Article 2: Trucking Freight Futures 101

This article provides a snapshot of the trucking freight futures market, starting with a summary of the basics about derivatives-futures and then diving into the specifics of trucking freight futures and their application for the key trucking market participants – trucking carriers, shippers, 3PLs and opportunistic traders/investors.

Logistics Management and Lakefront Futures’ Trucking & Derivatives Group will be publishing a series of articles in the next five weeks on the “A-Z” of trucking freight futures. This 2nd article provides a snapshot of the trucking freight futures market, starting with a summary of the basics about derivatives-futures and then diving into the specifics of trucking freight futures and their application for the key trucking market participants – trucking carriers, shippers, 3PLs and opportunistic traders/investors. You can read the first article of the series here, “The Trucking Market's Paradigm Shift: The New 3-Dimensional Market”.

Trucking Rate Volatility & the Need for Rate Hedging

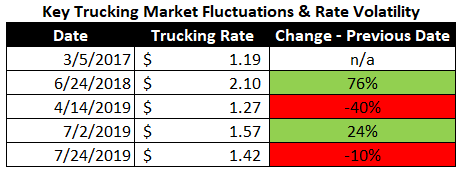

Trucking rates have been extremely volatile the last five years but more so the last two years (see the “Key Trucking Market Fluctuation & Rate Volatility” table).

The volatility in trucking rates is because changes in the supply of trucking capacity and the demand for trucking capacity, quickly impact trucking rates as they are “inelastic”. There are only so many trucks in a market at any given time and as the load to truck ratio increases so do trucking rates because shippers need to get their freight transported when scheduled and are unable to wait until trucking rates decrease.

As mentioned in our 1st article on trucking freight futures, the trucking sector is going through a major paradigm shift which is transforming it into a 3-dimensional market: trucking spot, forward and freight futures markets. As the 3 markets become more interrelated, daily trucking rate volatility will continue to increase.

Derivative & Futures Overview

A derivative is a financial security with a value that is derived from an underlying asset that serves as a benchmark (i.e. commodities, currencies, etc.). Derivatives include futures, options and swaps, and provide a way to lock in prices on the underlying asset today for something to be purchased or sold sometime in the future and hedge against unfavorable future movements in prices, and mitigate risks—often for a limited cost given that they can be purchased on margin.

A futures contract is a derivative and an agreement between two parties for the purchase and delivery of an underlying asset at an agreed upon price at a future date. Even though they are designed to accommodate the delivery of physical commodities, a delivery rarely takes place because the primary purpose of the futures market is to minimize risk and maximize profits. In that regard, as opposed to delivery, they are cash-settled, where the parties accounts see a gain or loss from the trade depending on the change in the futures contract price at contract expiration from the futures contract price when the position was entered. This is especially true for financial instruments like interest rate swaps and trucking freight futures.

Trucking Freight Futures Overview

As mentioned above, trucking rates are and will become increasingly more volatile. Hedging this trucking rate volatility is a necessity for trucking carriers, shippers, and 3PLs to increase profit margins and to stabilize cash flows. At this point, the only available derivative to hedge against adverse changes in trucking rates are trucking freight futures. At some point in time when there is adequate liquidity in the freight futures market, it is highly likely that options on the futures contracts will become available.

The $725 billion relatively unhedged trucking industry is ideally suited for the evolution of a vibrant and liquid freight futures market, just like other commodity markets with high price volatility. According to Nodal Exchange, the market size for trucking rate futures is estimated at approximately 40 billion miles that are subject to spot market rate volatility, which could be hedged using trucking freight futures. The addressable market is equivalent to 40 million futures contracts.

The trucking freight futures market was launched at the end of March 2019 on the Nodal Exchange and is a great tool for shippers, trucking carriers and 3PLs to hedge against the trucking market’s significant trucking rate volatility. Trucking freight futures are a financial derivative with no delivery, cash settled and traded against one of DAT.com’s calculated rates for 7 directional trucking rate lanes and 4 calculated regional and national indices (linehaul rate only). Each contract represents 1,000 miles and will be traded in calendar month increments as far out as 16 consecutive months. Market participants can either go long (expectation for a price increase) or short (expectation for a rate decrease).

Directional Lanes - Origin/Destination

- Los Angeles to Seattle Van

- Seattle to Los Angeles Van

- Los Angeles to Dallas Van

- Dallas to Los Angeles Van

- Chicago to Atlanta Van

- Atlanta to Philadelphia Van

- Philadelphia to Chicago Van

Regional/National Calculated Indices

- West US Van

- South US Van

- East US Van

- National US Van

These directional lanes and calculated indices were developed specifically for the trucking freight futures market and chosen because they represented the overall market or regions in the entire market. The chosen lanes represent over 20 percent of the truckload spot volume that is reported to DAT from the entire country.

Applications of Trucking Freight Futures

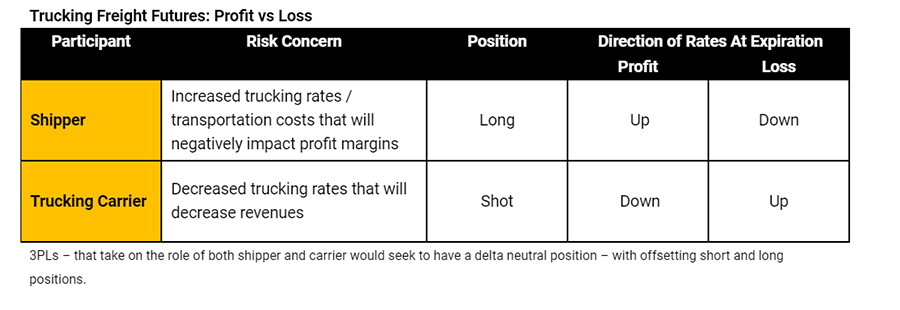

The participants for trucking freight futures are trucking carriers (hedging & profiting), shippers (hedging), 3PLs (hedging & profiting) and opportunistic traders/investors (profiting). The counter party to a contract is taking the opposite position. When a participant uses futures to trade, they are basically transferring the risk to a counterparty that is will willing to accept that risk for a small premium. For example, shippers (going long and looking to protect its profit margins) and trucking carriers (going short and looking to protect their revenues) are great counter parties for each other.

Hedging: Trucking freight futures provide a very effective hedge against the risk of adverse trucking rates for shippers, carriers and 3PLs by locking in a spot market rate today for the future. Regardless of which way spot market rates move, the participant would have the same rate. If a market participant is effectively hedged, adverse changes in trucking rates would be offset by the profits of the futures contract which would synthetically increase or decrease the spot market rate in the future to the benefit of the participant (this might get removed). The accompanying chart shows the position and profit/loss condition for trucking carriers, shippers and 3PLs.

Profiting: Trucking freight futures provide opportunistic a vehicle to profit from trucking rate changes, rate volatility, divergences in the spot to futures contract rates, overpriced/underpriced rates between different lanes, etc. via price speculation & arbitrage. Since they are purchased on margin, the leveraged returns can be significantly higher than if it was not margined, if the position is profitable. While opportunistic investors/traders would be the primary participant using freight futures for profiting, a commercial user such as a trucking carrier can also use freight futures to profit from while having a separately hedged position (given their unique insight on trucking rate direction in their active lanes).

Price discovery: the forward curve of the freight futures contracts (16 months of freight futures contracts) provide a great tool for knowing where trucking spot market rates could be in the future based on the market’s current expectations. As opposed to the privately negotiated/limited competition spot market rates, trucking freight futures prices are derived in an open transparent market competing bidding format and represent “true market” based on everything the market knows today.

Benefits

Trucking freight futures provide several economic and non-economic benefits to trucking carriers, shippers and 3PLs including:

- Decreased trucking rate volatility; more stable trucking costs (shippers), revenues (carriers) and cash flows

- Improved budgeting and forecasting capabilities

- Valuable tool for trucking rate price discovery

- Increased competitiveness as carriers with hedged positions can bid on load volume more aggressively

- Improved financing terms and market valuations for carriers & 3PLs due to increased cash flow stability

- Enhanced revenues for carriers/3PLs in a dropping rate environment

- Reduced trucking rates for shippers/3PLs in an increasing rate environment

Conclusion

To protect itself from adverse movements in trucking rates, that can have a significant negative impact to a participant’s bottom line, and to have a competitive advantage, shippers, carriers and 3PLs should consider the important hedging benefits provided by trucking freight futures. Regardless of whether trucking freight futures will be used by a market participant, the trucking freight futures market’s prices will become more interrelated with spot market rates and should be monitored. Because the trucking freight futures reflect only the linehaul rates, participants should also be hedging their exposure to fuel costs volatility via fuel derivatives as fuel costs are extremely volatile as well and a major cost component for carriers and to a lesser extent shippers.

In the upcoming series of trucking freight futures articles, we will provide more insight on how trucking rate futures hedging work, the financial basics of freight futures, applications for each market participant, position determination / sizing, profiting with freight futures, and cross-market opportunities between the trucking forward and freight futures markets etc.

In September, Logistics Management will be launching a new section to reflect the new 3-dimensional market – “Trucking Financial Markets 360o”. This section will be published weekly digitally and monthly in print. This section will provide a comprehensive snapshot of the trucking spot, forward and futures markets along with the diesel/derivatives market and will be an invaluable resource for market participants in the new 3-dimensional trucking market. The content will be provided by Gary Saykaly who heads up Lakefront Futures’ Trucking & Freight Derivatives Group which helps market participants hedge trucking rate and fuel cost risk – [email protected].

Past performance is not necessarily indicative of future results. The risks associated with trading futures and options are substantial. Futures and options trading are not suitable for all investors.

Article Topics

Motor Freight News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates Preliminary March North America Class 8 net orders see declines National diesel average heads down for first time in three weeks, reports EIA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ More Motor FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources