Freight Forwarders: Managing the storm with technology

Agility and the ability to adapt to difficult circumstances remains the No. 1 attribute for freight forwarders—but the pandemic put them to the test. Today, the leading forwarders are investing in technology that not only increases efficiency, but also enhances operations and creates new global solutions.

The global COVID-19 pandemic has created a climate of uncertainly for the freight forwarding industry and a perfect storm of challenges, including skyrocketing freight rates due to capacity crunches in supply chain networks; escalating demand for consumer goods and e-commerce; mounting port congestion and port closures; increasing container shortages due, in part, to abandoned cargo; and continuing factors such as illness among port and terminal operators, bad weather, and the Suez Canal being blocked for nearly a week.

“Simultaneously, companies are replenishing their inventories, which is overwhelming the ocean freight market and creating a shortage of containers,” says Cathy Morrow Roberson, president of he consulting firm Logistics Trends and Insight. “Trying to track down those containers, get them back to Asia, and get them filled and to final destination is taking time.”

The situation is not any better for airfreight. Most passenger aircraft, which represents nearly 50% of belly capacity, remain grounded. “It’s returning, but not fast enough,” comments Roberson. This has resulted in a severe shortage air cargo capacity, high shipping rates, and pressure to find space, including on chartered aircraft.

Meanwhile, the relationship between the giant forwarders and a consolidated shipping industry has also been called into question. “Forwarders have found it difficult to provide a consistent service to their customers and have blamed the carriers for many of the problems,” says Jon Manners-Bell, chief executive of London-based freight analyst firm Transport Intelligence (Ti).

All indicators point to continued challenges throughout 2021; however, Manners-Bell remains optimistic and maintains the market for forwarders is very positive. “Demand is exceptionally strong in North America and Europe,” he says. “Although there have been some signs that forwarders’ margins have been squeezed by high carrier rates and shipper push back, the lack of air and sea capacity has meant that those forwarders with the best access to capacity have prospered.”

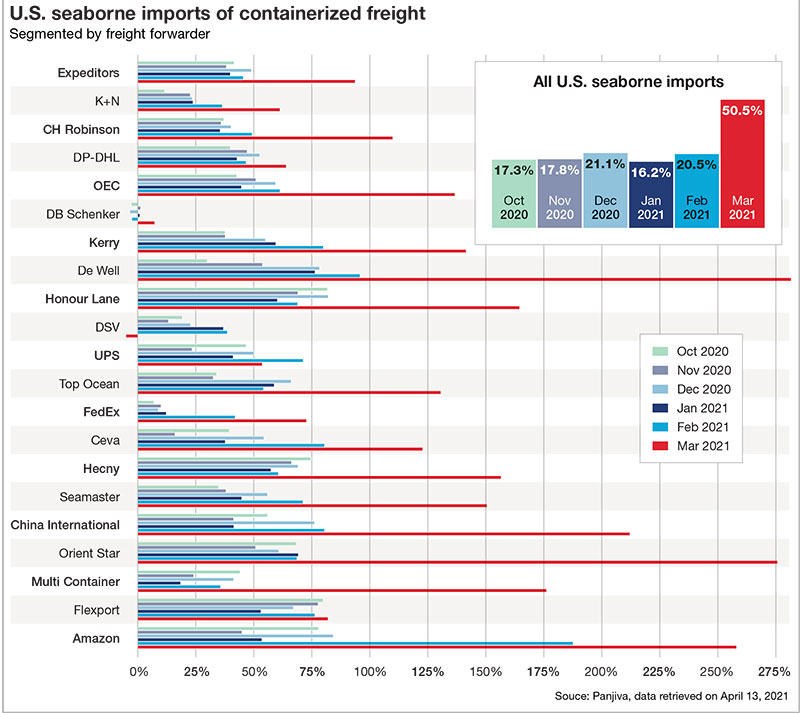

In the meantime, Panjiva research indicates that the top 20 forwarders have built their market share as cargo owners shift to larger firms with more flexible solutions. “In total, the top 20 forwarders’ volumes climbed 46.3% year-over-year in January and February 2021 combined, though their aggregate share of total U.S. inbound shipments was still only 20.3%,” reports Panjiva.

The fourth quarter of 2020 was particularly good financially for the large freight forwarders who buy bulk spaces from carriers yearly, then sell them to customers throughout the year.

For example, XPO Logistics revenues increased some 12.8% during the fourth quarter of 2020 to $4.67 billion—the highest ever of any quarter in its history. Expeditors International reported a record 55% increase to $3.2 billion during that quarter compared to the same period 2019, while C.H. Robinson reported total revenues increased 19.9% to $4.5 billion.

Tech developments

Agility and the ability to adapt to difficult circumstances remains the No. 1 attribute for freight forwarders. The pandemic has put them to the test.

“Early on in the pandemic, forwarders leveraged their global volume and years of building carrier relationships to get customers’ containers on board ships leaving ports in Asia for North America and Europe, despite facing rising container equipment shortages, uncertain demand, and unreliable shipping schedules,” says Evan Armstrong, president of the third-party logistics analyst firm Armstrong & Associates, Inc. “Freight forwarders also started converting passenger aircraft into cargo-carrying aircraft, expanding use of charter flights and added or changed trade lane routes.”

Forwarders are also increasingly investing in technology that not only increases efficiencies, but enhances operations and creates new solutions.

“Digitalization is one of them, and the pandemic just cranked that up,” says Roberson. “Digital solutions help increase real-time global visibility of transport services across end-to-end supply chains, and smarter solutions keep up with consistent changes.”

Today, most large freight forwarders have customer portals that aggregate huge sums of data for enhanced order and shipment visibility, improved shipment planning and inventory management, predictive analytics and standardized systems and processes. “This helps shippers plan for supply chain disruptions and changes in carrier supply, which has been very volatile throughout the pandemic,” says Armstrong.

One example is C.H. Robinson’s Navisphere Purchase Order Management (POM), which saw 1.3 billion digital transactions in 2020.

“When the global pandemic suddenly hit, our customers were able to stay connected with their vendors in a remote working environment with Navisphere POM,” says Mike Short, president of global forwarding at C.H. Robinson. “Our customers leveraged its these capabilities to proactively minimize the impact of pandemic-related and other disruptions on their supply chains and to keep stakeholders informed on status, risk, cause, and responsibility.”

That ability to track and trace shipments also helps shippers mitigate the impact of bullwhip effects in the supply chain. “Greater visibility of potential disruptions upstream and downstream allows companies to speed up or divert some shipments as well as quickly resolve issues with suppliers and carriers,” says Manners-Bell.

Mapping out supplier networks is also essential to manage the potential risks to production and delivery schedules. “Systems that provide supply chain visibility and inventory velocity, not to mention acceleration, create the necessary agility to mitigate the impacts of pandemic disruption to the market,” adds Manners-Bell.

An example is Kuehne + Nagel’s new SeaExplorer functionality that was introduced during the height of the pandemic to help mitigate disruptions. “It provides users a single, digital platform to find the best option for container shipping needs, including transparency on alternative routings and sailings,” says Armstrong.

Using artificial intelligence and data mining, SeaExplorer provides shippers with realistic lead times for routings, service updates, up-to-date sailing schedules, and alternative departures for canceled sailings. It also provides detailed information on the CO2 emissions of each route.

DSV Panalpina introduced new track-and-trace capabilities and also implemented new robotic storage and retrieval systems in its warehouses to support e-commerce operations.

In collaboration with Verity, DSV Panalpina is implementing an autonomous drone system to better manage inventory at several warehouse operations. Operating mainly at night, the drone system can scan barcodes without human interaction and detect if pallet positions are empty or occupied. This supports cycle counting and overall inventory management.

In May 2020, Hellmann Worldwide Logistics announced its rollout of CargoWise, the integrated single-platform transportation management system (TMS) from WiseTech Global. It will be implemented for all air and sea freight operations across its network. “The goal is to enhance operational processes by standardizing systems and databases and enabling more efficient resource usage across the supply chain,” says Armstrong.

Following the completion of a pilot phase, Hellmann will implement CargoWise across 42 countries including the U.S., Australia, Germany, UK, India, South Korea, South Africa and Hong Kong. Hellmann is also deploying a digital warehouse management system for a long-standing customer in Bor, Czech Republic, that leverages artificial intelligence to better manage the

customer’s material flows.

GEODIS has developed its own final-mile retail digital transportation management platform dubbed GEODIS City Delivery. It enables retailers to manage the delivery of goods such as apparel, health and personal care products, and high-tech merchandise directly to U.S. consumers from their closest retail store. It interfaces with GEODIS’ mobile driver application, GEODIS Zipline, to provide shipment status updates and information.

DHL Global Forwarding is upgrading its TMS to speed up and simplify processes, increase responsiveness, eliminate paper, and operate more efficiently. It’s applying incremental technology innovations in its operations, such as scanners and sensors, to increase speed and accuracy, and add customer transparency. The company is piloting the use of artificial intelligence (AI) and machine learning (ML) to improve route and capacity planning, and using new capabilities such as chatbots, virtual reality, myDHLi, and a data analytics platform to improve customer experience and employee training.

David Goldberg, CEO, DHL Global Forwarding U.S., describes myDHLi as the only fully integrated online platform for freight forwarding customers. “myDHLi provides completely transparent management of freight rates, offers, transport modes, carbon emissions, and all other relevant shipment data,” he says. “The platform offers social media functions like follow and share. In addition, relevant information can be accessed across organizations and trading partners. Plus, it offers online services for full shipment visibility and control in one platform.”

CEVA Logistics began its digitalization processes prior to the pandemic and is focusing on myCEVA, a customer-facing platform that offers real-time quoting and booking, end-to-end visibility, document sharing and best-in-class digital customer service.

“By expediting some of our initiatives and leveraging our established digital expertise, we were able to adjust to the changing environment to deliver responsive logistics solutions,” says Shawn Stewart, president and managing director of North America for CEVA Logistics. “Through technology, we have been able to provide these new service offerings to our customers, reduce labor-intensive processes, and collaborate both internally and externally.”

The myCEVA platform makes it possible for CEVA to offer value-added services like customs clearance, insurance, and environmentally friendly options. “Currently available for ocean freight, we envision this platform being a one-stop shop for all our customers including air, ground, and contract logistics by the end of 2021,” says Stewart.

For many forwarders, however, the challenge is how to advance in technology without losing the personal touch. To address this issue, CEVA Logistics has invested in customer relationship management (CRM) software to provide an omni-channel customer service platform to unify all customer communications into a single system—from traditional phone and e-mail to chat and social feeds.

“We have also invested in a Cloud contact center that leverages our existing voice channels to intelligently deliver customer communications to the right person, at the right time, the first time,” says Stewart. “Our goal is to deliver the exact answers right away.”

New chapters

While many freight forwarders now steer away from being one-stop logistics operators, transportation providers like CMA CGM and Maersk are venturing into the business. Maersk has acquired customs brokers and invested in digital tools like Loadsmart and platforms such as Maersk Flow and Twill.

Large inefficiencies still exist in the air cargo industry, which is still dependent on paper-based processes. However, McKinsey & Co. indicates that air carriers could capture 15% of the forwarding market by 2030 by introducing digitalization into their networks and capturing some e-commerce business.

“Carriers will need to have clear value propositions to succeed because forwarders provide services beyond transport, such as end-to-end offerings and tailored solutions for customers,” says Mark Williams, associate partner at McKinsey & Co.

But there are hurdles for carriers in this sector, adds Williams. “Forwarders don’t idly sit by, and Amazon is full in.”

Article Topics

Global Trade News & Resources

Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. Industry experts examine the impact of Baltimore bridge collapse on supply chains More Global TradeLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources