the full width, depth and height of a pallet.”

Finally, Jindel says, shippers should collaborate more closely with both carriers and warehouse managers to strip inefficiencies out of the unloading and loading process. “Part of the reason we have a driver shortage is because there’s too much time wasted waiting at the warehouse,” he says. “No one makes any money when this happens, and logistics managers end up telling their companies that rates have to be hiked.”

Rail & Intermodal: Boom and bust

Rate forecasts are always challenging for the rail and intermodal sectors, says Jason Kuehn, vice president of the consultancy Oliver Wyman. But this year is more difficult than most.

“Rail and intermodal pricing were very strong this year,” says Kuehn. “Demand was robust this year, and truck shortages and supply chain congestion slowed things down, creating a perfect storm for logistics shortages.”

But with all things that boom, there usually follows a bust, Kuehn maintains. Inflation is high and consumer sentiment is declining, and he adds that after a strong year and an all-out back in-person holiday season, consumer spending may see a pull-back in 2022.

“Grocery, gas, restaurant prices—and soon utility bills—are all going to be higher, tugging at consumer wallets,” says Kuehn. “Input expenses are also soaring for iron and steel scrap, finished steel, oil and natural gas, and wage rates. It seems unlikely that people can absorb these increases without some retrenchment in demand, and it’s been a long time since we’ve seen 5% inflation rates.”

Kuehn notes that until intermodal delivers a more reliable service product, it will continue to be whipsawed by the trucking market. Intermodal rates, as usual, will lag general trucking trends, creating demand as rates rise—but suffering faster defections when truck rates fall.

“A restocking of inventory in the face of falling demand will favor intermodal for several months as transit time and reliability will be less of a factor until demand and inventory levels reach a new equilibrium,” says Kuehn.

Finally, labor shortages are hitting suppliers, carriers, and receivers across the board—the pressures from wages and high diesel prices are likely to keep truck rates high even as demand eases. And Kuehn believes that supply chain congestion is likely to keep equipment constrained through much of 2022.

“These factors taken together argue for intermodal rates to be flat to up, even if we see some easing in demand,” adds Kuehn. “Once prices rise they tend to be sticky and not come down quickly.”

Air: Upward pressure

Industry analysts also observe that as the ocean peak season cools off, the air peak season heats up.

This year, air rates are feeling even more upward pressure than usual from reduced passenger jet capacity—which could be made worse by Omicron fears—and congestion due to labor shortages among overwhelmed ground crews. Strict quarantine restrictions in places like Hong Kong are also complicating operations for many air cargo providers.

“The air cargo market remains very demanding and constantly changing due to the regulatory pandemic landscape, outbreaks of new variants, and escalated vaccine distribution needs,” says Niall van de Wouw, managing director of CLIVE Data Services in Amsterdam. “And that means higher rates across the board. Matching capacity to need is going to be the key concern for shippers in 2022—almost regardless of price.”

However, there may be light streaming across the horizon, says Brendan Sullivan, global head of cargo for The International Air Transport Association (IATA). He sees improved cooperation across the logistics supply chain as governments and border authorities lead to the safe transport of millions of tons of live saving medical supplies and the delivery of millions of doses of vaccines.

“We succeeded in what was the most sophisticated global logistics operation ever undertaken, but there were and continue to be challenges that need to be resolved,” says Sullivan. “Despite this, air cargo emerged from the pandemic even stronger and more agile than before. And as a result, it’s well positioned to support the global economic recovery and overcome future challenges.”

Addressing the capacity crisis, he points to a trend of “re-fleeting” by airlines. “We’re already seeing some great examples by Atlas Air, DHL, and Lufthansa,” says Sullivan. “All of which signed new aircraft contracts recently. And there has been some interest in electric aircraft too, with UPS planning to purchase up to 150 electric cargo carriers. DHL Express is also ordering their first-ever all-electric cargo planes.

According to Sullivan, logistics managers may also mitigate rate hikes by agreeing to pay a premium for airline purchase of “sustainable aviation fuel,” initiated by industry leader, Lufthansa Cargo. “And FedEx and DHL Express have committed to getting 30% of their jet fuel from alternative fuels by 2030,” he says.

Parcel: New players

With the prospect of new players in the parcel shipping arena next year, logistics managers may see some pricing “corrections” in 2022.

Matt Bohn, a senior consultant for Shipware, notes that now that UPS and FedEx have both announced their 2022 rates, it’s important to look forward to how these rates and the overall shipping environment will change.

“If we took a sampling of shippers during this time in 2020, they likely would have expected the pandemic and its corresponding issues to subside by 2022 at the latest,” says Bohn. “But now that doesn’t appear to be the case. UPS has even rebranded their ‘peak’ surcharges to ‘peak/demand’ surcharges, which illustrates that these are likely here to stay.”

If the UPS announcement is foreshadowing peak charges through 2022, it also portends more carrier supply issues, likely similar to the challenges shippers have faced in 2021. Bohn observes that UPS mentioned on their latest earnings call that they have successfully taken rate increases on over 50% of their largest shippers.

“I would expect the rest of these increases to continue into 2022,” says Bohn. “FedEx has been doing the same on a smaller, more selective scale thus far, but it’s likely that they will follow suit with more customer increases as well.”

Bohn contends that there is good news for shippers in 2022 and onward, however, with the likely entries of Amazon and Lasership/OnTrac into the national marketplace. “While I don’t expect either of these to become fully capable nationals next year, their pending entry should pressure UPS and FedEx to relent on their margin improvement focus or risk losing relationships and eventual market share to the new entrants,” he says.

According to Bohn, the pandemic has conditioned consumers to turn to online merchants for many more products than they would have normally purchased at a brick-and-mortar store—and the marketplace has realized this adaption over the last year. “The carriers are aware of this, and they’re also aware that the new consumer mindset handcuffs shippers into fulfilling more orders or risk losing business to those who can,” says Bohn.

“The carriers leverage this phenomenon to raise rates both via rate increases to target high frequency items like minimum charges, additional handling, and new delivery area surcharges and also contractually via forced increases or long termination charges which lock shippers into unknown future rate increases.”

Bohn is now advising shippers to “push back” as much as possible and be willing to leverage the new entrants as they become available or look to existing alternatives like regionals within their footprints or postal consolidators for lightweight, e-commerce shipments especially if the incumbents are acting punitively. “Despite what UPS and FedEx might say, negotiation of your current rates is still an option, but it’s important to do so with an eye on the future,” he concludes. “Locking into a multi-year term with penalties for breaking is a more palatable option for a duopoly, but it can prevent reaching out to the likely new entrants as they become more viable.”

Article Topics

Motor Freight News & Resources

XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates Preliminary March North America Class 8 net orders see declines National diesel average heads down for first time in three weeks, reports EIA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ New Breakthrough ‘State of Transportation’ report cites various challenges for shippers and carriers in 2024 More Motor FreightLatest in Logistics

Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources