Global 3PL Management: Hedge your bets

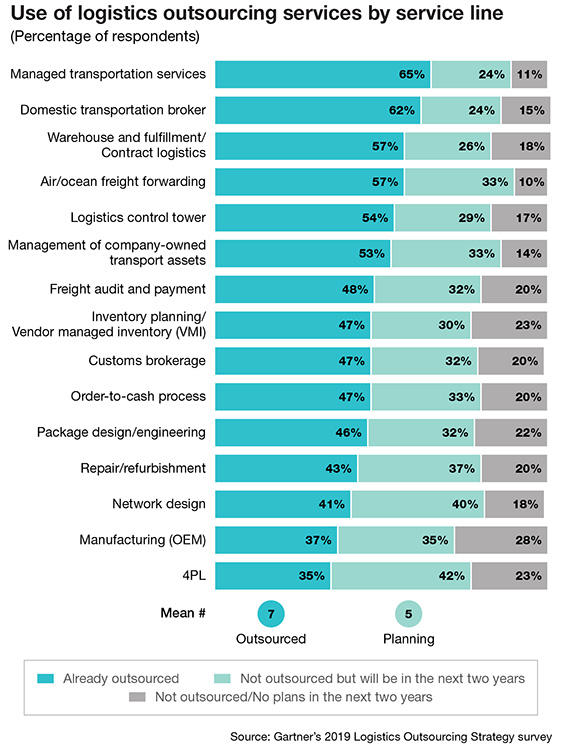

New research confirms that the current risk-mitigating trend in the third-party arena will continue this year. Indeed, 85% of logistics managers expect that their outsourcing budget will increase by more than 5% in 2020, according to Gartner, Inc., with a sizeable portion of that aimed at choosing multiple third-party logistics (3PL) partners.

Outsourcing one or more logistics service types has become largely mainstream, says Courtney Rogerson, senior principal analyst with the Gartner supply chain practice. Furthermore, risk mitigation and “hedging your bets” represent major reasons given by today’s global supply chain managers.

“The question is no longer whether to outsource, but instead what and how much,” says Rogerson. “Evaluating different outsourcing strategies has become a priority for global managers.”

Based on the “Gartner 2019 Logistics Outsourcing Strategy Survey,” one explanation for the expected budget increase is that logistics outsourcing supports the business. Approximately 70% of respondents stated that functional, end-to-end supply chain and overall business objectives have been met or exceeded with the help of logistics outsourcing counterparts.

Top priorities

However, to be effective, the logistics outsourcing strategy needs to be aligned with the overall logistics priorities. Almost half of surveyed logistics leaders stated that updating their technology systems, increasing speed to customer and improving visibility are their most important goals for 2020.

Those priorities show that we are in the thick of the digital era,” says Rogerson. “New routes to market and technology enabled products and services are rapidly disrupting industries and business models. To respond to these accelerated and evocative changes, logistics leaders need to not only understand the foundational elements of good overall strategy, but also need to rethink how their logistics outsourcing strategy is assessed and developed.”

For example, leaders can increase the “iterative frequency” of strategic planning across multiple time horizons, suggests Rogerson. “Rather than treating the outsourcing strategy solely as an annual process, they should include mechanisms, techniques and open communication channels for continuously capturing issues, ideas and insights that will increase the contribution of logistics outsourcing toward meeting the overall business goals.”

While 3PL outsourcing is viewed as helpful by a majority of logistics managers surveyed, there are also risks and challenges. The complexity of working with multiple partners is the most mentioned challenge, followed by cyber-security concerns and the incompatibility of information systems between diverse logistics providers and the shipper.

“Low maturity organizations often outsource logistics with unrealistic expectations regarding ROI and service levels,” adds Rogerson. “Outsourcing can help make your organization more efficient, but it requires a high degree of coordination. Make sure you have the appropriate resources and skills at your disposal.”

Contract logistics update

Much of the same advice is offered in a new report from the London-based consultancy Transport Topics (Ti). Titled “Global Contract Logistics 2020,” Ti researchers examine the growing concerns in the 3PL sector surrounding the environment and the differing actions governments are taking to address pollution levels. Again, risk mitigation is key.

“An increasing number of governments are implementing emissions regulations and diesel bans which will have consequences on transport and logistics companies’ delivery operations,” notes Ti’s research analyst Cameron Morrison. “These regulations, however, remain inconsistent, even at a national level where regulations can differ within the same country.”

Ti also looks at the challenges posed to logistics in the complex environment of megacities. Indeed, no two megacities are the same. For example, some resemble Singapore with high levels of organization, good transport infrastructure and a prospering economy. Others, however, may develop into cities like Kinshasa or Mexico City, with relatively high levels of wealth juxtaposed with endemic poverty, poor infrastructure, crime and corruption.

Ti also looks at the challenges posed to logistics in the complex environment of megacities. Indeed, no two megacities are the same. For example, some resemble Singapore with high levels of organization, good transport infrastructure and a prospering economy. Others, however, may develop into cities like Kinshasa or Mexico City, with relatively high levels of wealth juxtaposed with endemic poverty, poor infrastructure, crime and corruption.

“This creates a complex and ever-changing environment in which logistics providers must navigate and adapt in order to remain efficient,” says Morrison. “In developed countries, megacities still prove to be as complex as in emerging markets.”

Morrison adds that contrary to what some logistics managers may think, a city being developed and thriving economically does not necessarily equate to having the perfect environment to operate a logistics network, as other factors come into play. “Population density can be equally as high, inequality can also be prominent and the lack of space available to set up operations is increasingly sparse,” he says. “Logistics providers are still faced with many of the same challenges to overcome as in emerging markets.”

In addition, the report explores the implications of “circular fashion” for logistics and supply chains. With fashion supply chains on the verge of a major transformation that will have drastic effects on the associated logistics industry, changes are being thrust upon manufacturers and retailers in the sector at the same time.

“There’s increased pressure regarding the negative effects modern practices and culture are having on the environment,” adds Morrison. “The emergence of new markets such as online clothing rental is an example of how reduction of waste in this industry is possible without the reduction of consumerism.”

Continued volatility

When the 3PL consultancy Armstrong & Associates (A&A) staged its “7th annual 3PL Value Creation North America Summit” in Chicago late last year, the focus was on coping with supply chain volatility. At that time, industry analysts were saying that 3PL providers were confronting considerable challenges created by uncertainty—and now that situation may have only become more complex for 2020.

The panel addressing “Transportation & Logistics Merger & Acquisition Trends & Insights” addressed many of the shifts that have become all too familiar for shippers and service providers alike. “Mergers and acquisitions may be facing a few more headwinds in the transport and logistics sectors due to concerns about a freight recession, trade war tensions with China, slowing GDP growth and political uncertainty with the impeachment proceedings,” says Kris Hopkins, head of transportation and logistics at Houlihan Lokey, an independent global investment bank.

At the same time, however, investors can hedge their bets by concentrating on 3PLs specializing in growing segments, such as those serving e-commerce customers and final-mile logistics providers. Other spots with “recession resilient” characteristics include consumer staples such as food, beverage and household goods. Meanwhile, cold chain logistics is an area that should continue to hold up well during any potential downturn, as demand for these essential products and services remains robust.

“Even when an economy faces a downturn, consumers still need to eat, and the long-term trends and demand for fresh foods requiring temperature control remains attractive,” says Hopkins. “Demand for cold chain warehousing and transport solutions in the temperature-controlled segment remains high.”

According to Hopkins, 3PLs reining in their global supply chains in reaction to trade tensions are not likely to be as attractive as those willing to reconfigure their networks. “While moving some sourcing to Mexico might make sense for some manufacturers, we see more reliance on Southeast Asia as an alternative to China,” he says. “The most diversified 3PLs are always going to be better off and can weather disruptions more effectively.”

At the same time, the “middle market” remains resilient. Hopkins says management strength and “a deep bench” are important for strategic buyers and more acutely for private equity buyers who are not in the business of running their portfolio companies. “Finally, we would advise managers to be mindful of the upcoming elections and time their sale launches accordingly,” adds Hopkins.

Article Topics

3PL News & Resources

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More 3PLLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources