National average spot truckload rates dipped last week as capacity returned to the market after the Fourth of July holiday, said DAT Solutions, which operates the industry’s largest network of load boards.

Load-posting volume on the DAT network increased 48%, recovering the 45% loss during the previous week when many businesses reduced their schedules. Truck posts increased 21%.

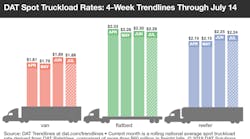

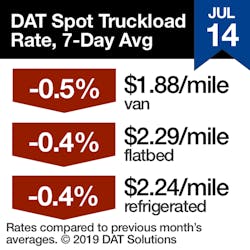

National average spot rates, through July 14:

- Van: $1.88/mile, 1 cent lower than the June average

- Reefer: $2.24/mile, 1 cent lower than June

- Flatbed: $2.29/mile, 1 cent lower than June

Van trends: Despite a rise in the national average van load-to-truck ratio from 2.0 to 2.3, spot rates on the DAT Top 100 van lanes fell 3%, wiping out gains made over the past four weeks. Rates were higher on just 23 of these high-volume lanes; the national average linehaul rate (the rate excluding fuel surcharge) was $1.58/mile, essentially the same as June.

Where rates were rising: Rates fell in virtually every major market for outbound spot van freight but a few lanes ran counter to the trend:

- Philadelphia to Boston, up 10 cents to $3.57/mile

- Chicago to Buffalo, up 10 cents to $2.64/mile

- Denver to Albuquerque jumped 13 cents to $2.02/mile, unusually high for a lane out of Denver

Tropical Storm Barry was likely to blame for declining spot rates in Memphis, Atlanta, and Charlotte as truckers eager to escape the weather flooded these markets with capacity.

Reefer trends: Unlike the van market, reefer volumes were slow to regain their pre-holiday levels last week, a sign of seasonal weakness in produce-oriented markets in Texas, Arizona, and California. The reefer load-to-truck ratio made a modest gain from 3.5 to 3.8 last week but rates were lower on 55 of the DAT Top 72 reefer lanes while 15 lanes were higher.

Where rates were rising: Eight reefer markets gave up more than 4% of the prior week’s rate, led by Nogales, Ariz., down 7.4% to $2.21/mile; Atlanta, down 6.5% to $2.52/mile; and Los Angeles, down 6.4% to $2.93/mile. There were mild surprises for reefer rate increases, especially in the East. Elizabeth, N.J., jumped 7 cents to $1.67/mile, and a few outbound lanes from the region paid considerably better:

- Elizabeth to Atlanta, up 17 cents to $1.61/mile

- Elizabeth to Lakeland, Fla., up 12 cents to $1.70/mile

- Philadelphia to Miami, up 26 cents to $1.79/mile

Key takeaways:

- A decrease in spot rates is typical following the Fourth of July holiday.

- Barry’s impact on supply chains was regional.

- Agricultural markets lost strength.

- Are we on the cusp of a “freight recession”? Not as long as van load counts remain solid.

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.