(Bloomberg) — U.S. exporters are increasingly relying on trucks to get fuel into Mexico as the country’s gasoline production sags and infrastructure constraints limit shipments from one coast to the other.

Windstar LPG, Nustar Energy LP and Indimex Marketing and Trading are among companies capitalizing on Mexico’s growing fuel demand to carve out their own slice of the cross-border distribution business.

The trend comes as state-owned oil company Petroleos Mexicanos struggles to meet Mexico’s consumption needs due to declining refinery output and distribution bottlenecks exacerbated by a dearth of pipelines and storage facilities. Some gas stations, including those run by private companies that buy from Pemex, have been forced to shut periodically due to lack of supply.

“The supply crisis at the start of this year accelerated to some extent the need for a guarantee of supply and private companies began to look for alternative solutions,” Josefa Casas, formerly a sub-director of strategic analysis at Pemex Industrial Transformation, said at an International Society for Mexico Energy event in Mexico City last week.

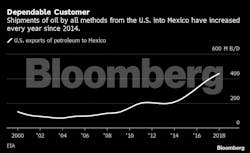

Against this backdrop, imports of U.S. crude and oil products has grown every year since 2014, reaching a high of 1.42 million barrels a day in November, according to the EIA. Transporting fuel by truck is a small but growing piece of that business.

Windstar, a small El Paso, TX, company with a handful of traders in Houston, has started shipping Texas-origin gasoline and diesel by truck 300 barrels at a time across the Mexican border south of Tucson, AZ, while NuStar, which delivers diesel into Nuevo Laredo, is building a new wholesale distribution center to handle fuel from Valero Energy Corp.’s Texas refineries.

“Mexico is a net importer of refined petroleum products and is likely to remain so,” said Nustar spokesman Chris Cho. “Much of the imports along the Texas portion of the US-Mexico border are currently supplied by truck” and the new distribution center will “optimize existing pipeline and terminal assets to serve growing markets with rates attractive to our customers,” he said.

Mexico City-based trading firm Indimex already trucks Gulf Coast and West Texas refined products across the border.

“Given the fact that Mexico is a wide-spanning country, it is much easier to move product via truck,” said Indimex founder Rajan Vig. “Trucking is efficient. People understand the viable routes for trucking. Some areas of the country are just much easier to truck to, rather than to rail to.”

Windstar declined to comment on its Mexico fuel business.

Top energy firms including BP Plc, Exxon Mobil Corp., Koch Industries Inc. and Glencore Plc, have also piled into the Mexican fuel market over the past several years following landmark legislation in 2014 that ended Pemex’s monopoly in the sector. Pemex still owns a majority of Mexico’s distribution networks and infrastructure, however, with only a few big players like Koch and Glencore utilizing their own private import terminals at Mexican ports and many companies’ unable to utilize permits to import fuel.

While trucking fuel is growing in popularity, it is limited by volume, and is one of the most expensive and inefficient methods to import fuel, Casas told Bloomberg, noting that rail and ports infrastructure needed to be expanded. The biggest problem is that the “infrastructure remains limited, but that’s also an opportunity for investment,” she said.