Domestic transportation demand patterns continue to trek eastward, shaking up entrenched freight flows and positioning the market for future rate hikes. Multiple factors are fueling this shift — from inventory correction to nearshoring — and the trend is not expected to reverse anytime soon.

This movement is best observed by comparing truckload demand out of surging markets in the Southwest region with demand coming from the West. While demand is currently growing out of several regions, popular markets in Texas and Arizona are seeing bigger spikes than historical showstoppers in California.

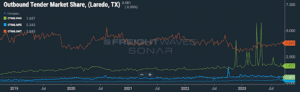

“Truckload demand has nearly doubled out of the border town Texas markets of Laredo and McAllen since 2018. Phoenix has experienced a similar developmental boom, becoming a proxy for California’s old warehousing capital in Southern California’s Inland Empire,” FreightWaves Head of Freight Market Intelligence Zach Strickland wrote in a recent article.

“The trend is more important than the current value in this situation,” Strickland continued. “Ontario’s market share value hit all-time lows this past winter, falling below 3% for the first time in the indexes’ history.”

Inventory correction

Early in the course of this shift to the East, industry experts pointed to inventory offloading as a potential contributing factor. Thanks to the pandemic-fueled economic roller coaster and ongoing recession, many retailers had inventory backlogs to work through before ramping up their ordering activity once again.

This would naturally drive down demand from the West. While inventory correction likely contributed somewhat to this change, there is little evidence that it was a leading factor. This is especially true since the shift has continued despite dwindling backlogs.

Nearshoring

The coronavirus pandemic has spurred companies to diversify their supply chains in order to avoid facing the same challenges in the event of future disruptions. These efforts have primarily focused on moving facilities away from China to sidestep political pitfalls and cope with rising labor costs.

“Supply chain diversification strategies help explain this pattern shift as companies try to move away from single sourcing practices,” Strickland explained. “This practice does hedge companies against wild swings arising from geopolitical risks, but it also can increase costs.”

An increasing number of companies are opening facilities in Mexico in order to increase diversity in their supply chains. Manufacturers operating in Mexico are able to take advantage of the lower labor costs once associated with China while moving their products closer to their end customers in the United States, reducing the likelihood of disruptions in transit.

As retailers and manufacturers continue to increase their presence in Mexico, freight demand out of the Southwest will continue to climb, underscoring current trends.

What does this mean for freight rates?

Due to the soft economic climate, these changes have not had a particularly strong impact on rates. This will likely change as the balance of power in the market shifts back to carriers.

“These shifting patterns are not very obvious to transportation providers in a soft market. Once the tide of excess capacity retreats, as it is expected to do over the next year, these areas will be more exposed to higher outbound transportation costs than they were prior to the pandemic.”

It takes time for carriers to adjust to new freight patterns. When demand starts outpacing supply once again, rates will reflect this adjustment period. The best way to be prepared for these changes before they occur is to utilize high-frequency data to keep track of what is happening in the market today — and what may be happening in the market tomorrow.

Click here to learn more about how SONAR can help you prepare for tomorrow’s freight market.