Ocean Cargo: Post-pandemic strategies take hold

Long “the sick man” of the transportation ecosystem, the container-shipping industry stands on the brink of a new era of sustainable profitability. But can carriers now step off the boom-and-bust treadmill and continue to balance capacity against demand?

Brian Nemeth, a director in the transportation and infrastructure practice at AlixPartners, a global, multi-industry consulting firm, says that due to this current environment, logistics managers may want to approach new contracts from a high-value strategic perspective this summer. “With time-sensitive shipments, they will want to lock in guarantees at the premium price,” he says. “From a tactical point-of-view, however, they can play the spot markets if they can handle the risk exposure. It’s a delicate balance this year, for sure.”

Smaller shippers may not have the volume to “segment” their loads, however, and may even spread their business through different ocean cargo gateways. “Given the congestion at ports in San Pedro Bay, we’re seeing more interest in booking freight through Mexico and Canada,” says Nemeth. “This is a trend that we expect to continue through the next Peak Season.”

Meanwhile, ocean carriers are taking all available measures to improve the speed and efficiency of cargo movement, including employing all available vessel tonnage. When demand dropped some 20% to 30% in the second quarter of 2020, carriers curtailed services and idled vessels. However, as cargo volume rose, carriers redeployed those assets as quickly as possible.

Maximizing efficiency

The Paris-based consultancy Alphaliner concluded at the end of 2020 that the inactive fleet was at just 2.5%, and more than half of that (62%) represents ships that are in shipyards for repair and other services.

Mid-January normally marks the beginning of capacity reductions in anticipation of the Chinese Lunar New Year holidays when factories in Asia close, but that was not the case this year according to Alphaliner, indicating that carriers had made best possible use of this time to clear volumes out of Asia. Furthermore, carriers demonstrated that they were willing to share capacity to maximize efficiency.

Suez Canal: Box lessors in sweet spot

In the world of global supply chain container leasing, the Suez Canal catastrophe of last spring may be an example of an ill wind that blows nobody any good. A recent report issued by investment banking firm KBW, a Stifel Company, explains to what degree the disruption has driven demand for containers.

“Broadly speaking, disruption to containerized trade is a net positive for the container lessors as it drives a need to add containers to global shipping fleets to address shortfalls from the disruptive event,” says Michael Brown, managing director of equity research at KBW.

Brown notes that, most recently, the effects of the disruption have played out in the West Coast ports. For example, Long Beach has seen wait times for ships of up to 21 days due to the combo of supply chain disruption, high demand for consumer goods, and labor shortages.

In the Suez, the compounding effect is due to the unwinding of the logjam and then the subsequent delay in getting containers back to Asia to pick up new goods. Shifting to trade lanes around Africa also results in longer shipping times, and thus is a disruption to supply chains.

“The disruption is a modest positive for the lessors,” says Brown. “Traditionally, to meet disruption such as this, shipping lines would pick up containers in China to meet export demands there—a need that the lessors would often address. The challenge in the current market is that the tight supply conditions make it hard for the lessors to realize the opportunity. Utilization rates are near maximum levels and container factories are booked out through July. “

In Brown’s view, the Suez Canal crisis highlights the shortage of containers in the global fleet that has been impacting the market since mid-2020. This supports his contention that the supply and demand dynamics in the container trade market will remain tighter for longer, reinforcing his positive bias for all three global lessors: Triton International, Textainer, and CAI International.

“Vessel sharing agreements are extremely important during times of high demand for vessel capacity,” says Stephen Fletcher, an Alphaliner analyst. “They ensure that all available slots are used even when an individual operator doesn’t have sufficient demand from its customers for a particular sailing. With a vessel sharing agreement, that capacity can then be made available to other partner carriers to offer to their customers.”

Contrary to some suggestions, carriers are not abandoning capacity investments for the future, maintains Alphaliner. “Despite the fears of a market collapse at the time of the pandemic outbreak, 2020 concluded with a significant increase in ordering activity, with the global order book for new container ships growing to 10% of global capacity,” concludes Fletcher.

Crisis control

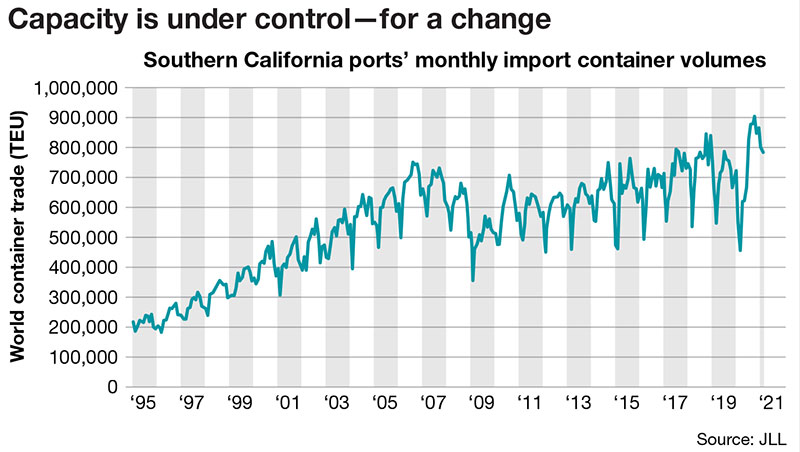

Analysts with Chicago-based commercial real estate broker JLL maintain that the on-going pandemic has created chaos for retailers and manufacturers trying to keep up with supply and demand.

“Ocean carriers have been deploying more and larger vessels to catch up, which is creating chaos at the ports,” says Rich Thompson, international director of supply chain and logistics solutions consulting practice for JLL.

A new research paper titled “The Shipping Crisis,” which is co-authored by Thompson, notes that retailers and manufacturers have had an increasingly difficult time keeping store shelves filled and fulfilling orders due to swings in consumer spending patterns since the beginning of the virus.

The pandemic-related demand patterns caused disruptions to manufacturing supply chains and ocean carriers’ sailing schedules were severely disrupted. At the same time, U.S. ports got caught in the “bull whip effect,” and initially volumes plummeted, but are now surging.

“The stimulus-driven shift in consumer behavior caught retailers off guard,” notes Thompson. “When the economy shut down in the first half of 2020, retail sales plummeted, and inventories soared.”

Ocean carriers have been deploying more and larger vessels from China to the ports of Los Angeles/Long Beach and the incoming volume has been overwhelming, says Thompson.

“Substantial numbers of stevedores and truck drivers were infected with COVID-19 and exiled for two weeks due to exposure, slowing the movement of containers and leaving them over-crowded,” he adds.

Since November 2020, there have been at any time between 20 to 40 container vessels anchored outside the San Pedro Bay ports waiting for a berth for as long as 10 days. Shortages of workers, truck chassis, railcars and container boxes worsen the situation.

Considering the “China factor”

New research suggests that there’s also a “China factor” to consider. Manufacturing activity in China began to decline in the first quarter of 2020 due to the pandemic, and there were many cancelled container ship sailings due to the lack of product from closed factories.

“The lack of Chinese-made inputs, critical to manufacturing operations in the U.S., Japan and Korea, negatively affected the global supply chain,” says Dr. Kemmsies, CEO of the Kemmsies Consulting Group and executive consultant for JLL’s U.S. ports, airports, and global infrastructure group. “Ocean carriers re-started sailings from China and have scrambled to catch up with Chinese export demand.”

In the fourth quarter of 2020, Chinese manufacturing capacity reached its highest level in five years. However, there remains a backlog of orders. U.S. manufacturing capacity utilization has still not regained its pre-pandemic level due to difficulties attracting workers and ongoing shortages of imported components.

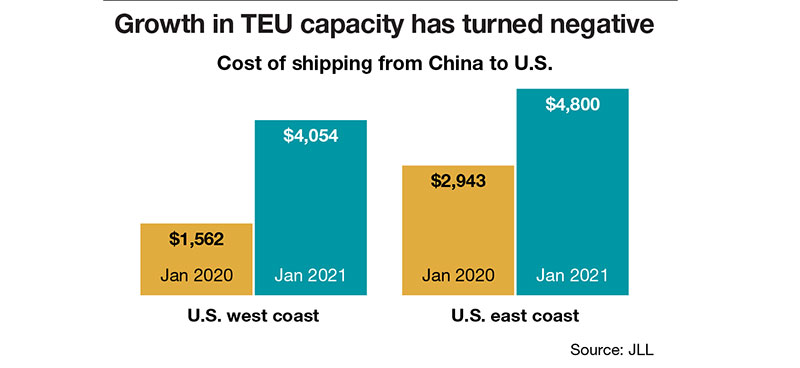

According to Kemmsies, that’s why U.S. retailers are struggling to meet demand and rebuild inventories. “Ocean carriers have started to deploy or re-route more vessels to alternative U.S. ports such as Oakland, Seattle-Tacoma, Savannah, and Charleston port gateways,” he says. “Southern California container terminals have responded by opening more truck gates and expanding hours of operation. Ocean carriers have increased shipping rates to ration spare capacity, but this has not deterred importers desperate to meet demand.”

JLL analysts add that some importers are resorting to very expensive airfreight. Peloton, for example, spent $110 million on airfreight to get their Taiwan-sourced product into the U.S. over the past year. Others have shifted to utilizing East Coast ports to avoid the congestion on the West Coast. “We see more importers utilizing a multi-port strategy to mitigate risk in the future,” says Kemmsies.

Furthermore, transportation trends have worsened container congestion issues at ports. The surge in port volumes in the second half of 2020 is also reflected in railroad volumes. Railcar movements exceeded their 2019 levels and rose to historic highs. Since August 2020, some railroads have imposed surcharges—sometimes as high as 100% of the base rate for the railcar to ration capacity.

Kemmsies says that didn’t deter shippers, not even those paying ocean carrier rates that were double their 2019 levels. The heavy use of railcars across the U.S. has limited the supply available in Southern California, which has exacerbated the container terminal bottleneck as approximately 40% of containers go elsewhere in the United States by rail.

Since the pandemic began, home improvements and additions have also been increasing as households prepare to at least spend a few days per week working or potentially studying from home. These trends also drive containerized import volumes at ports.

Big shifts in trade flows are expected for U.S. imported goods. In addition to the “bullwhip effect,” the pandemic has had on global goods, the transportation industry has had to deal with changing world trade flows.

“China has lost 5.4% of U.S. containerized import goods by volume in the last three years,” says Kemmsies. “More shifting is expected. Some of this loss was already occurring due to cheaper labor availability in other Asian countries like Vietnam and India. Some of the loss is also due to changes in the U.S. trade policy that started with Trump and will continue with Biden.”

Importers shifting their sourcing to companies located west or south of China are more likely to send their goods through the Suez Canal to the U.S. East Coast. “We’ve seen this trend in market share favoring U.S. East Coast ports and expect it to continue slowly over time,” concludes Kemmsies.

Article Topics

Ocean Freight News & Resources

Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore Industry experts weigh in on Baltimore bridge collapse and subsequent supply chain implications Expensive, lengthy delays expected before Port of Baltimore can re-open to vessels following Key Bridge collapse More Ocean FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources