Enterprise Resource Planning (ERP) Update: The leaders of the pack

As logistics, transportation, and the end-to-end supply chain gain prominence in the C-suite, large ERP vendors continue to enhance their supply chain management offerings to serve both new and existing customers.

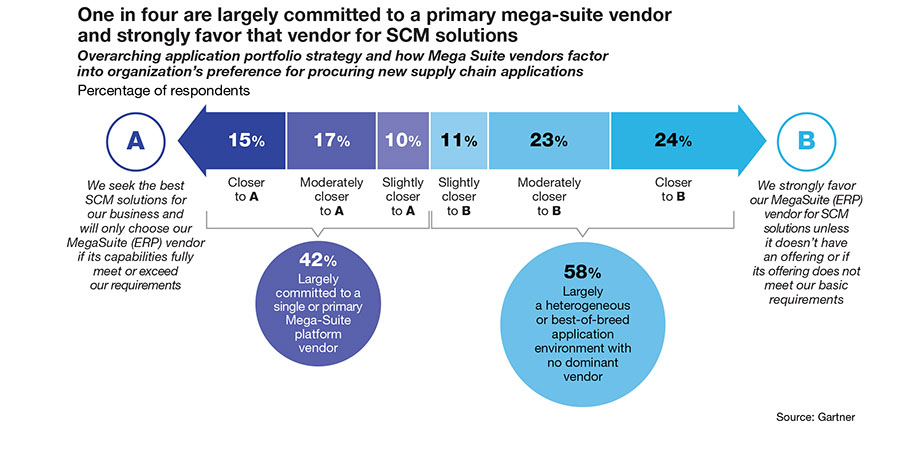

As large enterprise resource planning (ERP) makers continue expanding into the supply chain management (SCM) market, the number of shippers turning to these mega-suite providers for supply chain applications is holding steady. According to this year’s “Gartner Supply Chain Technology User Wants and Needs Study,” one in four companies remain “largely committed” to a primary mega-suite (ERP) vendor and strongly favor that provider for SCM solutions.

Looking at how mega-suite (ERP) vendors factor into shipper preferences when procuring new supply chain applications, Gartner found that 42% are largely committed to a single or primary mega-suite platform vendor. Fifty-eight percent of companies prefer a heterogeneous or best-of-breed application environment (with no dominant vendor).

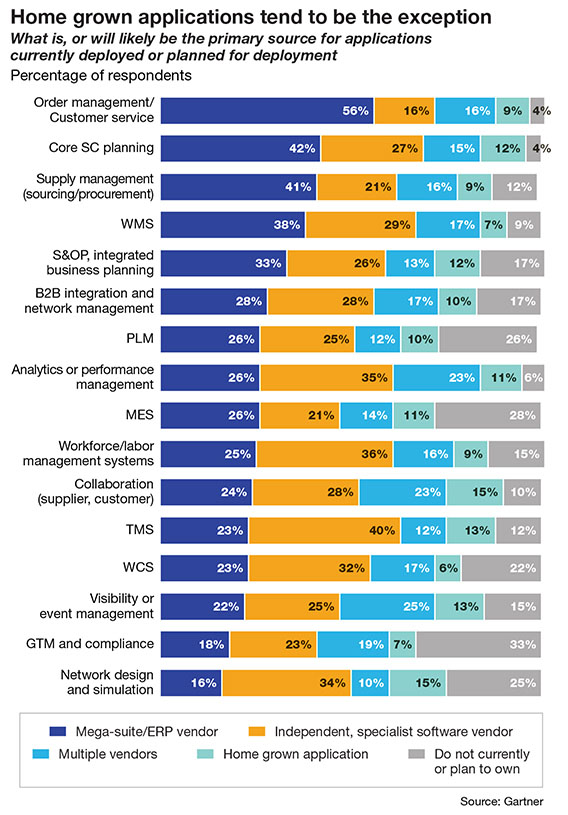

Digging down deeper into the supply chain applications that companies either already deployed or are planning to deploy, Gartner found that mega-suite ERP vendors tend to dominate in the areas of order management/customer service (where 56% of companies prefer their ERPs); core supply chain planning (42%); supply management like sourcing and procurement (41%); and warehouse management systems (38%).

At the other end of the spectrum, a higher percentage of shippers either work with best-of-breed providers or multiple vendors for applications like network design and simulation (25%); global trade management and compliance (26%); visibility or event management (38%); warehouse control systems (23%); and transportation management systems (25%).

Dwight Klappich, research vice president at Gartner, says that within the ERP sector, SAP, Oracle and Infor are the top three providers that shippers are turning to. The supply chain “mega-suite” is dominated by JDA, Manhattan and High Jump. “Those six vendors—between their revenues and number of customers—dominate the market,” says Klappich. “That doesn’t mean other vendors can’t encroach on their market,” he continues, “but as it stands right now those six vendors have well over 10,000 customers. The rest of the market combined probably doesn’t have that many users.”

In this article, we explore the steady progress that mega-suite vendors are making in the supply chain management solutions market, show how shippers are embracing those solutions and predict what lies ahead for the rest of the year and into 2020 for this sector of the software market.

Leaders of the pack

A sector that grows by either developing its own applications or acquiring best-of-breed companies that specialize in specific solutions, ERP has been steadily making its way into the supply chain management space for years now. With shippers paying more attention than ever to their supply chains, logistics operations and transportation networks, demand for the technology that supports these operations has grown exponentially.

According to Klappich, both Oracle and SAP have made names for themselves in the transportation management systems (TMS) market, where both JDA and Manhattan also have a strong presence. “Those are the four leaders in the Gartner TMS Magic Quadrant,” he says. Moving down the list and looking beyond only TMS, Klappich says vendors like E2open (which in May acquired GTM provider Amber Road), Mercury Gate and BluJay are carving out their own piece of the SCM pie by focusing on mid-sized shippers.

“There’s still a robust best-of-breed market, and particularly on the supply chain planning (SCP) side of the equation,” says Klappich. That’s because there remains a contingency of users that would prefer a dedicated solution versus one that has been developed as part of a larger product portfolio. “As the ERP vendors continue to build out their applications, I don’t think they’ve reached a point of offering best-in-class functionality that’s 100% equal to the leading vendors in the space,” says Klappich, “but I also don’t think they necessarily need that to be successful.”

“There’s still a robust best-of-breed market, and particularly on the supply chain planning (SCP) side of the equation,” says Klappich. That’s because there remains a contingency of users that would prefer a dedicated solution versus one that has been developed as part of a larger product portfolio. “As the ERP vendors continue to build out their applications, I don’t think they’ve reached a point of offering best-in-class functionality that’s 100% equal to the leading vendors in the space,” says Klappich, “but I also don’t think they necessarily need that to be successful.”

Using SAP as an example, Klappich says the vendor’s Extended Warehouse Management (EWM) has positioned it as one of the largest vendors overall in the WMS space. “EWM is certainly up there with Manhattan, HighJump and JDA in terms of customer base.” Add SAP’s base of legacy ERP users to the mix and the vendor moves to the front of the pack pretty quickly. “EWM may not be a best-of-breed,” he explains, “but it is a contender.”

Expanding the scope

As he examines how the ERP sector has grown over the last few years, Clint Reiser, research analyst with Boston-based ARC Advisory Group, says the term “resource” itself has expanded significantly since the earliest ERPs began hawking their wares to large enterprise users. “It’s not just about planning anymore; it also about execution,” says Reiser. “As a result, ERP vendors are becoming enterprise software platform providers.”

Looking outside of the SCM space, for example, Reiser points to SAP’s 2014 acquisition of behavioral marketing firm SeeWhy, the maker of a Cloud-based platform that analyzes real-time shopper data from consumer actions on web, mobile and social. A few years earlier, SAP bought Sybase, which produced software to manage and analyze information in relational databases. “Both of those acquisitions were way outside of the scope of what would traditionally be considered ERP,” says Reiser.

These and other strategic moves have pushed ERPs into a new realm of being able to offer up comprehensive product suites that don’t always align with the traditional definition of an enterprise resource planning application. Supply chain management hasn’t been immune to this trend, says Reiser, who expects the push to continue.

“The ERPs are going to market not just as an extension of their core legacy applications, but they’re also going out to new customers,” says Reiser, who points to Oracle’s SCM Cloud as one example of how a large ERP is thinking beyond its core customer base. “These large vendors are not only expanding with SCM, but they’re also growing within the enterprise software market as a whole.”

Blurring the lines

Bob Hood, a Capgemini principal and lead for the group’s Move Domain practice, is also seeing the traditional lines between ERP and best-of-breed providers blurring in the supply chain space, where he says companies like Oracle are “aggressively bringing Cloud-based supply chain functionality to the Cloud.”

These moves help to open the door for small to mid-sized users that may not have invested in the vendor’s legacy ERP solution, but that want to take advantage of its TMS capabilities. It used a similar approach on the WMS side when it purchased Cloud-based WMS provider LogFire in 2016.

“The blurring of the lines between ERP and best-of-breed continues,” says Hood, who points to SAP’s Integrated Business Planning (IBP) and Ariba (for procurement) as two more examples of how dedicated the ERPs are to going “head to head” with best-of-breed supply chain solutions.

“The ERPs are getting pretty aggressive with supply chain—and the market in general—in the Cloud, which is much different than the traditional, monolithic, ERP ‘soup-to-nuts’ kind of deployment,” says Hood. “The ERPs are still bringing a ‘suite’ to the table in terms of the various modules and functionalities, but they’re now more point-focused and competing more like the best-of-breeds than they have traditionally.”

“The ERPs are still bringing a ‘suite’ to the table in terms of

the various modules and functionalities, but they’re now more

point-focused and competing more like the best-of-breeds

than they have traditionally.”

Hood expects that momentum to continue, with at least some of it driven by the high number of SAP S/4HANA migrations that are taking place as the vendor’s ERP platform moves toward its 2025 end of life (EOL) deadline (at that point, support for this platform will stop and users will have to migrate to S/4HANA). “There’s a tremendous amount of energy being devoted to those migrations right now,” says Hood. “As customers move to S/4HANA, there’s going to be some [increased] interest in supply chain functionality as part of those transitions.”

As Oracle continues to build out its Cloud offering, Hood expects the vendor to incorporate functionalities like finance and human resources into the equation—along with new supply chain capabilities. “We’re likely to see the continued evolution to more of a Cloud suite,” he says, “with supply chain as a significant component.”

Klappich also expects more traction ahead for the mega-suite vendors that invest in their applications and come up with new options that help shippers run their end-to-end supply chains. “I’ve seen no indication that they’re backing off investment or ceasing to add new functionality to their platforms,” says Klappich, who sees partnering with best-of-breeds as a good option for ERPs that may not want to build out their own functionalities or purchase new companies.

“We’re at point where the mega-suites can do more partnering with third-party systems,” says Klappich, “and taking steps like bolting on Optricity for slotting versus having to actually purchase the technology or build it themselves.”

To shippers who are investing in new SCM solutions this year, Klappich says those that are already using an ERP should probably “short list” that vendor and explore any new supply chain offerings it may have folded under its umbrella. “If you’re right down the middle of the plate in terms of functional requirements, your mega-suite vendor may be a good choice,” says Klappich, “but integration shouldn’t be the dominant evaluation criteria. There are also advantages to considering the other options that are out there in the market.”

Article Topics

TMS News & Resources

First scheduling API through the Scheduling Standards Consortium is released by Uber Freight TD Cowen/AFS Freight Index points to a muted peak season and mixed activity across TL, LTL, and parcel markets Enterprise Resource Planning (ERP) continues to push further into Supply Chain Management (SCM) Gain Greater Visibility With ERP & TMS Integration Top Transportation Management System (TMS) Trends for 2023 Trimble acquires Transporean in major deal, for nearly $2 billion What you need to know for a better ROI More TMSLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources