2023 Warehouse Equipment Survey: Tighter budgets prompt targeted spend

After a banner year for materials handling automation indicators last year, our annual equipment outlook survey reveals a more conservative approach to spending on automation, equipment and related software—however, the indicators didn’t decline drastically.

If last year the spigot on materials handling system investments was nearly wide open, this year a more conservative approach is revealed in our annual survey into automation spending and related trends.

The spigot isn’t being shut off, but there is some fiddling of that spigot to find just the right flow of automation spend and projects to arrive at productivity gains that will help contain costs over the longer term.

Our “Annual Warehouse and Distribution Center (DC) Equipment Survey” sets out to find how much was spent on materials handling automation, equipment, and related software over the past year, while also asking about the outlook for future spending as well as trends that will be growing in importance.

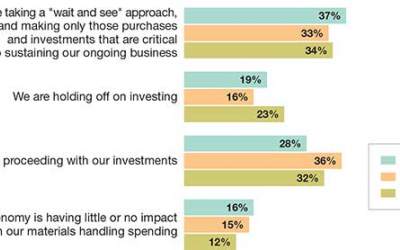

While we did find an increase this year in those respondents who would “hold off” on investments, that finding only declined by 7%, with two-thirds either taking a “wait-and-see” approach or proceeding with investments.

Meanwhile, there were positive signs in the survey results of both growing adoption and interest in many categories, with niches like autonomous mobile robots (AMR) and voice-directed solutions showing strong gains.

This year’s survey, conducted in December 2022 by Peerless Research Group (PRG), drew responses from 102 managers and executives in multiple verticals who are involved with materials handling system decisions. The annual survey not only asks about automation and equipment usage and spending plans, but also top industry issues, best practices and capacity levels.

We found issues like labor availability continuing to be seen as “very important,” while two years out, “cost containment” grew the most rapidly as an important issue to address. Yes, the survey shows a more conservative approach to spending this year, but longer term, most respondents have high interest in solutions that can gain efficiencies.

Norm Saenz, managing director and partner with St. Onge Company, a supply chain engineering and logistics consulting firm, who reviewed the survey findings along with his colleague Donald Derewecki, senior consultant with St. Onge, sees a slightly more conservative approach to spending this year, but also sees high interest in targeted solutions, especially for automated systems and supporting information systems (IS) and software.

“There is a more cautious approach reflected in these findings, but at the same time, there isn’t a slowdown in interest and consideration of automation like goods-to-person solutions,” says Saenz. “Issues like the labor market remain a major concern, so managers know they need to continue to automate, but they’re looking at careful use applications like AMRs or robotic depalletizing and palletizing that they can plug in and make a huge impact on their operations.”

Outlook and budgets

Each year, the survey asks how the present state of the economy is affecting spending on material handling systems and related technologies. Compared to last year’s findings, there is more hesitancy. Last year, 23% said that they were “holding off” on investing, up 7% from last year’s 15%. Only 12% said the economy is having little or no impact on their spending plans, versus 15% last year.

This year’s survey also found that 32% of respondents are proceeding with investments, down 4% from last’s year’s strong findings, while the “wait-and-see” response grew from 33% last year to 34% this year. Of those in the “proceeding” camp, the strongest interest was in automation technology, up from 59% last year to 72% this year.

Interest in IS solutions such as warehouse management systems (WMS) also grew sharply, from being noted by 33% of those proceeding last year to 50% this year. However, interest in proceeding with materials handling equipment was down by 2% versus last year, and 52% said that they would proceed with lift truck investments, down from 69% in 2022.

These indicators do not represent a big contraction, notes Derewecki, given that two-thirds of respondents are either proceeding with investments or taking a wait-and-see approach, especially when you consider external macroeconomic factors like the impacts of the war in Ukraine, inflation, and rising interest rates. “Overall, respondents are a bit more cautious due to various external factors,” he says. “In the past year, the Fed’s interest rate hikes have been significant and they do affect that cost of capital.”

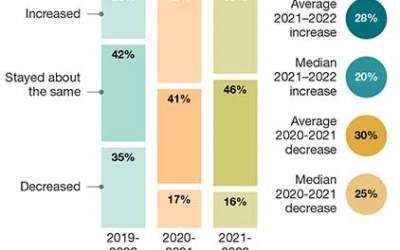

When asked how 2022 spending compared to 2021, 38% said it increased, down from 42% on the same question last year. The “stayed about the same” response grew to 46%, up from 41% last year, while those saying spending decreased did go up, but only 1%.

Respondent demographics

Peerless Research Group’s (PRG) e-mail survey questionnaire was sent to readers of Logistics Management and Modern Materials Handling in December 2022, yielding 102 qualified respondents.

The respondents were from sites whose primary activity is corporate headquarters (23%), warehouse/distribution (36%), manufacturing (233%), and warehousing supporting manufacturing (15%).

The average annual revenue size for respondent companies was $238.1 million this year, up from $184.8 last year. Qualified respondents—managers and personnel involved in the purchase decision process for materials handling solutions—hold influence over an average of 126,042 square feet of DC or facility space.

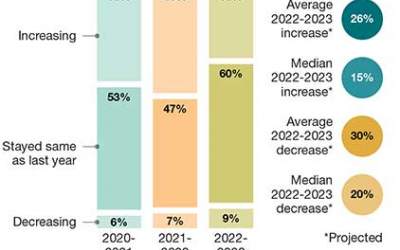

Looking at expected spending for the present year, 31% expect an increase, down from 46% last year, while the “staying the same” response grew from 47% last year to 60% this year. This year, 9% expect a decrease, up 2% compared to last year. Still, a combined 91% this year are either keeping their investment level steady, or actually increasing it.

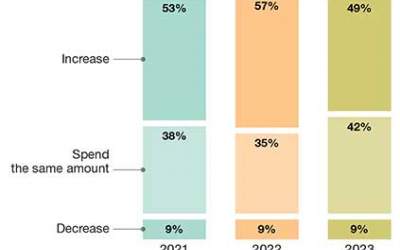

The annual survey also asks if spending will increase over the next “two to three” years, and compared to last year’s strong outlook on this question, we found that those expecting it to increase fell from 57% last year, to 49% this year. Those expecting it will stay about the same grew from 35% last year to 42% this year. Those expecting a decrease over the next two to three years stayed put at 9%.

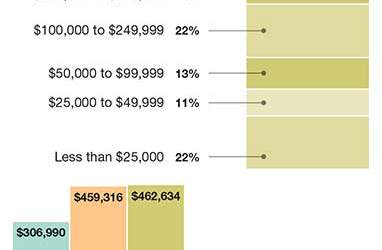

In terms of anticipated spending in dollar ranges and averages, there was a slight rise in the average, from $459,316 to $462,634. The median was up slightly as well, but this year, we had respondents from slightly larger companies, which likely explains much of this modest rise.

In terms of dollar ranges for anticipated 2023 spending on materials handling, 22% (likely respondents with small companies) will spend less than $25,000. However, 8% will spend $2.5 million or more, and another 7% indicated that their spend level will be between $1 million and $2.49 million.

When asked in which areas they will be investing over the next 12 months, 52% will spend on new equipment or equipment upgrades, down from 60% last year. Additionally, 43% plan to invest in IT and software, down just 2% from last year.

The only broad spending bucket that went up this year is enterprise applications software, with 32% of respondents saying that they will spend on this over the next 12 months, up from just 18% on this question last year.

This year’s survey found a decrease in the percentage of respondents whose companies have a pre-approved, capital expenditure (capex) budget for materials handling solutions, going from 39% last year to 31% this year.

However, 31% this year say they have a budget in excess of $1 million, and the average pre-approved budget actually climbed from $449,219 last year to $557,143 this year. Again, this is likely tied to larger companies in the respondent mix this year, where the average annual revenue for all respondents grew from $184.8 million last year, to $238.1 million this year.

Spend targets

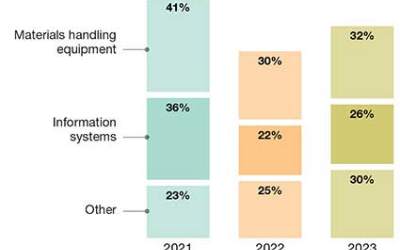

When asked what percentage of overall spending will be on either materials handling equipment, IS, or “other”

over the next 12 months, for 2023, 32% is for equipment, 26% is on IS, and 30% on other. Last year, this breakdown was 30% on equipment, 22% on IS, and 25% on other.

When asked which IS subcategories they will be spending on, niches on the rise this year include warehouse execution system (WES) and warehouse control systems (WCS), asset management, transportation management, voice recognition/picking, and distributed order management (DOM). Plans for DOM grew by 5% compared with last year, and voice is up by 9%.

In terms of evaluation or deployment plans for material handling equipment over the next 12 months, most categories were down a bit from last year’s response or stayed steady, though this year we did see an increase in the order picking and fulfillment systems niche (up 5% compared to 2022); systems solutions (up 3%); mobile and wireless (up 1%); and AMRs and automated guided vehicles (AGVs) up from 5% last year to 16% this year.

The survey also asked about which new purchases or substantial changes to existing systems across three broad areas of investment: IT; use of 3PLs; and various “system equipment” investments such as automated retrieval, lift truck and conveyors. Compared to last year, these areas were down, except for IT and software applications, which held steady at 41%,

The survey also asks about methods for gauging productivity, and whether these are automated, both now and two years from now. Across the board, our survey found that managers want a more automated means of monitoring and managing various processes.

For example, measurement of on-time shipment is an automated process for 42% today, but 58% want this automated within two years.

Likewise, order fulfillment cost tracking is automated for 36% today, and 50% want to automate in two years; while 38% monitor inventory accuracy in an automated fashion today, but 56% want to do so within two years. Similarly, daily throughput monitoring is automated for 30% today, with 48% wanting it automated in two years.

“People are looking to automate more in terms of how they gauge productivity across every area when you look at those two-year plans, even when the level of automation measurement is fairly high today,” notes Saenz.

Achieving automated performance metrics, it should be noted, might involve several types of solutions, from better reporting coming from a WCS, WES, or from higher level solutions like WMS and labor management, to robotics solutions that generate pick rate metrics—or even technology such as inventory-counting drones.

Another bright spot from the survey was increasing use of mobile solutions, and various devices and technologies used for data capture and inventory or fulfillment process tracking. This year’s survey found that overall, 69% are using or have plans for various mobile solutions, up from 56% last year.

In terms of current use level and plans for various types of automatic data capture technologies, the leading type is currently bar code labels, at 70% in use, with 42% having plans for labels in the next 12 months. Bar code scanners is second, at 63% current use, and 54% with plans.

In terms of AIDC subcategories with rising indicators is voice technology—currently in use by 5%, but with 29% having plans for voice. Likewise, just 7% indicate they use drones today, but 15% have plans for drones over the next 12 months.

Robots continue ascent

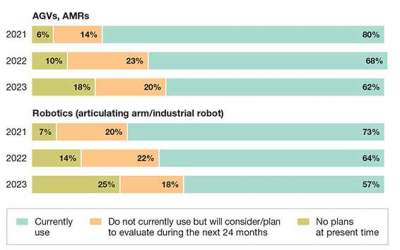

While our study has a relatively small sample size, as an annual tracking study the rise of robotics solutions shows solid three-year growth, with the in-use level of AGVs and AMRs now at 18% from 6% two years ago, and solutions which use industrial robots (cobots and robots with articulating arms) are now up to 25% from 7% two years ago.

In two years, another 20% of this year’s respondents plan to deploy or at least evaluate AMRs and AGVs. Similarly, interest in industrial robots and related solutions should grow two years out, given that 18% said they would explore such solutions within two years.

We further asked which applications AGVs, AMRs, and industrial robots will be used for. Growth applications for AMRs and AGVs this year are “picker to part” solutions, with 54% having interest in this, as well as “part to picker” order fulfillment, with 38% having interest.

Transportation leveraging AMRs/AGVs is another leading app, with 42%

having interest.

The growth over two years is fairly dramatic in terms of interest level on some of these apps, with picker-to-part order fulfillment having been at just 21% in 2021, but now over half saying they have interest in the niche, which to many, would be inclusive of assistive picking mobile robot fleets that help the productivity of human pickers.

For robotic solutions that use smart, articulating arms, leading applications include palletizing (45% have interest) and depalletizing solutions (38%) as well as solutions that automate a pick-and-place function (now at 41%). Again, the curve is steep. Two years ago, only 17% indicated interest in robotic depalletizing, for instance.

Maintenance, capacity trends

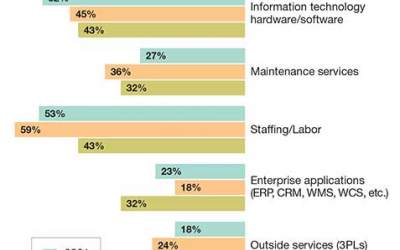

This year’s findings around systems maintenance saw a decrease in those saying they use internal staff, from 67% in 2022 down to 54% this year, which is 1% higher than two years ago.

However, there was a 2% increase in those who outsource maintenance, while using a combination of internal staff and outside resources stayed even at 23%, and those who marked “other” was up 6%.

When asked what role automation vendors or third parties play in maintaining automation, there was a tie for the leading role, with upkeep/upgrade at 43% (same as we found last year), and “consulting” at 43%, up from 36% from last year. There were also modest gains in those using third-parties for maintenance (now at 40%, up from 36%) and data analysis (now at 23%, up from 19%).

There may be multiple pressures at play with maintenance. Fluctuating budgets might lead to more outsourcing for some companies, while the increasing complexity of systems solutions and the need to manage inventory and orders in real-time might increase needs around consulting or data analysis.

The survey also tracks capacity levels, and again this year, the trends point to relatively high utilization, though starting to lighten for warehousing. For example, when we asked about activity/capacity level for standalone warehousing, 22% are above the 80% capacity/activity level, whereas last year, 31% were at 80% or higher.

A related part of the survey asks if average capacity utilization is 50% or more, and for standalone warehouses, this year 77% said on average that they are higher than 50%, down from 78% in 2022, and 80% in 2021.

Industry issues

Each year in this survey, we ask respondents to rate how important a set of key issues are to their operations today, and looking two years out, how important these issues will be then.

This year, we found that the top four issues are safety (named by 85%), company growth (named by 73%), labor availability (65%), and capital availability (named by 64%).

However, two years out, all these areas are seen as declining a bit in importance, with 82% seeing safety as important in two years, 65% for company growth, 58% for labor availability, and 62% for capital availability. The growth, in terms of importance two years out, is around cost containment—named as important by 61% currently, but that climbs to 76% seeing it as important two years out.

Derewecki notes that while issues like safety and labor availability will still be top issues two years out, the rising importance of cost containment in two years shows that respondents expect they’ll be under the gun to show bottom-line efficiencies being gained via automation, whereas the past couple of years, external disruptions may have made cost containment secondary to just keeping operations running and meeting customer expectations.

“We may be seeing a post-pandemic shift in priorities, with more attention going forward on achieving measurably lower costs,” says Derewecki.

The annual survey also looks at how e-commerce orders are fulfilled, both today and two years out. Using DCs and fulfillment centers as fulfillment nodes remain the leading way, but leveraging stores is seen as a growth practice.

The most common practice today is to “buy-online, ship to customer from a DC,” used by 30% today and expected to be practiced by 28% of respondents two years from now. Today, 20% practice “buy-online, ship to customer from vendor,” with this practice rising to 21% two years out, while 9% currently use a “buy online, ship from store” method, with this seen as rising to 17% two years from now.

The survey also asked if e-commerce will or already is prompting change in where distribution and manufacturing activities take place. This year, 58% said e-commerce is prompting more distribution functions in manufacturing, up 1% from last year. This year, 27% said e-commerce was prompting more manufacturing functions in distribution, down from 32% last year.

When asked “where does packaging and fulfillment occur” (with choices including warehouses, manufacturing sites, fulfillment centers, DCs, retail stores, and outsourced), the most common type of location remains a warehouse, cited by 60% this year, up from 55% last year.

Additionally, 32% this year indicate that packaging and fulfillment occurs at a fulfillment center, up from 27% last year. Another 19% cited stores this year, up from 8% last year, and finally, 38% say packaging occurs in manufacturing, down from 53% last year.

Attention to supply chain risk planning held steady, after increasing last year versus 2021. This year, 55% said that they have a plan for identifying, analyzing, and mitigating risks, which is even with last year and well above the 39% finding for this question back in 2021.

When it comes to leading types of risks, the three leading areas this year were logistics risks (named by 75% this year, up from 65% last year); in-house production or operational risks (56% this year, up from 44%); and a tie for third, with supplier risks at 44% and legal liabilities also at 44%. This year’s survey found a decline for risk plans for natural disasters (down by 10% versus last year), while plans addressing intellectual property theft, grew from 26% last year, to 38% this year.

“It’s a good thing that risk planning did not decline in the survey, but given all the potential disruptions and disasters that affect supply chains, that finding should really be significantly higher,” says Derewecki. “These disasters and risks materialize and can carry significant negative impacts, so you need to plan for them.”

Article Topics

Photos News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources 2023 LTL Study: Partner for reliability 2023 Logistics Salary Survey: Strong numbers, high demand 2023 Warehouse Equipment Survey: Tighter budgets prompt targeted spend 2022 Less Than Truckload Study: Trials and tribulations of rising rates 38th Annual Salary Survey: Salaries begin to rebound 2021 Warehouse/DC Equipment Survey: Preparing for post-pandemic volumes More PhotosLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources