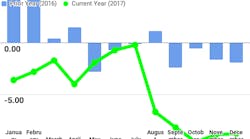

FTR’s Shippers Conditions Index (SCI) for December was basically unchanged from November at a reading of -8.8. Carrier capacity remains extremely tight with rate acceleration expected through Q2, keeping the index in decidedly negative territory through early 2018.

“The question for many shippers is how long will the tough times last?" said Jonathan Starks, CEO at FTR. "When we look at freight demand, which has been strengthening for nearly a year now, our forecast shows robust demand for most of 2018. If there will be improvements for shippers, it won’t be because of a softening of freight. Truckstop.com’s Market Demand Index, at roughly twice the level that it was at this time last year, highlights the tight capacity situation within the spot market. It began rising again in February after softening following the strong holiday season. For shippers who haven’t locked in capacity, this year’s spring shipping season will be a tough one.”

The Shippers Conditions Index could improve later in the year dependent upon how much carriers can add capacity to meet the strong demand, as well as shippers adjusting supply chains to enhance carrier productivity.

“We are seeing record truck and trailer orders, which indicate buying above replacement demand, and much of that will hit the market in the second half," said Avery Vise, VP of Trucking at FTR. "However, that narrative is somewhat disrupted by ELD implementation and the driver shortage. People naturally think of the driver shortage in terms of the supply of drivers, however, changes in carrier productivity are just as important. We anticipate that shippers and carriers will implement a host of productivity enhancements -- measures like drop-and-hook, better scheduling for pickups and deliveries, faster dock turnarounds, better coordination among shippers through intermediaries, and so on. Higher rates motivate shippers to be much more flexible on steps that increase carrier productivity.”

The February issue of FTR’s Shippers Update, published February 5, 2018, details the factors affecting the December Shippers Conditions Index, along with a closer look at the Owner-Operator market.

The Shippers Conditions Index tracks the changes representing four major conditions in the U.S. full-load freight market. These conditions are: freight demand, freight rates, fleet capacity, and fuel price. The individual metrics are combined into a single index that tracks the market conditions that influence the shippers’ freight transport environment. A positive score represents good, optimistic conditions. A negative score represents bad, pessimistic conditions. The index tells you the industry’s health at a glance. In life, running a fever is an indication of a health problem. It may not tell you exactly what’s wrong, but it alerts you to look deeper. Similarly, a reading well below zero on the FTR Trucking Conditions Index warns you of a problem….and readings high above zero spell opportunity. Readings near zero are consistent with a neutral operating environment. Double-digit readings (both up or down) are warning signs for significant operating changes.

For more than two decades, FTR has been the thought leader in freight transportation forecasting in North America. The company’s national award-winning forecasters collect and analyze all data likely to impact freight movement, issuing consistently reliable reports for trucking, rail, and intermodal transportation, as well as providing demand analysis for commercial vehicle and railcar. FTR’s forecasting and specially designed reports have resulted in advanced planning and cost-savings for companies throughout the transportation sector.