Article 4: Trucking Spot Market Vs. Freight Futures Market Pricing & Price Discovery

If a market participant is interested in using trucking freight futures for hedging or profiting, they should understand a few things about pricing before they start taking positions in the trucking freight futures market.

Latest Logistics News

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch More 3PLLogistics Management and Lakefront Futures’ Trucking & Derivatives Group are publishing a series of articles during August & September on the “A-Z” of trucking freight futures. This fourth article provides an overview of the difference between trucking spot market rates and freight futures prices, how each are calculated, pricing considerations and the price discovery benefits of the trucking freight futures forward curve.

Previous articles in the series:

- Article 1: The Trucking Paradigm Shift & the New 3-Dimensional Market

- Article 2: Trucking Freight Futures 101

- Article 3: Hedging Applications for Trucking Carriers, Shippers & 3PLs

If a market participant is interested in using trucking freight futures for hedging or profiting, they should understand a few things about pricing before they start taking positions in the trucking freight futures market. Set forth below are salient points on key information to know related to pricing:

Spot Market vs Futures Market: The easiest way to think of the spot market vs. the futures market is that they both involve the same commodity. In the spot market, you are getting and paying for the commodity now. In the futures market, you are agreeing today to pay for the commodity in the future at a specific price and at a pre-determined future date.

Trucking Spot Market Prices: For the trucking market, trucking spot market rates are what you would pay to a carrier today if you wanted a freight load to be picked up in the next few days. Trucking spot market prices are derived from privately negotiated transactions and based on the load to truck ratio. If there is less trucking capacity for the existing load volume, rates will go up and if there is more capacity for the existing load volume the rates will go down.

For the trucking industry, there are hundreds of lanes and thousands of load transactions that occur daily. In that regard, DAT, the largest trucking data provider in the country, compiled the activity and created the 7 directional lanes and 4 calculated indices to use as the spot market benchmarks for the trucking freight futures market. See below for the pricing methodology that DAT uses to update the spot market pricing on these directional lanes and calculated indices daily.

Freight Futures Prices: With a futures contract, you are locking in a price for a financial transaction today that will occur on a future date when there will be a financial settlement. Trucking freight futures prices are based off of the DAT spot market prices for their 7 directional lanes and 4 calculated indices – the benchmarks. The futures market price calculation is shown below.

Future contract price = trucking spot market rate + the market’s expectations for changes in future supply and demand conditions based on what the market knows today + seasonality

The great thing about trucking freight futures or the futures markets in general, is that prices are derived from a transparent open market/auction bidding process on a futures exchange. In that regard, they produce “true market” prices. The futures prices continuously change based on the bidding and trading activity happening on that contract. Please note that there is a difference between the final settlement price (DAT spot market index) vs the futures settlement (Nodal curve set by market activity - trades, bids, offers).

Market participants who join Nodal Exchange using a Nodal FCM/clearing firm, have access to Nodal’s trading screen where they can see the current prices for trucking freight futures contracts up to 16 months in the future and the current bidding level.

Interrelatedness: Spot market rates and futures prices are interrelated as the futures price is based off a discount or premium to the current spot market rate. In addition, since freight futures prices provide a transparent market based standardized benchmark that the spot market does not have, trucking spot market prices can be impacted by changes occurring in the trucking freight futures market. Especially, the near term and next month futures contracts.

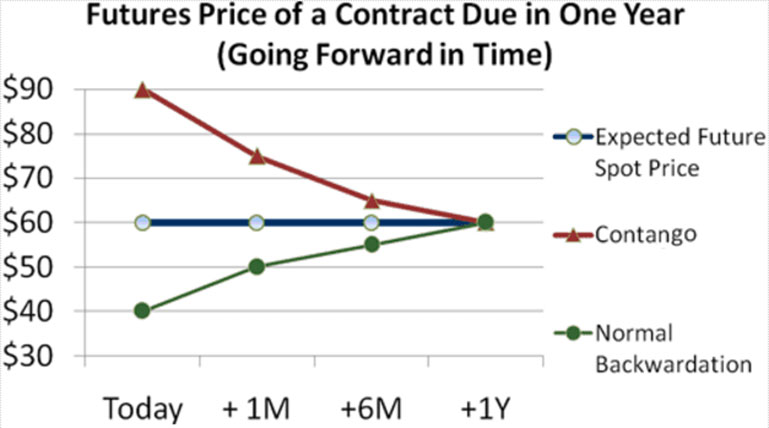

The Freight Futures Forward Curve: The futures forward curve is a graphic representation of future price expectations. If the market expects futures prices to be higher than the spot market rate, then the forward curve will be upward sloping. Conversely if it expects rates to be lower in the future, the forward curve will be downward sloping. Given the seasonality of trucking, the trucking freight futures forward curve is upward sloping at times and at other times downward sloping.

The Basis: The difference between the spot market price and the futures price is called the “basis” and needs to be taken into consideration as it can have an impact on the effectiveness of a hedged position. As an example of a basis in a futures contract, assume the spot price of a lane is $1.50 and the futures price for a certain month is $1.75. In that case, the basis would be $.25. However, as a futures contract approaches expiration, both the spot market rate and futures price should converge. If they didn’t converge, traders looking for arbitrage opportunities would quickly remove any differential between the two prices.

Seasonality: The seasonality of the trucking industry is incorporated into the freight futures prices. If you placed the graph of the spot market rates for the last 12 months above a graph of the futures prices for the next 12 months of the same lane, you should see a similar price pattern.

Price Discovery Benefits of the Forward Curve: The futures forward curve is a very useful price discovery tool: 1) it provides the best source of data available on where rates could be in the future and 2) the “near term” contract (closest futures contract expiring) is a great indicator of current spot market trends given the transparent open market bidding environment that produces true market based prices.

DAT Directional Lane / Calculated Indices Price Methodology: DAT is the largest provider of trucking data in the country and has access to a tremendous amount of daily completed freight loads for lanes nationwide. According to DAT, it sources its rates directly from the accounting systems of shippers, freight brokers and trucking companies based on actual transactions. DAT created each of the 7 directional lanes specifically for the trucking freight futures market. An overview of DAT’s methodology can be found via this link: DAT Van Rate Pricing Methodology

Each of the DAT indices are based on a combination of the directional lanes:

- West US Van – (Los Angeles to Seattle Van + Seattle to Los Angeles Van)/2

- South US Van – (Los Angeles to Dallas Van + Dallas to Los Angeles Van)/2

- East US Van – (Chicago to Atlanta Van + Atlanta to Philadelphia Van + Philadelphia to Chicago Van)/3

- National US Van – (West US Van + South US Van + East US Van)/3

Whether you are looking to hedge or profit via trucking freight futures, it is advisable to engage a futures market advisor that can help determine your trucking rate exposure. The advisor will perform a correlation analysis to determine the optimal futures market strategy to execute given your objectives.

Logistics Management will be launching a new section to reflect the new 3-dimensional market – “Trucking Financial Markets 360o”. This section will be published weekly digitally and monthly in print. This section will provide a comprehensive snapshot of the trucking spot, forward and futures markets along with the diesel/derivatives market and will be an invaluable resource for market participants in the new 3-dimensional trucking market. The content will be provided by Gary Saykaly who heads up Lakefront Futures’ Trucking & Freight Derivatives Group which helps market participants hedge trucking rate and fuel cost volatility risk – [email protected].

Past performance is not necessarily indicative of future results. The risks associated with trading futures and options are substantial. Futures and options trading are not suitable for all investors.

Article Topics

3PL News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates More 3PLLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources