E-commerce, booming economy fuel 11.45% rise in U.S. logistics costs, new report says

Riding a booming economy, U.S. Business Logistics Costs (USBLC) rose 11.4% to reach $1.64 trillion-- or 8% of 2018’s $20.5 trillion gross domestic product (GDP). That’s according to the authoritative State of Logistics report released today by A.T. Kearney, sponsored by the Council of Supply Chain Management Professionals and presented by Penske Logistics.

Riding a booming economy, U.S. Business Logistics Costs (USBLC) rose 11.4% to reach $1.64 trillion—or 8% of 2018’s $20.5 trillion gross domestic product (GDP). That’s according to the authoritative State of Logistics report released today by A.T. Kearney, sponsored by the Council of Supply Chain Management Professionals and presented by Penske Logistics.

Supply chain costs are rising due to a few reasons, according to the report, including:

- Retooling of supply chains to account for more e-commerce sales—online sales increased by 14.2% last year. The need for smaller, more costly warehouses has spiked;

- “Extremely high” utilization of existing truck fleets limits available freight capacity and drives up rates;

- Increasing government regulations on driver hours-of-service causing smaller trucking firms to cease operations, consolidate or acquired by larger transport companies; and

- Tight U.S. labor market and higher wages for truck drivers and warehouse workers; attracting and retaining labor in general remains challenging for transportation and logistics companies

The report cited several innovations driving state-of-the-art supply chains in the following ways:

- Silicon Valley has devoted time, energy and resources to automation and robotics with inventions like automated trucks and automated warehouses

- Vehicle electrification will lead the way to a more sustainable transportation network

- The upgrade to a 5G communications network is on the horizon, which will improve logistics operation execution; planning and management

- High-security encryption

Entitled “Cresting the Hill,” the report states the strong seller’s market that carried over from 2017 well into 2018 began to weaken in the second half last year as capacity started to catch up with demand and the quarter-on-quarter pace of Gross Domestic Product (GDP).

Citing President Donald Trump’s trade and tariff disputes, the report noted U.S. inventory buildups began in the second half of 2018 despite “dramatically rising costs” for drivers and warehousing staff. But the report says logistics providers managed to complete the year with “generally excellent” results and cautious optimism for 2019.

Conversely, shippers hoped for redress after what for most was the worst year in memory in terms of cost and capacity availability, the report says. But at the halfway point of 2019, signs of a slowdown and talk of recession are “abundant,” but in-year rate cuts and other forms of economic stimulus may be on the way.

Key indicators suggest that the economic momentum that lifted GDP 2.9 percent last year will wane with “swollen retail and wholesale inventories being depleted” and corporations turning cautious in the short term, according to the International Money Fund and other sources.

Noting quarterly GDP growth turned in a robust 3.1 percent growth rate in the first quarter, the report says there’s temptation to see the shoe as being on the other foot.

“Cautious carriers have been making concessions and have cut back on capacity plans,” the report says. “At the crest of this hill, we see both hope and evidence of a better road being taken.”

Leading shippers looking to control logistics costs have moved in the direction of constructive engagement and innovation than ever before. The report noted carriers have been pleased with the new collaboration while opening up to start-ups and new technologies for novel solutions to transportation challenges.

A closer look at 2018 numbers shows rising costs across all USBLC components: transportation, inventory-carrying costs and other expenses. Inventory led the way with a 13.2 percent overall cost increase on a 4.6 percent rise in year-over-year inventories as trade-tension buildups met declining demand.

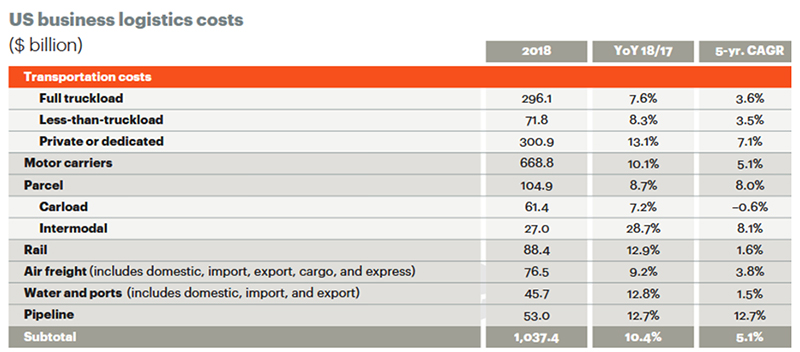

While transportation costs fared better with a 10.4 percent increase, certain modes saw big jumps. Intermodal and private fleets jumped 28.7 percent and 13.1 percent, respectively, as shippers sought alternatives to common carriers and the U.S. Postal Service powered up 9.7 percent as the big volume winner in last mile deliveries.

But all modes enjoyed gains, as the following chart details:

Article Topics

Latest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources