Truckload freight volumes increased in March although ample capacity and weather-related supply chain disruptions kept rates in check, according to DAT Solutions, which operates the largest truckload freight marketplace in North America.

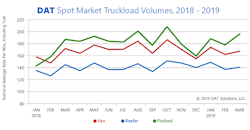

The DAT Freight Index increased 4.3% in March compared to February. The index is a monthly volume indicator for full-truckload van, refrigerated (reefer), and flatbed freight transportation.

“We anticipated a bigger increase in demand for trucking services, but unexpected events, including flooding in the Midwest and a major tank fire in Houston, prevented the typical surge of shipments ahead of the close of Q1,” said Mark Montague, DAT senior industry analyst. “As a result, truckload rates were lower than expected in March.”

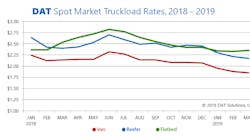

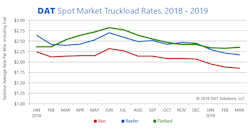

While freight volume increased 3.7% for vans and 2.1% for reefers compared to February, the national average spot (non-contract) van rate fell 3 cents to $1.85 per mile and the reefer rate declined 4 cents to $2.17 per mile.

Flatbed freight was the strongest segment of the three, with a 10% increase in demand for available trucks. The national average spot flatbed rate increased 2 cents to $2.35 per mile month over month. Flatbed freight includes construction materials, heavy equipment, and freight related to oil and gas markets.

Changes in contract rates were mixed. The van rate fell 4 cents to $2.26 per mile, the reefer rate increased 4 cents to $2.57 per mile, and the flatbed rate gained 2 cents to $2.61 per mile, compared to February. Contract rates rose higher for all equipment types compared to March 2018, however. Many contract carriers raised prices in 2018, but the increases did not take effect until the second half of the year.

Year-over-year: freight is abundant, so are trucks

Spot truckload rates in March were well below last year when load-to-truck ratios and rates were at record levels. Yet freight volumes remained relatively strong. Van and reefer volumes declined just 2.5% and 3.4% compared to March 2018, and flatbed volume increased 4.8% year over year.

“Overall freight availability reflected a solid economy during the month of March, with van freight volumes increasing more than 6% during the last week of the month,” Montague said. “There was enough capacity to cover the demand, and as a result rates did not rise as expected for this time of year.”

The DAT North American Freight Index is based on load counts and per-mile rates recorded in DAT RateView, with an average of 3 million freight moves per month. Spot market information is based on transactions arranged by third-party logistics (3PL) companies, while contract volumes and rates are arranged between shippers and carriers, with no intermediary.