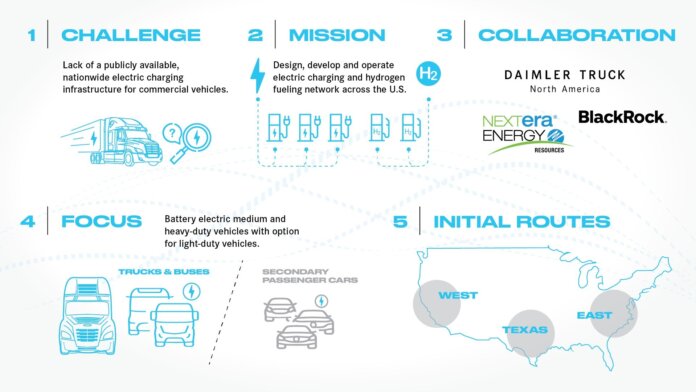

Daimler Truck North America LLC (DTNA), NextEra Energy Resources LLC and BlackRock Renewable Power have signed a memorandum of understanding (MOU) to lay the foundation for a proposed joint venture (JV) to design, develop, install and operate a nationwide, high-performance charging network for medium- and heavy-duty battery electric and hydrogen fuel cell vehicles in the U.S.

With the goal of accelerating the rollout of carbon-neutral freight transportation, start of operations for the future JV is planned for 2022. Initial funding is expected to be comprised of approximately $650 million divided equally among the three parties.

“This planned joint venture, and our collaboration with BlackRock and NextEra Energy Resources, will address the urgent need for a nationwide battery electric and hydrogen fuel charging infrastructure for commercial vehicles to reach shared climate goals,” says John O’Leary, president and CEO of DTNA. “Our joint investment will act as a catalyst to make a carbon-neutral trucking industry a reality.”

“This project is a critical step toward developing a sustainable ZEV ecosystem across North America, and we look forward to including additional partners as it progresses,” adds O’Leary. “We are committed to providing access to this network not only for the DTNA vehicle brands, but also for any manufacturers using predominant industry charging standards and communication protocols.”

Lack of a publicly available, nationwide electric charging infrastructure for commercial vehicles, especially those used for long-haul freight operations, remains one of the biggest barriers for widespread deployment of electric trucks. With formation of this JV, the three parties will be pooling their resources to address this challenge. The parties plan to build a network of charging sites on critical freight routes along the east and west coasts and in Texas by 2026, leveraging existing infrastructure and amenities while adding complementary greenfield sites to fulfill anticipated customer demand. First phase is set to begin construction in 2023.

“Working with Daimler Truck North America and BlackRock, we expect to accelerate the transformation of the transportation sector and make future investments in electrification upgrades, charging stations and renewables,” states John Ketchum, president and CEO of NextEra Energy Resources. “This collaboration builds on our market-leading eIQ Mobility software platform for quantifying the value and timing of fleet conversions and our decarbonization-as-a-service platform that help fleets execute on their plans to transition to zero emission electric and hydrogen vehicles.”

Initial focus will be on battery electric medium- and heavy-duty vehicles followed by hydrogen fueling stations for fuel cell trucks; the sites will also be available for light-duty vehicles to serve the greater goal of electrifying mobility.

“The commercial transportation sector is a significant contributor to carbon emissions, and we firmly believe that decarbonization of transportation will be a critical societal focus for the next decade,” comments David Giordano, global head of BlackRock’s Renewable Power Group. “Having already made several investments in the EV charging infrastructure space around the globe, we also believe that investments in the sector are highly complementary to our renewable power generation investment strategy.”

NextEra Energy Resources is a investor in electric and charging infrastructure and brings experience optimizing renewable energy, resiliency and grid integration. DTNA develops electric trucks (start of production of battery electric Freightliner eCascadia and eM2 in 2022/23), walk-in vans and school buses, as well as provides consultant services to fleet operators. In cooperation with the local utility company Portland General Electric (PGE), DTNA opened a public charging site for commercial vehicles in the U.S. BlackRock’s Renewable Power group is a renewable power equity investment platform. The group seeks to invest across the spectrum of renewable power and energy transition supporting infrastructure globally, with over $9.5 billion in total commitments and investments in over 350 wind and solar projects, in addition to electric vehicle charging infrastructure and battery energy storage systems, across 15 countries and 5 continents. BlackRock’s Renewable Power group is a part of BlackRock Real Assets.