Since 2020, freight rates have increased or remained stagnant at all-time highs. So, are freight rates finally starting to fall? And what will freight rates look like by the end of 2022?

Here's a breakdown of what’s happening with freight rates this year, and what you can expect for the rest of 2022.

Are freight rates falling in 2022?

Freight rates were predicted to reach all-time highs in 2022. But, as usual with shipping, the actual picture of how freight rates are changing is complex.

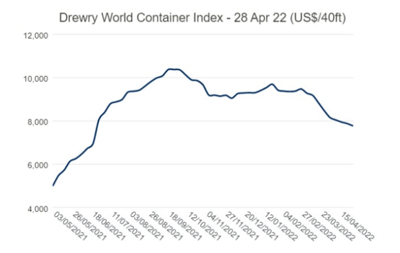

The good news is the composite index is dropping – falling week-on-week since mid-Q1. The current price is still 56% higher than one year ago, but it’s a positive step towards more reasonable rates. This drop in spot prices brings rates down to the lowest point since mid-2021 – although still far above the post-Covid rates we’d like to see.

Image credit: Hellenic Shipping News

Image credit: Hellenic Shipping News

So, why are freight rates decreasing right now? Many analysts are putting this drop down to typical market deceleration post-Chinese New Year. During this time, sales decrease and inventories are already full – leading to a decrease in demand for spot.

Covid lockdowns in Chinese port cities have also contributed to reduced rates. As entire cities went into lockdown, manufacturing and the number of truck transports significantly reduced. This means that Chinese manufactures are making fewer goods, which is, in turn, decreasing demand for the ships.

The cost-of-living crisis, which is impacting much of Europe, is also driving freight rates down. With the price of commodities going up, consumers have less to spend on goods that would otherwise take up cargo ships’ capacity.

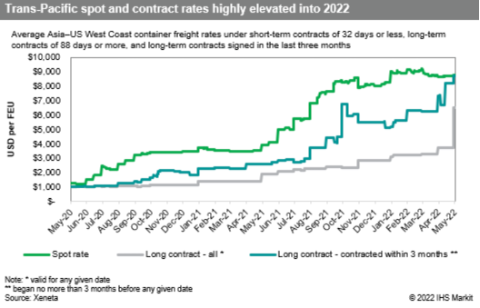

However, while spot rates may be decreasing, contract rates are another story…

Are contract freight rates falling in 2022?

Contract rates are not falling in line with the current spot market drops. According to Xeneta data, April saw substantial growth in long-term contract rates, jumping 11% month-over-month – an increase of 110% over last year.

Shippers are not turning to spot rates, despite the potential saving on offer. Many have already signed up for highly elevated contract rates to ensure they can secure the capacity they need for the upcoming year.

Strong contract rates have meant shipping giant Maersk is forecasting their strongest year ever – despite lowing spot rates. Maersk’s CEO, Søren Skou, stated they currently only have 20% volume left to contract which they’re offering on a block space agreement signed under ‘take-or-pay conditions.

With many shippers banking on contract rates for security, what can we expect to see happen with spot rates in the upcoming months?

Are freight rates forecast to fall?

Is the downward trend of spot rates here to stay? The market is still incredibly uncertain. Congestion remains a massive problem, there’s still a shortage of containers and oil prices are looking likely to spike even higher as the EU’s proposal to ban Russian gas becomes more serious. All these issues could drive freight rates up higher than they've ever been.

And some experts have suggested the current rate decrease is just a seasonal trend, pointing to historical freight drops in the months after the Chinese new year.

That said, the market has remained fairly stable throughout the year so far, despite massive disruptions such as the War in Ukraine, and ongoing issues, such as truck driver shortages.

So could we expect long-term stability in 2022? Market research firm Drewry has predicted that spot rates will stabilise in the coming weeks – but has not indicated how long they will remain stable - so it looks like another year of difficult forecasts ahead.

One thing we can be certain of is that carriers are in for another massive year. Many firms and analysts are predicting their biggest year ever, despite the record-breaking revenues we saw in 2021.

Want to learn more about how to save costs from falling ocean freight rates? Download the eBook below to uncover the key strategies shippers can leverage to benefit from the current market.

.png?width=915&height=289&name=Ocean%20Campaign%20Email%20Footer%20(1584%20%C3%97%20500px).png)