No swift changes for air cargo

There is no telling just how stormy air cargo markets may be in 2021, but one thing is certain: The passenger side is rocky because capacity remains tight.

Since the pandemic struck last year, air cargo has become sort of an economic lifeline for the airline industry. However, there are no good numbers. International Air Transport Association (IATA) data for global air freight markets shows that demand for air cargo decreased by 10.6% in 2020, compared to 2019—the largest drop in year-on-year demand since IATA started to monitor cargo performance in 1990. Global passenger traffic fell by 65.9% compared to the full year of 2019.

“Last year was a catastrophe,” stated Alexandre de Juniac, IATA’s director general and CEO, upon releasing the data. “There is no other way to describe it. What recovery there was over the Northern hemisphere summer season stalled in autumn, and the situation turned dramatically worse over the year-end holiday season, as more severe travel restrictions were imposed in the face of new outbreaks and new strains of COVID-19.”

IATA adds that pre-pandemic, 60% of all international air-cargo capacity was in the bellies of passenger aircraft and that in 2020 that capacity shrank by almost a quarter.

The collapse was felt around the world, especially by Middle East carriers due to their limited home market. In late March 2020, for example, COVID-19 forced Emirates to completely suspend all passenger flights, triggering a loss of all cargo capacity on those operations.

“This normally constitutes more than two-thirds the total global capacity we offer over the course of normal operations,” reports Henrik Ambak, Emirates senior vice president of cargo operations worldwide. “We were only left with our full freighter operations with a fleet of 11 Boeing 777 aircraft.”

Delta Cargo’s cool chain is in action at the ATL warehouse.

With the stalling of the recovery in passenger markets, there is no end in sight for the capacity crunch being felt in the air cargo markets. Early 2021, however, did offer rays of hope.

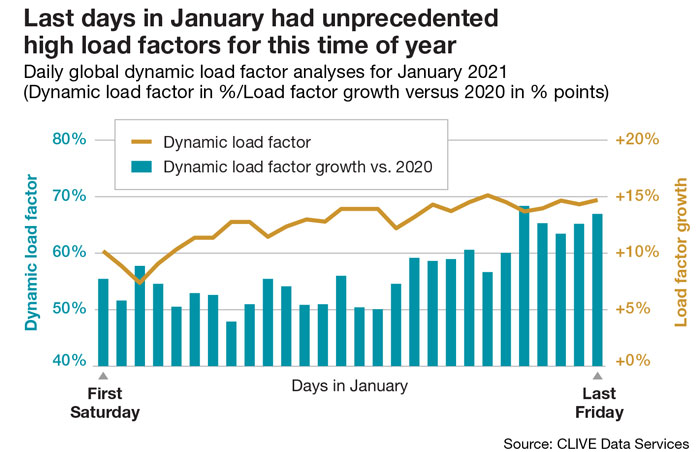

The February CLIVE Data Services and TAC Index report indicated that for January, cargo load factors were 66%, up 9% year-on-year. The global dynamic load factor for the last two weeks of January showed an exceptional 10% to 15% rise over the same days of January 2020. They also indicated that available global air cargo capacity in the four weeks to January 31 was -18% compared to 2020.

Niall van de Wouw, managing director of CLIVE, remarks on how flights in January were “very full for that time of year.” He relates this to consumers spending on high-value products—not travel and leisure.

Wouw also warns that January’s load factors are anomalies compared to previous years. “But they’re also not surprising when you look at the current dynamics in the industry,” he says. “One airline recently mentioned to me that they had ‘November volumes in January.’”

The market remains very demanding and constantly changing due to the regulatory COVID landscape, outbreaks of new COVID variants, and escalated vaccine distribution needs.

“Airlines are having to ‘fly by sight’ as you simply can’t know what is around the next corner,” Wouw says. “When we read that some carriers are telling customers they can’t guarantee their capacity commitments in January and February, this tells you how full flights are. On a lane level, for example, westbound and eastbound load factors across the Atlantic were higher in January than they were in November and December at 88% and 76% respectively. Capacity is tight and we sense no underlying currents that will swiftly change this.”

Data from TAC Index indicates that airfreight rates remain in a state of flux. Airfreight rates out of Asia may have dropped in the first couple of weeks of January but regained ground in the last part of the month.

Emirates SkyCargo transports first batch of Pfizer-BioTech Covid-19 vaccines for Dubai Health Authority.

“Despite the Chinese New Year, there is a continuing negative trend, but market consensus has it that rate negotiations between shippers, forwarders and carriers are much more short term again (weekly or even per shipment) and, as a result, the number of spot rates has increased drastically compared to previous years,” says Robert Frei, TAC Index business development director. “In our numbers, we see big spreads.”

Demand continues

Air cargo faces continuing challenges. IATA predicts an anticipated 25% rise in freight tonne-kilometers (FTKs) this year. Meanwhile, to counter revenues lost due to grounded passenger planes, some airlines have converted airplanes to cargo-only pax aircraft, dubbed “preighters,” to accommodate cargo demand.

“The ‘preighters’ prevalence looks set to continue throughout 2021 and beyond,” states Dominic Hyde, vice president of Cr¯edo On Demand, Pelican BioThermal.

Case in point: When the pandemic crisis hit, Emirates immediately restored air cargo connectivity to markets around the world by operating our Boeing 777-300ER passenger aircraft as cargo only aircraft so that it could continue transporting essential commodities that were required in response to COVID-19.

“This had never been done before and our team had to work within a very short time to plan our new route network, work with our partners across the world and also work with the relevant authorities to get the required permissions to operate the flight,” Ambak says.

Lufthansa also quickly absorbed crisis-related capacity bottlenecks in airfreight through flexible network management and the use of “preighters.”

“In 2020 during the height of the PPE demand, we removed seats from the main deck of 10 passenger aircraft to serve additional demand. If required, we would do that again this year,” states Dorothea von Boxberg, CEO, Lufthansa Cargo.

Lufthansa managed to maintain its global freighter network, despite a multitude of ever-changing regulations related to the pandemic.

Although more aircraft continue to be converted to “preighters,” there still remains a shortage of belly capacity. Part of the reason is because prior to COVID-19, airlines were already looking to utilize smaller, more efficient aircraft.

“Those decisions have massively accelerated,” Hyde remarks.

Boeing noted in its World Air Cargo Forecast 2018-2037 that, given typical retirement rates, 2650 freighters would be in demand. But of those, it projects 1,170 will be new B737s and 757s with payload less than 45 tons.

Airbus reported in its 2019-2038 forecast that 76% of demand for 39,210 new passenger and freighters would be for small aircraft with payloads between 10 tons to 40 tons. In 2019, the OEM already announced the cancellation of deliveries of its A380 in 2021. These aircraft have been retired by every carrier except for Emirates.

Vaccine demand

The rapid rush to distribute COVID-19 vaccines is also putting pressure on capacity and shipping rates. Hyde reveals that rates have risen sharply from $2.5 to $25 a kilo. He does see this waning.

Meanwhile, airlines continue to court niche sectors such as pharmaceuticals, electronics, perishables and high-value goods. They are investing time and money to develop expertise in handling pharmaceuticals, in particular, an effort that is coming to fruition with transport demands of the COVID-19 vaccine.

Delta Airlines is transporting the vaccines in the belly hold of its passenger aircraft.

“The entire journey is monitored in Delta’s unique Vaccine Watch Tower that enables full end-to-end visibility for all vaccine shipments,” states Rob Walpole, Vice President Delta Cargo.

With 24/7 centralized monitoring and customer reporting, the Tower works closely with flight operations to ensure their safe and secure transportation at the required temperature.

“Our vaccine task force, which was created last summer to understand the shipping requirements and work with healthcare and pharmaceutical experts, has built scalable, critical shipment capabilities to support this effort,” Walpole adds.

Of note, Delta is the first U.S. passenger airline to receive IATA’s Center of Excellence for Independent Validators Pharma Logistics Certification (CEIV) at its Atlanta hub and headquarters. The airline operates large warehouses and cooler facilities in Atlanta, Detroit, Los Angeles, New York-JFK and Seattle, plus pharma facilities at 75 other domestic airports and a network of 49 certified Pharma airports across the globe.

American Airlines Cargo, which also is CEIV-Pharma certified, uses state-of-the-art tracking technology in its Integrated Operations Center to keep a 24/7 watchful eye on pharmaceutical shipments, including vaccines.

“To ensure a smooth cold chain, we also established a designated group of sales and operational team members trained to lead the coordination of temperature-critical shipments,” said Derrick Chengery, a spokesperson for American Airlines Cargo. “These efforts, which were established before the pandemic, have enabled us to create industry-leading cold chain solutions.”

To handle the rush of vaccines, many of AA’s widebody aircraft remained in service during the pandemic to help operate the airline’s cargo-only network. “Our global network of temperature-controlled facilities provides a variety of climate types for short-term pharmaceutical storage,” Chengery comments.

Freight awaits to be boarded on a Lufthansa Cargo aircraft.

Lufthansa Cargo, one of the first airlines to specialize pharmaceutical transport, has been continuously improving its capabilities of transporting temperature-sensitive freight. Lufthansa offers a dedicated “COVID-19 Temp Premium” product that offers special tracking in addition to “must go” capacity access, temperature support and very high security standards. “Our dedicated customer service team has all information available about where and at which state of the process the shipment is,” von Boxberg explains.

Lufthansa Cargo’s ground infrastructure includes pharmaceutical hubs in Frankfurt, Munich, Shanghai, and Chicago as well as around 30 CEIV-Pharma certified stations worldwide. “We run one of the world’s largest airline pharmaceutical networks,” von Boxberg adds.

Going forward

The pandemic will continue to put pressure on all aspect of air cargo, but carriers will continue to improve services by focusing on providing transparency through the shipment process with tracking products and digitization.

Besides re-launching its website, Delta is focusing on digitization and last year introduced PayCargo, a new secure payment platform as well as launching API connectivity. “This provides our customers with the convenience of real-time connectivity to Delta systems from a customer’s own platform,” Walpole says.” This means customers can now easily shop, book and track their shipments from their own platforms.

Mark Williams, associate partner, McKinsey & Company sees e-commerce opening opportunities for air cargo. “By digitizing customer interactions, improving operational efficiencies with analytics to better predict demand or predictive maintenance, enhancing data systems to standardize and introduce electronic air waybills, and increasing door-to-door business (e.g., upsell hinterland operations and services), air carriers could capture up to 15% of today’s forwarding market by 2030,” he states.

To be successful, Williams emphasizes that carriers will need to have clear value propositions to succeed as forwarders. This means providing services beyond just the transport, such as an end-to-end offering and the ability to tailor solutions for customers.

Lufthansa is already heading in this direction via its digital startup subsidiary heyworld, which offers door-to-door solutions for cross-border e-commerce shipments. The carrier is also undergoing a digital transformation with a goal of digital mapping the entire supply chain.

Article Topics

Air Freight News & Resources

2024 Air Cargo Update: Cleared for take off Supply Chain Currents Part I: Is there a different way to move freight more effectively? Global 3PL market revenues fall in 2023, with future growth on the horizon, Armstrong report notes UPS fourth quarter earnings see more declines GRI Impact Analysis: Getting a Handle on Parcel Costs Averitt’s ‘State of the Supply Chain Survey’ presents an optimistic tone for 2024 2024 Transportation Rate Outlook: More of the same? More Air FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources