U.S. Ports Update 2020: All hands on deck

Federal trade policies and spending priorities in port infrastructure are having a direct impact on supply chain performance for shippers and receivers. The good news is that port managers have adopted a proactive mentality and are optimistic about their futures.

In a similar pattern to how climate change is now culminating in a variety of debilitating weather events, the business of international trade is experiencing its own maelstrom. To better manage through these challenging times, logistics professionals now need to clearly understand what’s happening at the ports their products flow through in order to adjust for the waves of change that are almost certain to hit our docks in 2020.

We’ve identified these six major waves as sourcing shifts; the Panama Canal and port expansions; vessel size and design; reduction in carbon footprints; domestic carrier capacity; and industry integration and consolidation—and they’re all hitting our shores at once. Over the next few pages we will touch on the first three of these waves and examine how ports on the West Coast, Gulf Coast and East Coast are preparing to power through the squalls.

Sourcing shifts

The gradual shift of offshore manufacturing from China to Southeast and Southern Asia is accelerating as trade disputes and rising wages in China reduce its competitive profile. As Southeast Asia has developed capacity in manufacturing and ports, it has made the option of reaching eastern U.S. markets via the Suez Canal competitive to traditional trade routes. Remember that two-thirds of the U.S. population lives east of the Mississippi River.

Freight buyers are finding themselves negotiating new westbound trans-Atlantic volumes verses the eastbound trans-Pacific lanes they’re familiar with. The impact of this sourcing shift is causing waves of change across other areas as well. Traders, buyers and vessel operators are shifting resources to focus on Atlantic and Gulf ports—decisions that shippers will certainly influence in 2020.

The Panama Canal and port expansions

The expanded Panama Canal opened for business in June 2016. Widely hailed as a game changer on the scale of the original, the increased capacity of the new locks permitted larger vessels as well as simultaneous transits in each direction—both serious limitations of the pre-existing canal. Panama Canal Authority (ACP) stated that the purpose of the expansion was to double the Canal’s capacity in order to accommodate much larger container vessels.

The expanded Panama Canal opened for business in June 2016. Widely hailed as a game changer on the scale of the original, the increased capacity of the new locks permitted larger vessels as well as simultaneous transits in each direction—both serious limitations of the pre-existing canal. Panama Canal Authority (ACP) stated that the purpose of the expansion was to double the Canal’s capacity in order to accommodate much larger container vessels.

On the Atlantic and Gulf coasts, the government and industry have been pumping money into port expansions and upgrades in order to handle new vessels and get product moved inland more rapidly. Starting in the northeast, Boston, whose depth at mid-channel is 31 feet, is not competing for mega ships requiring 45+ feet, but has recently received a $20 million Department of Transportation grant for terminal and roadway expansion.

The major Mid-Atlantic Coast ports of New York/New Jersey, Baltimore, and Norfolk have all recently completed—or nearly completed—dredging and dock expansions. In NY/NJ the most dramatic change for the non-shipping public was the raising of the Bayonne Bridge in New Jersey. The project to raise the navigational height of the 151-foot-tall bridge to 2l5 feet was completed in mid-2017. Prior to that time, the largest ships that could dock at the terminals in Newark and Elizabeth carried between 8,500 twenty-foot eqivalent units (TEU) and 9,000 TEU. Today, ships of more than double this capacity will now be able to reach these two key terminals.

In the Southeast, Charleston has begun a dredging project that will deepen its harbor to 52 feet at mean low water (MLW) over the next four years to six years. This port will also soon reach its physical capacity, and so South Carolina has turned its attention to one of the poorest counties in the state—Jasper County.

Jasper County borders the Savannah River. Large tracts of undeveloped South Carolina land sit across from Georgia Port Authority’s (GPA) rapidly growing port of Savannah. While Savanah is still growing, it too will reach a point soon where more land will be needed.

After years of lawsuits including attempts by South Carolina to slow the dredging of the Savannah River to 47 feet MLW, South Carolina and Georgia have agreed to a $4.5 billion multi-year joint project to build the largest single land port in North America. This is on top of a current $1.2 billion port expansion at Georgia Ports Authority-Savannah that will double capacity for cargo handling and rail access at the existing site.

Beyond dredging, in order to rapidly process the large numbers of containers flowing as a result of larger ships, ports have sought to spread the volume around to more locations. For instance, in 2013, the South Carolina State Ports Authority (SCSPA) opened an inland port in Greer, S.C., 212 miles inland.

This facility connects with port facilities in Charleston via a dedicated daily rail service that facilitates the rapid movement of containers out of and into the port itself, effectively extending the Port’s reach well beyond the borders of South Carolina. The facility was so successful that the SCSPA opened a similar facility in Dillon, S.C., in 2018. The Georgia Ports Authority has opened their second site, the Appalachian Regional Port in Chatsworth, Ga.

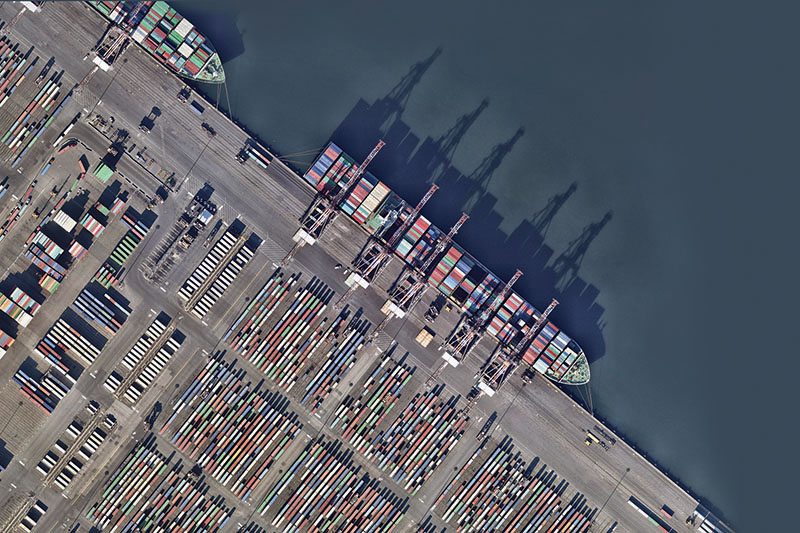

The Gulf Coast’s major ports, with much shallower water because of the gulf’s coastal profile, are planning upgrades to capacity. At Bayport, the Gulf’s largest and newest container facility near Houston, port authorities are dredging deeper channels, expanding berthing space, adding container yard acreage, and installing cranes for New Panamax size vessels.

The West Coast ports enjoy sufficient natural harbor depth to handle the huge ULCS ships and much of their investment has been in procuring larger cranes and other equipment to service those vessels. In the West, it’s about increasing throughput to and from vessels. Congestion on and off the West Coast terminals can seriously impede the flow of goods into and out of the ports even on the best of days.

Eastbound intermodal has struggled with capacity issues, as truck driver shortages and hours of services rules for long-haul drivers have contributed to a sense that alternatives are critical.

Contentious labor relations keep the specter of slowdowns and strikes on the West Coast an ever-present threat, especially at peak shipping times. The long-term effect of these West Coast limitations has been to pull the center of gravity for U.S. distribution activities farther east.

To expedite door-to-door delivery times and mitigate the risk of shipment disruptions, logistics managers will opt for using ports where the chances of congestion and labor issues are small—those ports on the Southeast or Gulf Coasts of the U.S. In fact, a 20l6 National Real Estate investor study confirmed that the East and Gulf Coasts are currently experiencing the highest traffic growth, and listed Savannah, Charleston, and Houston among the five top performing non-West Coast ports for real estate investment.

Clearly, U.S. ports, regardless of size, expect to benefit from the expansion and are, at great cost, proceeding accordingly. For shippers and transport intermediaries it would be wise to get to know the ports you plan to use. Take a tour and gain an understanding of your options for reliable service that will help your company be competitive in world trade.

Vessel size and design

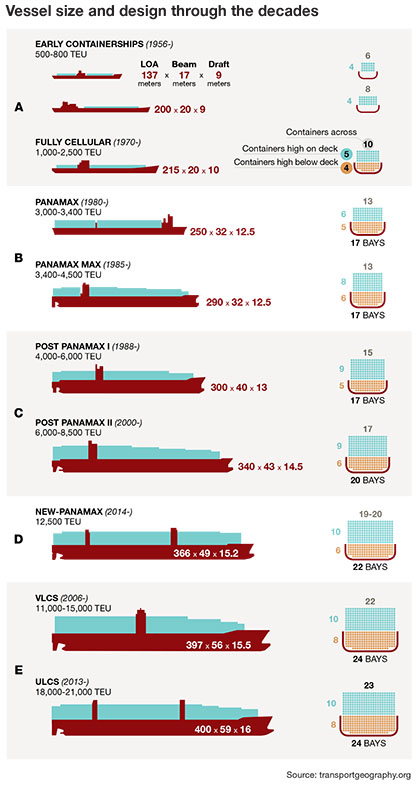

Beginning in 2010, the average size of the global container fleet surged as ship owners began buying megaships, a term loosely referring to vessels capable of moving 18,000 twenty-foot equivalent units (TEU) or more. In order to handle these large vessels, ports in the U.S. have been forced to make significant investments in new infrastructure.

The first wave was comprised of 8,000 TEU to 12,000 TEU “New Panamax” vessels that could pass through an enlarged Panama Canal. These were a challenge for the East Coast and Gulf Coast ports. However, a new generation of ultra-large container ships (ULCS) are now too big even for the larger locks of the newly opened canal.

These vessels will proliferate in major lanes between ports that can handle their size, and shippers will the have new ports and routes inland for which to plan. Distribution models are being redone and organizations like the American Association of Port Authorities (AAPA) are organizing training programs for port management personnel to adjust.

Larger vessels are faster and can, therefore, provide better service and utilization of assets. On the other hand, they’re often harder to handle, necessitating more demanding requests in terms of both time and money related to navigating channels along rivers and canals, port berthing, port access channels and cargo handling facilities.

Because there’s a tradeoff between the positive returns earned at sea and the negative returns while in port, the overall efficiency of a ship may depend ultimately on the total time taken to complete a movement from inland point to ultimate destination.

“In the present world of constantly moving inventories, in addition to total landed cost, the complete supply chain analysis includes consistent transit time,” says Dr. Karl Manrodt, a contributor to Logistics Management and professor at Georgia College and State University. “Increasing capacity and speed in one leg of the supply chain causes a wave of product to hit the next link of the supply chain—in this case the port.”

Article Topics

Ports News & Resources

U.S.-bound import growth track remains promising, notes Port Tracker report Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore New Breakthrough ‘State of Transportation’ report cites various challenges for shippers and carriers in 2024 Industry experts examine the impact of Baltimore bridge collapse on supply chains Port of Baltimore closed indefinitely to ships after 1.6-mile Key Bridge collapses following maritime accident February and year-to-date U.S. import growth is solid, reports S&P Global Market Intelligence More PortsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources