Europe Transportation Faces Uncertainty

Underscoring the scope of the challenge testing Europe's transport business: one of its most illustrious names, P&O, soon will be swallowed up by an "upstart" foreign firm with a distinctly modest pedigree -- either Dubai-based DP World or Singapore's PSA, which are slugging it out in a multi-billion bidding war for the world's fourth-largest container terminal operator.

[P&O on Jan. 26 said it had accepted PSA's $6.4 billion bid after withdrawing approval for DP World's earlier offer.] When the dust settles, there will only be one European company among the top five terminal operators, APM Terminals, a unit of Copenhagen-based A. P. Moller-Maersk. You can't escape the Big Blue!

Yet, what makes the P&O takeover battle really stand out is that it is one of the very few cases of a European transport firm falling into foreign hands. It's been one-way traffic in the other direction over the past decade with the Europeans snapping up overseas rivals, especially in the United States, as they seek to become global operators in order to keep pace with their customers' international expansion.

Dramatic changes are in the pipeline for three key freight transport sectors -- rail, aviation and mail -- which have begun a 12-month countdown to deregulation either on an EU-wide basis or in key national markets, including Germany, the EU's biggest economy.

European airlines are guardedly optimistic the EU and the U.S. finally will cut a deal in the coming months to liberalize passenger and cargo service that will eventually lead to a single trans-Atlantic aviation market. This will free the industry from restrictive rules drawn up at the end of World War 2 that have prevented it from pursuing global consolidation that has reshaped most other industries. While Germany's mail, express and logistics giant Deutsche Post and Deutsche Bahn, its state railway, can acquire large U.S. transport firms, its flag carrier, Lufthansa, is barred from taking over an American rival. Where is the logic? You got me....

Even a modest first-step agreement would help European airlines because they would be free to take over other EU carriers without worrying they might lose their nationality-based traffic rights to the U.S. The American air-cargo industry would be the beneficiary of a phased "open skies" deal because big guns like UPS and FedEx Corp. would be allowed to fly freight between EU countries while European all-cargo carriers are too small to reap matching benefits in the U.S. But in time, top European scheduled cargo carriers like Lufthansa Cargo and Air France-KLM will be well-positioned to snap up U.S. operators. Hey, let them evolve outside of "contrived" market competition!

The countdown to EU postal deregulation has begun early with some countries fast-tracking the liberalization of their domestic markets, forcing monopolies to look elsewhere for new business, normally in the transport sector. Deutsche Post, which will lose its delivery monopoly in 2007, has spent the past decade on a multi-billion acquisition binge that has transformed it into a global express and logistics player. But mail still remains a key revenue and profit center which will come under further pressure next year when outsiders, including UPS, move onto its home turf. DPWN has got plans...so don't get too comfortable UPS.

Other European postal monopolies have struggled to get into shape, particularly Amsterdam-based TNT which is seeking buyers for its underperforming logistics business in a bid to focus on its higher margin mail and express operations. This has raised the prospect of further consolidation of Europe's logistics sector, with FedEx, which has so far shunned the heavier freight market, emerging as a strong favorite to lead the bidding. But it could be acquired by La Poste, France's mail monopoly, which has made a hash of preparing for EU-wide postal deregulation. Britain's Royal Mail, meanwhile, is facing a deluge of competition from private delivery firms as its monopoly ends and smaller countries like Austria are preparing to privatize their vulnerable postal services in the hope they can team up with the big guns.

But all bets will be off if a consortium headed by German investor and former logistics executive Cornelius Geber makes its long-awaited bid for the whole of TNT which has a stock market valuation of around 12 billion euros ($ 14.4 billion). Geber said recently that the consortium has almost finalized the deal, pushing up TNT's stock on the Amsterdam stock exchange. Geber will deliver...so to speak...

The coming takeover battle for P&O and mounting speculation over the fate of TNT are grabbing the headlines, but the railways, Europe's most over-looked transport mode, could yet spring the biggest surprises in the coming months.

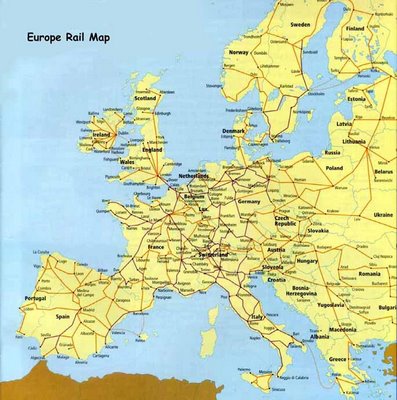

Europe's railways are still losing business to trucking and inland shipping, extending a decades-long trend that has seen their share of the EU's cargo market shrink from over 20 percent in 1970 to barely 7 percent today. But that could change from the start of 2007 when the opening of the Betuwe line, a $6 billion rail cargo corridor linking Rotterdam, Europe's top container port, to the German rail network, the continent's largest, coincides with the final phase of deregulation of rail freight which will usher in free competition across the 25-nation EU. Watch out independent rail operators like ERS (European Rail Shuttle BV...which WAS a joint venture between Maersk and P&ONL) as they continue to secure dedicated rail services over the once sovereign national rail lines of Germany, Holland, France, Italy, and the Czech Republic!

Rail could yet blow this latest -- and probably final -- chance to compete with trucking, but long suffering shippers and freight forwarders enslaved to increasingly congested road transport are beginning to believe an influx of private operators, including shipping lines, might just trigger a renaissance of the industry. The state-owned players also are getting ambitious with Deutsche Bahn, Europe's biggest rail cargo operator, recently paying $1.2 billion for Bax Global, a leading U.S. heavy freight transport firm, and currently eyeing a $1 billion bid for control of HHLA, Hamburg's biggest container handler.

0 Comments:

Post a Comment

<< Home