It’s helpful to pause from our day-to-day responsibilities and set aside time to look at what’s going on within our industry to get a handle on the bigger picture, taking into account the trends and developments on the short- and long-term horizon that could affect our customers and the way we do business.

At the recent NationaLease maintenance meeting, Rob Garcia, senior vice president of supply management, did just that when he shared his thoughts on key market trends that bear watching.

- Evolving logistics models: E-commerce and omnichannel marketing are changing freight patterns and causing many fleets to enter last mile delivery.

- Changes to parts, service and maintenance: We are seeing an expansion outside of the traditional OEM dealer network for parts, service and maintenance. The complexity of modern EPA-compliant vehicles has necessitated a secondary service network for PM, tire replacement, and replacement parts.

- Legislative changes: There is pending legislation to require the sides of trailers and the front of trucks to be equipped with underride guards. The FMCSA has approved the use of Stoneridge’s Mirror Eye as an alternative to conventional rear-vision mirrors.

- Emissions regulations: Tractor standards for MY 2027 require at least 25% lower carbon dioxide emissions and fuel consumption compared to a MY 2017 tractor. Phase 1 tractor 2027 rules require that engine reach carbon dioxide emissions and fuel consumption levels that are 5.1% better than the 2017 baseline. The rule also requires that engine emissions be reduced by 1.8% by 2021 and 4.2% by 2024.

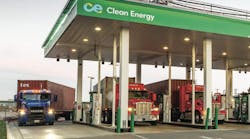

- Alternative fuels: Traditional OEMs, as well as some newcomers, are working on alternate ways to power vehicles. Electric vehicle manufacturers are in development to scale the technology for the commercial vehicle market. Electric grid infrastructure needs to be planned well before fleets acquire EVs. The likely market segment where commercial battery electric vehicles will first see use it in local fleets that operate in a 100-mile hub oriented range. Fleets traveling longer distances will more likely turn to fuel cell supplemented battery-centric technologies.