What’s happening in the robotics market? I guess it depends on who you ask and how you define “the robotics market.”

Last week, the Association for Advancing Automation (A3) announced that “after record orders in both 2021 and 2022, robot sales in North American declined by 30% in 2023.” Here are some excerpts from the press release:

Companies purchased 31,159 robots in 2023, compared to 44,196 ordered in 2022 and 39,708 in 2021. These 2023 orders were divided almost equally among automotive (15,723 robots sold) and non-automotive companies (15,436 robots sold), a 34% drop in sales to automotive OEMs and automotive suppliers over 2022 and a 25% total decrease in all other industries.

“While robot sales naturally ebb and flow, the return to more typical robot sales after the last two record years can likely be attributed to a few obvious issues: a slow U.S. economy, higher interest rates and even the over purchasing of robots in 2022 from supply chain concerns,” said Jeff Burnstein, president of A3. “We’ve seen a slowdown in the manufacturing of electric vehicles this year along with fewer new distribution centers, both likely reducing the demand for robots.”

Looking ahead, Burnstein said, “While we expect to see automotive orders rise again [in 2024], there’s little doubt that orders will increase from all non-automotive industries as they recognize how robots can help them overcome their unique challenges.”

I don’t have access to A3 data, so the breakdown of robot orders for manufacturing applications versus robot orders for distribution/warehouse applications is not clear. That said, I think it’s safe to assume that “reversion to the mean” has occurred across the board following the record growth experienced during 2020-22 due the pandemic, low interest rates, and other factors.

How you define “the robotics market” also matters. If you were at ProMat last year, you know what I mean. Simply put, there are many different types of robots being used in a wide variety of applications, from autonomous mobile robots used for item picking to robots used to load/unload truck trailers (see “ProMat 2023: The ‘I’ Word & Other Key Takeaways”).

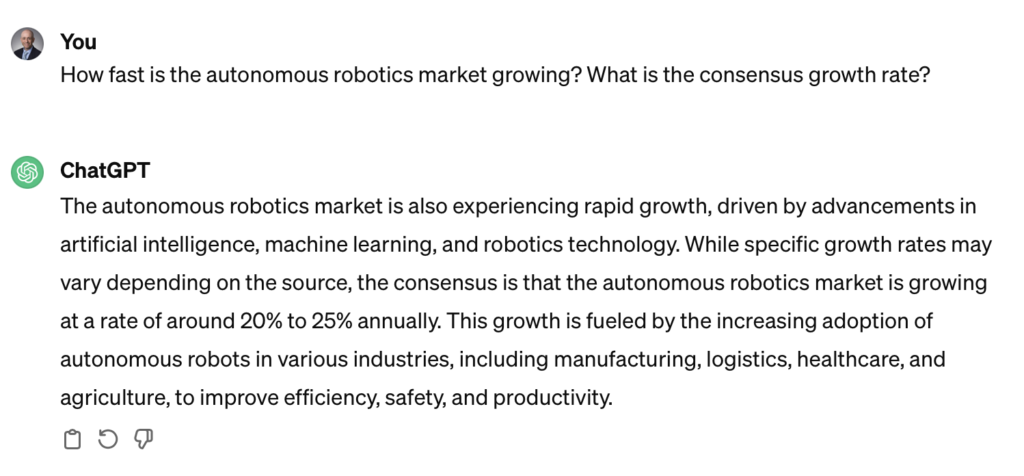

For example, if you do a Google search on “autonomous mobile robots market growth,” you’ll find numerous market research reports predicting a compound annual growth rate (CAGR) of 10% to 18%+ over the next five years. I also asked ChatGPT, and here’s its response:

(Then again, have you ever seen a market research report forecasting negative growth? I assume those reports don’t sell very well.)

The important question for most companies, however, is not how big is the size of the robotics market but “When is the right time for us to deploy a robotics solution?”

As I wrote last August in “The Tipping Point And Business Case For Warehouse Robots,” the tipping point to deploy warehouse robots will vary by industry and company, as these comments by supply chain and logistics executives from a February 2023 Indago survey illustrate:

“Our labor needs were the tipping point for our company to invest in warehouse robots. So far, the experience has been wonderful in two warehouses.”

“The tipping point for us was team member turnover in our distribution centers. We required a co-robot/team member solution to maintain velocity of daily picking along with error reductions.”

“Without a doubt, the dearth of good labor and the insane increases in labor costs for warehouse associates is what will eventually push us to robots if they’re easily integrated.”

“Our company would need to find a robotic solution that pairs well with big, bulky, and heavy products that also have some level of high-volume operations / flow to them.”

“The decision to adopt robots in the warehouse depends on several factors, such as the size and complexity of warehouse operations, the volume and variability of inventory, the level of automation already in place, and the availability of skilled workers.”

Staples reached one of these tipping points, as evidenced by the press release issued last week by RightHand Robotics announcing a multi-year agreement with Staples that allows the company “to deploy and install the company’s RightPick™ item-handling system to automate operations for higher service levels and Next-Day Delivery to over 98% of the U.S..” You can see the robots in action at Staples in this video:

“We have always valued automation, and we see it as the future of eCommerce picking,” said Amit Kalra, Chief Supply Chain Officer at Staples in the press release. “After evaluating other solutions, the RightPick system met our high performance and reliability standards, picking items with different shapes, packaging, sizes, and weight.”

Finally, there’s one segment of the robotics market that I’ve always been skeptical about: delivery robots. For example, when Fedex announced its SameDay Bot in February 2019, I raised the question in a short video titled, “FedEx SameDay Bot: Will Delivery Robots End Up In The Trash Heap Of Ideas?” I revisited the topic again in an August 2020 post during the Covid pandemic.

Well, it ultimately ended up in the trash heap for FedEx, which shut down its delivery robot program in October 2022. Amazon also scaled back its Scout delivery robot program in 2022, and as reported by Kirsten Korosec in a May 2013 TechCrunch article, “Autonomous delivery startup Nuro is in the midst of a restructuring that will result in [additional] layoffs and shift resources away from commercial operations and toward R&D.”

Bucking the trend is Starship Technologies which announced last week that it has raised $90 million, bringing the total raised by the company to $230M since its founding in 2014. The funds “will be used to expand globally as Starship looks to take advantage of the unstoppable rise in demand for home deliveries.” According to the press release:

Starship’s delivery robots have become a common sight on streets across Europe and the US and the company is now the world’s leading autonomous delivery service, making more than six million deliveries and transforming last-mile delivery. Found in 80 locations across the world including the US, UK, Germany, Denmark, Estonia and Finland, the robots use less energy than humans to deliver takeaways, grocery orders, tools and corporate documents to customers’ doors.

Will the “unstoppable rise in demand for home deliveries” save the delivery robot market? How big can it ultimately get? I don’t know, but I remain skeptical.

So, as you can see, a lot is happening in the robotics market, even if it’s not all roses.

The only thing I’m willing to bet on is that there will be more robots used in supply chain and logistics applications ten years from now compared to today. How big and how fast will the market grow? I’ll let others take their guesses, educated or not.