Manufacturing maintains momentum in February, says ISM

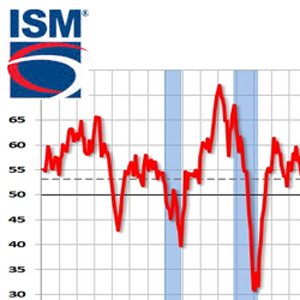

In its Manufacturing Report on Business, the ISM noted that the PMI, the report’s key metric, came in at 60.8 in February (a reading of 50 or higher indicates growth). This topped January’s 59.1 reading by 1.7%, and it represents the 18th consecutive month of PMI growth.

The Institute for Supply Management (ISM) reported today that manufacturing activity had another strong month in February.

In its Manufacturing Report on Business, the ISM noted that the PMI, the report’s key metric, came in at 60.8 in February (a reading of 50 or higher indicates growth). This topped January’s 59.1 reading by 1.7%, and it represents the 18th consecutive month of PMI growth, with the over all economy growing for the last 106 months. The February PMI is 2.8% ahead of the 12-month average of 58.0, and ahead of the rolling three-month average of 59.7. What’s more, this is the highest PMI reading since the 61.4 recorded in May 2004.

ISM said that 15 of the 18 manufacturing industries reported growth in February, including: Printing & Related Support Activities; Primary Metals; Machinery; Computer & Electronic Products; Petroleum & Coal Products; Nonmetallic Mineral Products; Plastics & Rubber Products; Fabricated Metal Products; Chemical Products; Transportation Equipment; Textile Mills; Miscellaneous Manufacturing; Paper Products; Electrical Equipment, Appliances & Components; and Food, Beverage & Tobacco Products. Two industries reported contraction during the period: Apparel, Leather & Allied Products; and Furniture & Related Products.

Even with the PMI growing from January to February, some of the reports key metrics declined during that period, although they were coming off of very strong baseline readings.

One example of that is new orders, which are viewed as the engine that drives manufacturing. New orders in February, at 64.2, fell 1.2% off of January’s 65.4, while remaining in growth mode for the 26th straight month, along with 15 of 18 manufacturing sectors growing for the month.

Production was off 2.5% to 62.0, down from a strong 64.5 in January and still growing for the 18th month in a row. Employment had a very strong month, rising 5.5% to 59.7 and growing for the 17th consecutive month. And inventories rose 4.4% to 56.7, showing growth for the second straight month.

Comments submitted for the report by ISM member respondents were mostly favorable, with some reflecting specific industry themes.

A food, beverage, and tobacco products respondent explained that employment is one of his company’s biggest challenges, with “[n]o labor available.” A machinery respondent pointed to the recently-passed tax reform package as a positive, observing that it appears to be making a difference, and that customers are spending more for capital equipment. And a plastics and rubber products respondent said that “business is running very strong, and our lines are running at full capacity.”

Tim Fiore, chair of the ISM’s Manufacturing Business Survey Committee, said in an interview that even though there have been slight declines for new orders over the last three months, the numbers are still strong. A reason for that, he explained, is that customer inventories still remain “too low,” down 1.9% to 43.7 in February.

Backlog of orders rose 3.6% to 59.9, and supplier deliveries slowed at a faster rate, at 61.1 (above 50 indicates contraction), a 2% difference compared to January.

“The new orders number is either the net result of not being able to output product to customers or it could be the fact that we are also saw longer lead time orders from customers,” said Fiore. “It is most likely a combination of both. Demand remains good, though.”

As for the slowing supplier deliveries number, he said that speaks to suppliers still struggling to deliver complete orders when they are missing a component, or part, of the order, which leave the order in inventory.

Also impacting things are over-the-road transportation issues in the form of tight capacity and the driver shortage which Fiore said are disruptive and prevent shipments from arriving at intended times and also a reflection of the dramatic increase in transportation sector activity.

“We saw this starting last year right after the hurricanes, and it has not abated at all,” he said. “Demand is increasing, and heavy-duty truck expansion is expected to be up 27-to-30% this year, which is a big step up. The story here is that the PMI is at a 14-year high, because the supply chain is struggling to deliver to need, to a large degree, and that is resulting in a high supplier delivery number, as well as a higher than normal inventory number. With a more stable supply chain, that inventory number would drop, as well as the supplier delivery number, too.”

IHS Markit U.S. Economist Michael Montgomery wrote in a research note that “manufacturing is on fire around the world,” saying this strength is reflected in an ISM export orders reading of 62.8 and an import reading of 60.5.

“Simultaneous strength in both subindexes almost always means that the manufacturing world is humming along everywhere,” he wrote. “A quick look at readings for other manufacturing powerhouses shows solid gains on almost all fronts, with only a few lackluster readings to mar a robust showing. US manufacturing continues to power forward. Even if the strength within the ISM index for manufacturing was overstated in February, it nevertheless remains quite respectable. The last few months' scores for manufacturing contained within the industrial production report were not inspiring, but that sogginess was probably transitory, since almost everything else says that manufacturing continues to roll along. Alas, this strength is feeding into higher prices, with broad-based gains in prices for a host of materials and supplies showing up in the report. Most manufacturers will live with higher commodity prices in the face of solid sales gains, since global strength means that their competitors face higher commodity prices as well. The prognosis is that the good times will keep on coming, with a 2018 environment that is the best in years, if not in more than a decade.”

Article Topics

3PL News & Resources

FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets More 3PLLatest in Logistics

FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources