7 min read

Driving Change: CA AB5 and the Challenges Facing the Dump Trucking Industry

By: TRUX Team on May 24, 2023 10:17:55 AM

In the ever-evolving landscape of the dump trucking industry, material producers and contractors who rely on independent, third-party dump truck operators are grappling with a wave of changes brought about by California Assembly Bill 5 (CA AB5).

This legislation has sent ripples of uncertainty through the dump trucking community, as it redefines the relationship between material producers and contractors and the independent dump truck operators they depend on. And though the bill is currently only applicable to trucking in the state of California, there are already other states considering similar legislation.

In this article, we will explore CA AB5 and shed light on the new challenges that material producers, contractors, and independent dump truck operators face in the wake of this transformative legislation. We will also delve into the specific provisions of CA AB5 that directly impact the dump trucking industry and the innovative strategies that material producers and contractors are implementing to maintain their relationships with independent dump truck operators while navigating the complexities of CA AB5 compliance.

Explaining CA AB5

CA AB5 is a landmark piece of legislation that was enacted in California on January 1, 2020. Its primary purpose is to address concerns surrounding the misclassification of workers as independent contractors and to establish a stricter framework for determining employment status.

The central goal of CA AB5 is to ensure that more workers are classified as employees and entitled to the benefits and protections that come with this status, such as minimum wage, overtime pay, workers' compensation, and unemployment insurance. The bill aims to prevent the misclassification of employees as independent contractors, which can lead to the exploitation of workers and the erosion of labor standards.

CA AB5 has had far-reaching effects on various industries, including ride-sharing services, gig economy platforms, and construction sectors. However, the bill also includes certain exemptions for specific professions and industries that have lobbied for more flexibility in their worker classifications.

How does this impact Material Producers and Contractors?

Material producers and contractors have long relied on the expertise and services of independent dump truck operators to fulfill their dump trucking needs. These partnerships have allowed contractors to leverage the specialized skills and equipment offered by these independent operators, creating a mutually beneficial relationship that has driven the success of countless projects.

CA AB5 has introduced a seismic shift in how material producers and contractors engage with these independent dump truck operators, making it increasingly difficult to maintain the independent contractor status. As a result, these entities are faced with the potential reclassification of valuable partners as employees. This change brings forth a host of new challenges for material producers and contractors.

Flexibility and Autonomy: The established flexibility and autonomy that material producers and contractors have come to rely on are now at risk. The ability to engage specific dump truck operators for individual projects, tailor agreements to suit project requirements, and maintain a dynamic network of specialized professionals is threatened by the implications of CA AB5.

Increased Costs: Under CA AB5, dump truck operators who were previously classified as independent contractors may need to be reclassified as employees. This change can lead to increased costs, including expenses related to minimum wage, overtime pay and hour laws, workers' compensation insurance, payroll taxes, benefits, and other employment-related costs. These are costs that many in the industry will not be able to bear and may cause some to lose out on valuable projects due to an inability to secure adequate hauling supply.

Administrative Burden: Compliance with employment laws, record-keeping requirements, and other obligations associated with employee classification can create additional administrative burdens. This includes maintaining accurate time records, ensuring proper wage calculations, and managing employee benefits and payroll taxes.

Uncertainty and Legal Challenges: The implementation of CA AB5 has faced legal challenges and ambiguity. The legislation includes various exemptions and exceptions for certain professions and industries, which have led to confusion and disputes over the proper classification of workers in the dump trucking industry. The uncertainty surrounding the legislation's application and potential amendments adds further complexity.

The downside of AB5 for independent dump truck operators

While the challenges facing material producers and contractors are pretty clear, independent dump truck operators are not immune from their own set of challenges related to CA AB5.

Reduced Operational Flexibility: The flexibility that independent contractor status provided to dump truck operators may be limited under CA AB5. Contractors may need to adhere to more rigid employment regulations, such as set work hours, breaks, and other requirements that could impact the flexibility and responsiveness of dump trucking operations.

Potential Loss of Independence: Dump truck operators who were accustomed to working as independent contractors may find their independence compromised under the employee classification mandated by CA AB5. They may lose the ability to set their own rates, choose their work assignments, and maintain the level of autonomy they previously enjoyed.

Reduced Work Opportunities: Some dump truck operators who prefer the flexibility of independent contractor status may find it more challenging to secure work under CA AB5. Material producers and contractors may be more cautious about engaging independent contractors due to the potential risk of misclassification and associated legal liabilities. This could result in a reduction in available work opportunities for dump truck operators.

Key provisions of AB5 and their impact

CA AB5 has specific provisions that directly impact material producers and contractors utilizing third-party dump truck operators. These provisions focus on the classification of workers and the determination of their employment status. Here are the key provisions of CA AB5 that affect contractors in their engagement with third-party dump truck operators:

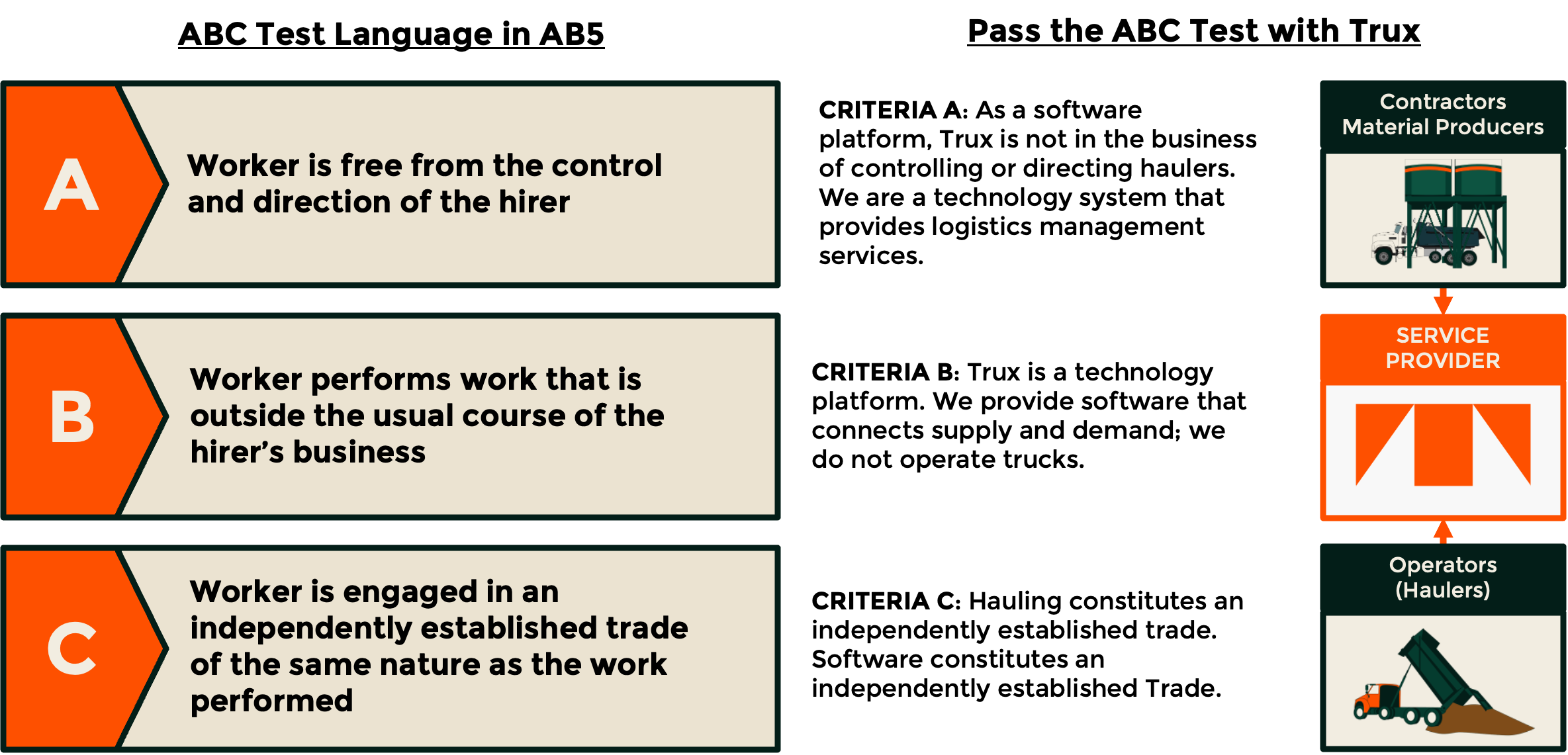

Adoption of the ABC Test: CA AB5 adopts the ABC Test as the primary criteria for determining whether a worker should be classified as an employee or an independent contractor. To be classified as an independent contractor, the dump truck operator must satisfy all three prongs of the ABC test:

- the operator is free from the control and direction of the hiring entity, both in contract terms and in practice;

- the work performed by the operator is outside the usual course of the hiring entity's business; and

- the operator is engaged in an independently established trade, occupation, or business.

Presumption of Employee Classification: Under CA AB5, there is a presumption that workers are employees unless proven otherwise. This presumption places the burden of proof on the hiring entity to demonstrate that a worker meets all the requirements of the ABC test to be classified as an independent contractor.

Worker Reclassification: The implementation of CA AB5 has led to the reclassification of many independent dump truck operators as employees. Contractors who previously engaged these operators as independent contractors may now have to reclassify them as employees, subject to wage and hour laws, benefits, and other employment-related obligations.

Increased Liability and Compliance: Contractors utilizing third-party dump truck operators face increased liability and compliance responsibilities under CA AB5. As employees, these operators would be entitled to minimum wage protections, overtime pay, workers' compensation, and other benefits. Contractors would need to ensure compliance with wage and hour laws, record-keeping requirements, and other obligations associated with employee classification.

Potential Impact on Contractor Relationships: CA AB5 impacts the dynamics and relationships between contractors and third-party dump truck operators. Contractors may face challenges in maintaining the flexibility and autonomy they once enjoyed when engaging independent contractors. The need to comply with employment laws and potentially negotiate different contractual arrangements could impact the contractor-operator relationship.

Satisfying the ABC Test

Trux realizes that simply adding a large roster of previously-independent dump truck operators as employees with the associated financial and legal implications poses an undue burden for many if not most material producers and contractors. That’s why material producers and contractors who currently make use of third-party dump truck operators are turning to Trux to help them satisfy and substantiate compliance with the ABC test. How does this work?

Securing your subcontracted haulers through Trux may also qualify you for a Business-to-Business (B2B) Exemption.

AB5 exempts business-to-business subcontracted haulers that meet 12 specific requirements.

|

|

Subcontracted haulers independently operate in an open marketplace administered by Trux. Material producers and contractors post hauling work on the Trux Marketplace where independent owner-operators are able to see and select this work from among many alternatives. The hauler remains independent and free to contract with and perform work for other entities at rates, locations, and times of their choosing.

CONCLUSION

The implementation of California Assembly Bill 5 (CA AB5) has undeniably ushered in a period of significant change and challenges for the dump trucking industry. While the legislation aims to address worker misclassification and provide greater protections, it has presented hurdles that many in the industry must navigate. The reclassification of independent dump truck operators as employees, increased costs, reduced operational flexibility, administrative burdens, and potential loss of independence all pose significant concerns. However, amidst these challenges, material producers and contractors can continue to work with independent operators by satisfying the ABC Test.

Schedule a personalized demo to see how Trux can help you overcome the significant challenges associated with the implementation of CA AB5.

Related Posts

How Dump Truck Company Logistics Software Creates Efficiency

Over the course of the next five weeks, we will be exploring a series of topics to help...

Recruiting Truck Drivers: How To Find and Recruit Drivers to Hire

Wondering how to recruit truck drivers? If you’re struggling to find and keep good dump truck...

How Trucking Technology Improves Operational Efficiency | Trux

Contractors, material producers, brokers and fleet owners are facing an uphill battle these days....