How to restart operations after coronavirus shock: A logistics perspective

The COVID-19 crisis is a human tragedy with almost 50% of the world’s population locked down and many lives at risk. It’s also an unprecedented real-life stress test for operations and supply chains.

Most economic activities, except those considered critical, are stopped or work in slow motion—and even critical activities are facing massive disruptions with supply as suppliers stop production and pressure mounts on governments, consumers and employees.

If this crisis underlines some weaknesses, bottlenecks, and interconnections of supply chains, it also highlights a series of operational risks affecting the global economy at a scale that is hard to accurately forecast.

While millions of people have to stay home and many companies’ operations are totally or partly mothballed, the priority is to use the shutdown time to launch not only survival mode actions, but also to properly prepare the restart of operations and the return to “normal.”

Adapt to new priorities

With the crisis, companies’ financials have been stretched with, for many of them, revenue down to near zero while fixed costs remained. Oil and gas companies, for example, faced a decrease of sales by more than 60% in just a few days.

No need to be a financial expert to understand that, in this context, surviving companies will require dramatic and urgent actions to recover as fast and as much as possible and avoid wasting remaining available resources during the restart phase.

To prepare the operation restart, companies should review their priorities based on three dimensions:

- cash generation and working capital management;

- profits (or possibly revenue protection for some); and

- time.

Sales and marketing teams will have to re-assess commercial plans to take into account dramatic changes in market size. Because the restart will be progressive and staggered by country and industry, customers’ priorities will shift with pricing affected by market conditions.

Therefore, products contribution in term of cash and profits will change with future demand and sales prices leading to adaptation in the production plan versus pre-crisis time. Some companies will focus on high contributor products during the restart phase and will neglect or restart later parts of their traditional product portfolios.

Being at the end of the supply chain, logistics capabilities will have to be adapted to properly ensure the adequate servicing of customers and meeting of restart objectives.

Define what capacities and capabilities are available for restart

The shutdown period should be used by logistics managers to build a complete and honest picture of the capacities and capabilities needed to restart versus what exists or could be available at the end of the lockdown.

Among the capacities and capabilities to assess:

Human resources: Who to mobilize, when and how?

While people are locked down working from home and stretched to deliver short-term cost reductions or cash management activities, it’s necessary to pay attention to the human factor by assessing the following.

- Which resources are available, where, when and for which capabilities?

- What is the level of commitment of resources (i.e. to what extent can they provide support while taking care of a family at home)?

- How to ensure safe working conditions especially in warehouses and distribution centers.

All these questions may require temporary adaptations in workforce mobilization, organization and prioritization while all countries, plants and DCs won’t restart at the same time.

Cash: Protect the company cash and allocate it to priority actions

Many companies already initiated cost reduction plans in which logistics teams can play a role by:

- identifying inventory buy back opportunities for inventories not needed for the restart phase, but needed by other industries;

- adjusting material requirements planning to resize replenishment batch to the size of future markets;

- reviewing inventory POs to re-allocate resources to priority supply vs. non-essential ones; and

- reviewing the total cost to serve of logistics companies or transportation modes (freight cost, inventory cost, lead time and payment terms).

Organization: Support decision making

On the organization side, adaptations are needed in the following four aspects.

- Integrated plan coordination. A logistics cluster should make the link with the multi-functional team in charge of the restart, planning preparation and coordinating execution at regional and local level.

- Simplified decision-making process. Managers should be empowered to ensure that decision-making remains agile and fact-based within the guidelines and scope of the restart plan.

- Real-time progresses monitoring. A logistics cluster will monitor real-time operations processes, roadblocks, risks and ensure proper solutions are discussed and implemented.

- Management mobilization. In this difficult period, it is important to make management visible and engage teams by communicating the vision, the restart plan, the expected role and duty of each one. They must also be visible in the monitoring of the plan to show all hands are on deck.

Processes and systems: De-bottleneck

Systems will have to fully support operations restart plan implementations and will require adaptability to adjust to the crisis development. The lockdown period should be used to remove traditional burden and complexities such as:

- anticipate bottlenecks and reallocate resources to mitigate/remove them;

- simplify system entries and processes whenever needed especially in WMS & TMS systems;

- re-parameter systems to fully leverage touchless operation like MRP;

- automate processes and basic transactions to ensure systems can operate with limited resources; and

- adapt system profiles and rights to ensure more flexibility.

A significant amount of work is also going to be needed on system data update, especially carrier and inventory data, to ensure the right information is used to make decisions.

Contribute to supply chain end-to-end alignment

Cross-functional supply chain teams will need to accurately model the end-to-end supply chain inclusive of all modes to fully evaluate the risks and vulnerabilities of the network. This digital twin of the end-to-end supply chain will need to incorporate scenarios from S&OP, sourcing risk models, logistics constraints and production and maintenance.

Logistics teams have a key role to play in coordination with procurement and manufacturing on several aspects:

Distribution supplier financial risks should be considered. Together with sourcing and supplier managers, logistics teams must organize the update of logistics suppliers’ financial risk. Liquidity, solvency and profitability ratios must be updated considering the lockdown effects for at least all critical suppliers to make sure they’re able to operate and support transportation and distribution during the restart period. For suppliers that are too weak and may go bankrupt, alternatives should be identified or financial supporting plans—subsidies, loan, bank warranty, cash advance—put in place with the support of finance teams.

Supplier logistics risks will have to be reviewed for inbound and outbound logistics to make sure:

- proper capacities are available and proceed to capacity bookings or new negotiations; and

- lead times are respected (logistics managers will have to assess the best mode based on cost and production plan needs and book accordingly).

Inventory levels should be recalculated based on new S&OP plans to ensure runners and repeaters for priority products will not run low while slow movers and non-necessary parts are minimized. Logistics teams should coordinate with sourcing and procurement to assess Tier 2 and Tier 3 suppliers for these critical parts to secure that manufacturing will be properly fulfilled without any disruption.

Distribution centers should be tested in the restart conditions. Whenever needed, corrective actions should be taken so that they can properly operate. Digital twins can be built to define optimal organization and network to improve priority parts and product movement.

Distribution capacities need to be assessed by market to ensure that they are adequate to meet the targeted customers during restart phase.

All of these assessments will help to bullet-proof the distribution restart plan and proceed with necessary iterations to ensure that this plan is highly feasible.

How to implement the plan

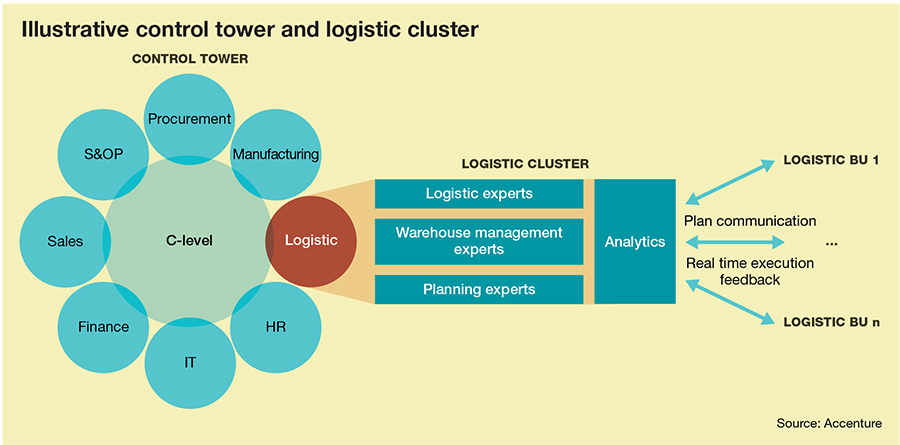

The set-up and monitoring of the restart plan requires a dedicated multi-functional task force inclusive of control tower capabilities. This task force should gather C-level, finance and treasury, human resources, procurement and sourcing, distribution and planning, manufacturing, sales and marketing as well as IT.

This multi-functional team should have a logistics cluster with planning, warehousing, transportation and order management experts supported by strong analytics capabilities to contribute to the restart plan preparation, iteration and the scenario building. Moreover, as the crisis is still ongoing and with an uncertain conclusion, all analysis will have to be updated live based on the coronavirus crisis development, increasing the need for efficient, scalable and repeatable analytics.

To make the control tower more efficient, the analytics team should mobilize:

- automation of transaction in existing systems;

- artificial Intelligence and machine learning to proceed with data extrapolations, speed up analysis, build forecast models for replenishment, inventory management; and

- digital twins to create models to optimize inventory facilities, logistics network and secure implementation outcome of the restart plan.

What next?

Beyond the short-term actions to ensure the survival and the recovery of companies, time will come to think about what’s next. The coronavirus crisis acted as a wake-up call to highlight that systemic shocks can and will happen.

Knowing this, it’s now the duty of each company to use the lessons learned from this crisis to promote a more resilient supply chain for the mid- and long-term.

The control towers and digital twins that each company will (or already has) set up will gather a lot of experience, information, and analysis capabilities. They could be the first building block to lead the transformation to:

- identify risks and vulnerabilities in the network;

- adapt logistic supplier base to future supplier relocations;

- strengthen the logistic supplier ecosystem (rethink supplier location base, develop new suppliers, develop supplier substitution, and promote better collaboration with suppliers);

- simplify specifications to promote easier and faster product move;

- adapt to new production flexibility and plant specialization, mobile production facilities, 3D printing whenever relevant, plant in a box;

- improve inventory levels and distribution networks;

- implement autonomous mobile robots to manage part picking and ensure business continuity;

- rethink the work organization and resource location developing redundancy, flexibility, or capabilities reorganization whenever relevant; and

- develop analytics, digital twins and AI utilization to speed up implementation and gain in efficiency.

The COVID-19 pandemic can become the potting soil for many innovations and positive transformations in the way we think and operate supply chains as long as we properly leverage what we learned while locked down.

Article Topics

Global Trade News & Resources

Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. Industry experts examine the impact of Baltimore bridge collapse on supply chains More Global TradeLatest in Logistics

Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources