The State of Intermodal Transportation: Still a game changer?

Volumes are declining due to various economic and market pressures—some out of the control of carriers and service providers. Today, the jury is still out on whether intermodal is in a temporary lull or if the bloom is off the rose on a longer-term basis.

Intermodal has changed radically since the early days, most recently with the innovation of double-stack cars and automated, purpose-built terminals. The productivity gains have helped propel expansive growth—but the momentum is slowing.

While intermodal volume has declined this year from the go-go market of 2018—by most measures an unusual year—there are many questions being raised, the answers to which remain unclear: Is this simply a correction due to the slowing of the economy? Is this a direct or tangential result of the sweeping changes brought on by precision scheduled railroading (PSR)?

Keep in mind that PSR appears largely focused on taking out cost, driving operating ratios down and pushing stock prices up. This is being done through the simplification of networks, running longer trains, rationalizing lanes, reducing headcount, pricing actions and abandoning markets seen to be unattractive. Reinvestment in infrastructure seems less of a priority than in years past, and often takes a back seat to stock buy-backs.

So, considering all this, has intermodal simply become less competitive? The recent JOC Index says “yes,” at least in certain lanes, where intermodal is actually a higher cost option than truck.

All that said, the business is largely made up of two major segments: domestic and international, in roughly equal measure. For purposes of this article, we’ll leave international off the table because it’s largely driven by the ocean carriers rather than beneficial cargo owners and is not subject to the same pressures the domestic business has to face.

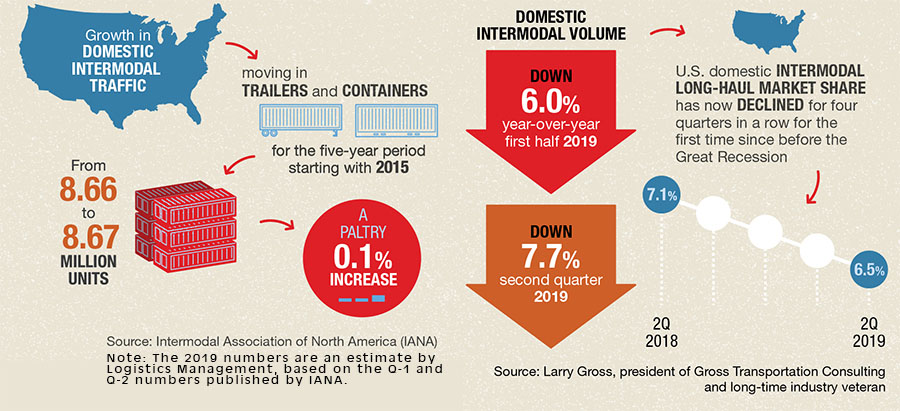

Narrowing the focus to domestic intermodal traffic moving in trailers and containers, we find that during the last five-year period, starting with 2015, growth has been a paltry 0.1% from 8.66 million to 8.67 million according to data from the Intermodal Association of North America (IANA) (Note: The 2019 numbers are an estimate by Logistics Management, based on the Q-1 and Q-2 numbers published by IANA).

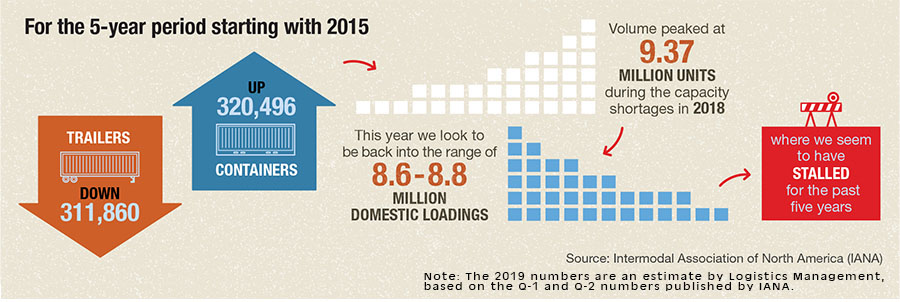

There has been a distinct shift from trailers (down 311,860) during this period to containers (up 320,496). Volume did hit a peak of 9.37 million units during the capacity shortages in 2018, but this year we look to be heading back into the range of 8.6 million to 8.8 million domestic loadings, where we seem to have stalled for the past five years.

According to Larry Gross, president of Gross Transportation Consulting and long-time industry veteran: “Domestic intermodal volume was down 6% year-over-year during the first half of 2019 and down 7.7% in the second quarter. U.S. domestic intermodal long-haul market share has now declined for four quarters in a row for the first time since before the Great Recession—from 7.1% in the second quarter of 2018 to just 6.5% in second quarter of 2019.”

State of Intermodal: What the players are saying

We turned to a few key people in the intermodal industry to assess their views on the current market, the impact of precision scheduled railroading (PSR), current customer needs and other issues and challenges facing the future growth and success of the intermodal business. As you would expect, opinions varied.

Railroads

“It’s difficult to compete in domestic intermodal with trucks that can deliver in one driver-day or less. There are lots of factors affecting this: congestion issues, driver shortages and fuel costs, for example. So in this segment—domestic intermodal—we focus on services that have lengths-of-haul greater than one driver-day.”

Mike McClellan, vice president, strategic planning, Norfolk Southern

“Our intermodal team has continually evaluated markets and made appropriate network adjustments for years prior to PSR. We’re always seeking to create the most efficient and flexible network possible, while maintaining service that meet the needs of our channel partners and their varied equipment mixes… In the meantime, we see IMO-2020 as modestly positive for our competitive position.”

Shawn Turman, group vice president, intermodal marketing, Norfolk Southern

“Domestic intermodal represents one of our largest opportunities for continued growth into the future because our customers’ reach has never been wider due to the rise of online retailing. We want to continue to make the intermodal product easier for all stakeholders to execute.”

Tom Williams, group vice president, consumer products, BNSF

Intermodal Marketing Companies (IMCS)

“Shippers continue to see upside in terms of both cost, service and reliability of intermodal, while intermodal lane transit times continue to improve. Certainly, price can be an advantage intermodal has over truckload. That said, often we’re seeing more and more that price isn’t the only factor—instead, it’s about reliability and a consistent capacity source.”

Doug Punzel, president, Celtic International

“The long-haul market is well served by intermodal, while growth requires penetration of short-haul markets. Sometimes these short-haul markets may be on two different railroads that can combine into a longer haul. With the shortfall in grain and coal, intermodal must now supplement its traditional role as a growth engine with growth and higher margins.”

Ted Prince, COO and co-founder, Tiger Cool Express

“Service consistency is good, and transit times are back to normal. The focus for our customers is on on-time performance. With PSR, I was really skeptical, but the railroads have communicated very well and done a very good job. We’ve seen a tremendous uptick in O-T performance with UP and NS, and we’ve seen a minimal decline due to lane closures where we couldn’t find an alternative.”

Dave Yeager, CEO, Hub Group

Subject Matter Experts (SMES)

“Intermodal has matured from being the ‘surplus mode’ to a ‘full-scale alternative’ and now is at the ‘execute and innovate’ stage. Indeed, growth is being affected by multiple factors at once, making it hard to predict. However, intermodal is still a key freight driver.”

Joni Casey, CEO, Intermodal Association of North America (IANA)

“The railroad industry has become enamored with cutting costs to lower operating ratios through PSR. This cost cutting has led to service issues and less shipper confidence in the industry. These negative impacts from PSR have led to more attention from the Surface Transportation Board [STB] and Congress. While record low operating ratios are appealing now, more investment in the network and better relations with shippers is the better path..”

Dan Elliott, former chairman, STB

“The share of U.S. long-haul dry van and reefer handled by Domestic intermodal equipment, including trans-loading, has dropped four consecutive quarters, which is the first time this has happened…The current railroad focus is on operating ratio, with intermodal margins taking precedent over volume. The data says we’re dropping into a pretty big hole that’s going to be hard to climb back out of.”

Larry Gross, president, Gross Transportation Consulting

Where’s the growth?

Clearly there’s still substantial upside opportunity in the long-haul markets, as well as the shorter 750-mile to 1,500-mile mid-market, which has not been aggressively targeted in years past.

Another key set of questions revolves around how the railroads and intermodal marketing companies (IMCs) will grow the business into the future.

The railroads have historically sought long-haul business, where both carload and intermodal service providers aimed at maximizing revenue and operating efficiency. While this market is far from exhausted for intermodal, it has seen the best penetration. The most fertile market is in the traditionally unattractive short-haul realm of 500 miles and under—where about 90% of the freight in North America lives.

Finding a way to penetrate the short-haul at prices that are attractive and operating costs that are acceptable is the big challenge. In order to be truly truck-competitive, not only do the prices need to be aggressive, but also the frequency of “sailings” must be high. A truck can leave when it’s loaded without having to wait for other trucks. In some cases, this becomes an insurmountable head start, particularly if the intermodal service operates only once or twice a day.

Railroads have experimented with short, fast, frequent services, but they have all fallen victim to the prevailing wisdom that productivity can only be achieved by running ever-longer, heavier trains. While that definitely improves the operating ration, it’s not a path to sustainable growth, which ultimately this industry will have to come to terms with.

While intermodal growth has been impressive, and while the industry has invested billions in new terminals, track improvements and new power and technology, this has been focused almost exclusively on their core competence of running long trains over long distances.

The “alternative” markets create a struggle for service providers because the same operating scenario is required to serve the short-haul market as the long-haul: terminals, which are expensive to build, and the equipment to operate must be used regardless of length-of-haul. It’s only logical to think that when I put a trailer or container on a train, I want to take it as far as I can.

IMO-2020 effect?

One event looming on the near-term horizon is the implementation of the IMO-2020 fuel regulations and the subsequent impact on the cost and availability of diesel fuel in the North American domestic markets.

Should the cost of diesel spike significantly upward—estimates are anywhere from 25% to 100%—as a result of the IMO-2020 regulations taking effect on January 1, it will likely drive a good chunk of highway freight to intermodal. The significant fuel efficiency and cost advantage intermodal has, along with the fact that trucking operating ratios are so high presently, will hamstring their ability to aggressively continue to compete on price—that is if they want to remain solvent.

Most buyers of transportation capacity are unaware of the impending change that will shift almost 90 billion gallons of fuel per year to the relatively static available pool of low-sulfur fuel. Those shippers who are tracking the situation closely (less than 10% according to a recent Logistics Management survey) are generally presuming that they will just pay more.

Examining the fuel component of moving freight—now as much as 35%—is a strategically sound approach. Using technology to remove market distortion, adding transparency and fairness into fuel management is a step worth taking. The additional benefit of real-time business intelligence relating to asset utilization and network capacity is something that will provide substantive benefits for those supply chain professionals tasked with moving the freight. This will enable conducting solid analytics around mode shift opportunities and the attendant economic tradeoffs relating to service, price and capacity.

Search for meaning

So, what does this all mean for logistics professionals and buyers of transportation capacity and service to move freight? The jury is still out on whether intermodal is in a temporary lull or if the bloom is off the rose on a longer-term basis.

And keep in mind that we won’t know the impact the IMO-2020 regulations will have on fuel until we gain some experience as the implementation process unfolds. That fuel costs will rise is a certainty. The question that remains is: How much and who gets stuck with the biggest share of it?

The trucking industry is, once again, on the downward slope of its predicable boom-and-bust cycle. Operating ratios across the business are hovering around 98% to 100%, which is clearly unsustainable. One outcome is that trucking has become more competitive with intermodal, as carriers seek to optimize their networks, but have less “wiggle room” in pricing due to compressed margins.

Shippers need to carefully assess their own networks (inbound, outbound and inter-facility) on a holistic basis to determine how best to allocate their transportation spend across modes and carriers. Linking the optimization of their networks with those of their serving carriers is a well-proven way to drive out supply chain inefficiency and simultaneously reduce carrier operating expenses.

While this is a key step for improving supply chain performance, that optimization needs to be coupled with on-going performance and compliance management, and the network needs to be continually tuned as market conditions change. Only in this manner can logistics and supply chain professionals hope to achieve solid, sustained performance and maintain reasonable costs.

Article Topics

Rail & Intermodal News & Resources

Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report U.S. rail carload and intermodal volumes are mixed, for week ending April 6, reports AAR LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch Norfolk Southern announces preliminary $600 million agreement focused on settling East Palestine derailment lawsuit Railway Supply Institute files petition with Surface Transportation Board over looming ‘boxcar cliff’ U.S. March rail carload and intermodal volumes are mixed, reports AAR Federal Railroad Administration issues final rule on train crew size safety requirements More Rail & IntermodalLatest in Logistics

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources