INDIANAPOLIS. After a big year for truck manufacturers, what can the industry expect for OEMs in 2019? Much of the same, according to John Walsh, the Mack Trucks vice president of marketing, so long as the U.S. economy continues to thrive.

“In our industry, we go as the economies of the countries in which we do business go,” Walsh said during a media briefing at the Work Truck Show at the Indiana Convention Center last week. “And for Mack, today, that really means the economies of the United States and Canada, in particular, where we currently sell more than 90% of our products.”

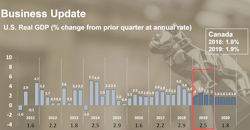

Looking at the U.S. GDP over recent years and current forecasts, Walsh said: “A good way to describe the U.S. economy at this point is ‘chugging along.’ The consensus this year is that GDP will be a little bit lower than last year — but still at good levels.”

He added that similar GDP growth is expected this year and next in Canada.

“If you look at 2019 here in the U.S., you can see perhaps a slowing going into the second half of the year — particularly the fourth quarter — and then moving into next year. But we still think that 2019 is going to be a very, very good year for the Class 8 truck market.”

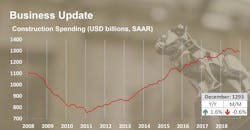

With “ongoing good levels of construction spending” in the U.S., Walsh said it’s good news for the trucking industry and particularly for Mack “given our longstanding leadership position in the construction segment of the market.”

Construction spending was up 1.6% in 2018 compared to 2017. December 2018 was down compared to the previous month “largely due to slower starts in single-family homes,” Walsh said. “But I think that December of last year might have been an all-time high for multifamily construction spending.”

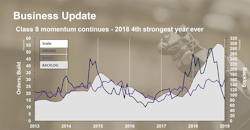

Walsh said that Mack expects these construction spending levels to continue this year. And that would be good for the Class 8 truck market, which is coming off its fourth strongest year on record.

“2018 — I mean — wow! What a year,” Walsh said.

The year saw 310,000 Class 8 trucks ordered in North America. And Mack is expecting 2019 to still be a strong year “even if we see that dropoff in the economy — largely because of the industry order backlog… All of the OEMs — including Mack — we have a heck of a lot of order backlog to build through this year. So we actually see this year as being at the same levels, retail-wise in the North American market, as last year. And, if anything, maybe a little bit of upward pressure on that market.”

Mack is forecasting another 310,000 Class 8 orders in the industry for 2019.

The industry order intake did drop toward the end of 2019, Walsh noted. He attributed that to unsustainable levels. “We’re seeing the downturn in orders now, but you can see with that backlog, we’re anticipating that the builds are going to continue to be very robust,” Walsh said. “We’re going to see a good year, retail-wise, for the North American Class 8 market as well.”

Walsh said that Mack Trucks had itself a great 2018 as its retail sales grew 18% over 2017. Its build rate was up 40% last year and its sleeper truck orders were up 221% in the first full year of the Mack Anthem.

“We are super excited about the customer response to our Mack Anthem highway model that we rolled out last year,” Walsh said. “Our sleeper order intake last year was up 221% over 2017; the industry was up 150%. So we’re outpacing the market in terms of sleeper sales. And that’s largely due to that new Mack Anthem and the response of customers to that product.”

Walsh said that Mack has a lot of momentum going into 2019, as the OEM expects the Anthem sales to continue to grow.

Mack’s Granite truck, which featured new interiors last year, has traditionally been the best-selling construction truck in the Class 8 market, Walsh said, as Mack “continues to optimize the offer.”

“All of this is helping make sure our customers can best serve their customers in longhaul, regional haul, on the highway side, as well as construction and refuse,” Walsh said. “So we feel like we are very well positioned for success moving into 2019.”