Global Risk Mitigation: Is it time to reshore

If there’s one lesson to learn, it’s that supply chains must now become more resilient. And as more companies consider reshoring to the United States, there are many things to consider beyond just making the economics work.

We didn’t see this coming. Who could have imagined a global pandemic and a three-year trade war with no end in sight? This level of risk has been difficult—if not impossible—to plan for, and it has most certainly been a major wake-up call for companies around the world.

But risk in general—either expected or unexpected—can indeed be planned for and strategies for responding can be developed. The first step is to examine the current state of your risk mitigation plans, or “how we are responding now.” This includes evaluating what is currently working— and what isn’t.

With this baseline of understanding, plans for responding to the next inevitable disaster can be developed. Begin by re-examining policies such as lean, global manufacturing, single-source and risky suppliers, and the potential your organization has to reshore.

Over the past 25 years, globalization, lean manufacturing, improved inventory control, and customer service have revolutionized supply chains. And as supply chains have become global and more tightly stretched, the consequences of supply chain failure have grown exponentially.

Now, managing the risk of failure in supply chains has become a hot topic as more companies focus on supply chain risk planning. With events like 9/11, the Japanese tsunami of 2011, the LA/LB harbor strike of 2014, the Icelandic volcano of 2014, the trade war of 2017-2020, and now the COVID-19 pandemic, supply chain managers are at last taking a hard look at supply chain vulnerabilities and how to mitigate risk.

If there is one lesson to learn, it’s that supply chains must become more resilient.

The practice of lean manufacturing

The pandemic has taught us that “lean” practices may take costs out of supply chains by reducing investment in inventory and minimizing what’s in the pipeline, but there is a significant downside too. Carrying little safety stock plus practicing just-in-time processes can leave a company vulnerable should there be any disruption in supply.

When auto parts manufacturers shut down in Wuhan in January, automakers around the world were scrambling for parts within weeks. Hyundai Motors in Korea had to halt its production lines by the first week in February, citing parts shortages from China.

Lean manufacturing and Six Sigma are the most popular and most common methodologies used in manufacturing. Both lean manufacturing and Six Sigma involve eliminating non-value-added activities that waste time and resources. Lean manufacturing also focuses on improving quality and on-time delivery and driving down costs. However, these methodologies don’t adequately address or elevate the potential for risk.

To balance risk with the quest for eliminating waste and investment in inventory, companies should take a more comprehensive view of the true amount of risk in their supply chains. This involves not only considering inventory levels, but also supplier risk.

Supplier risk

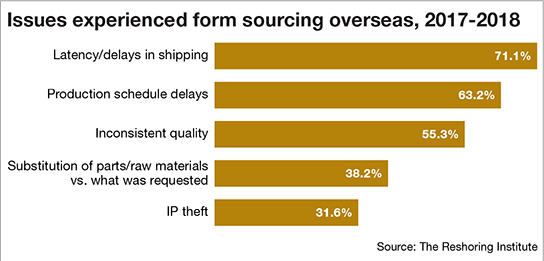

American companies have a new understanding that the least expensive supply or manufacturing options may ultimately bare the highest risks. Foreign suppliers may be subject to all kinds of political risk, including tariffs and trade wars, and even national security risks.

In turn, American industrial buyers may have to deal with delays in shipments or even canceled orders. Tier two and tier three suppliers that are delivering parts to tier one suppliers must also be evaluated for risk, as single-source and sole-source parts and products have always been tagged as high risk.

However, evaluations of these unique suppliers have primarily focused on determining the financial viability of a supplier and supplier willingness to produce. Now, buyers should consider that each supplier might be exposed to all kinds of other risks such as fires, floods, earthquakes, and other natural disasters—even pandemics.

The best approach is to develop risk criteria and a methodology for evaluating and scoring each supplier. Companies should start with the most critical suppliers, single sources, and long-lead time suppliers. This should be done quickly and an action plan should be developed for how to react should some calamity happen. In short, companies must become more prepared in order to survive the next disaster.

Software is now available that uses artificial intelligence to scan the world’s publications and social media looking for risk events. In fact, the software company Resilinc was able to identify a problem in Wuhan, China, in early January and notify its customers that this problem was emerging. This type of early warning gives companies a head start in reacting to keep their supply chains viable.

Considering global locations and reshoring

The growth in global sourcing and manufacturing has been nothing short of astounding, particularly since 2001 when China joined the WTO. The rush to China due to the low-cost manufacturing environment caused the closure of many manufacturing plants in the United States and the loss of millions of jobs. Companies were making decisions based on the undeniable cost savings, and paid little attention to the potential risk and the devastation being left behind all across America.

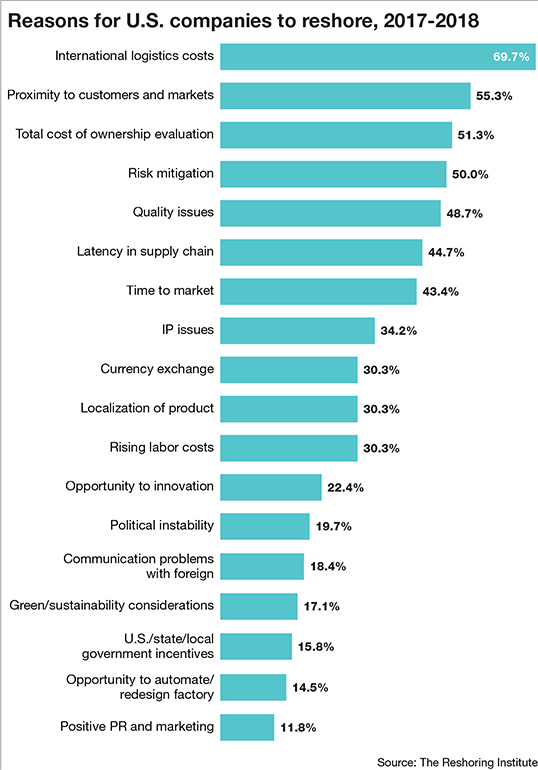

The trade wars with China made these cost structures for imported goods less attractive, and some companies began considering bringing manufacturing to America, or at least evaluating other countries such as Vietnam, India and Mexico as alternative manufacturing locations. But it was the COVID-19 pandemic that really exposed major supply risks.

The U.S. government had reduced its stockpiles of PPE and has had no coordinated approach to sourcing more supplies from the major supplying country—China. Unfortunately, it has been left up to the individual states and hospital companies to compete for global supplies, exposing the risk of rising costs, fraud and counterfeits. And due to the trade war and an adversarial relationship between China and the United States, Chinese suppliers have not been as willing to fill orders going to the United States.

The pharmaceutical industry and the medical device industry were also exposed due to limited production in the United States and dependencies on supply from foreign countries, especially China. Many of the basic building block ingredients and even pharmaceuticals such as antibiotics are sourced in China.

The pharmaceutical industry and the medical device industry were also exposed due to limited production in the United States and dependencies on supply from foreign countries, especially China. Many of the basic building block ingredients and even pharmaceuticals such as antibiotics are sourced in China.

If the U.S. government had paid closer attention to the World Health Organization’s warnings about the potential for pandemic risk, the United States could have been better prepared with stockpiling and alternative sourcing.

Recently, the U.S. government has shown some interest in and potential funding to reshore drug makers’ supply chains in order to bolster supplies during a future health emergency. Companies such as antibiotics maker Paratek agreed to make the shift to the U.S. with financial backing from the government.

However, the United States has traditionally been reluctant to force any company to do anything—instead relying on market forces to drive industrial responses. This time, however, the risk has been exposed and government incentives for companies willing to reshore may be the most appropriate mitigating response.

The risk of leaving China

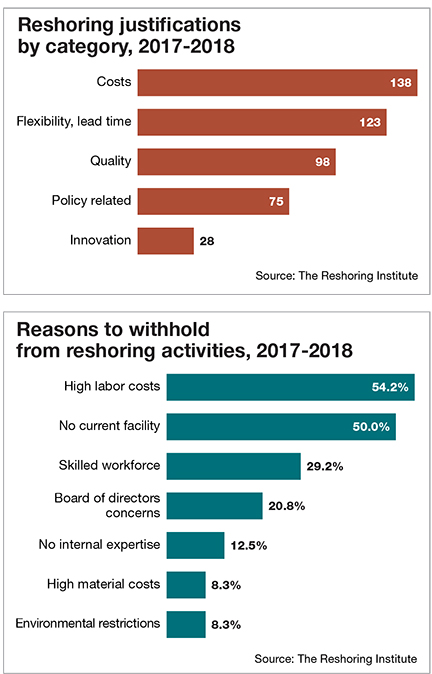

As companies consider reshoring to the United States, there are many things to consider beyond just making the economics work. Leaving a manufacturing site in China presents a lot of potential risks that are not often considered until it’s too late.

Risk of productivity rates and capacity. Companies may find that labor costs are 20% to 30% cheaper in Vietnam or Indonesia, but quality issues and productivity rates may erase the potential cost savings. The learning curve for establishing new production may be longer than a company expects, especially if you are used to China’s manufacturing might and capability.

Other countries aren’t nearly as sophisticated. In a recent comparison of athletic footwear manufacturing in China versus Vietnam, the company found that labor rates in Vietnam were 30% cheaper, but productivity was nearly 20% less and quality was a very significant issue with much higher rework rates than in China.

With many companies now attempting to find alternative manufacturing countries, some places in Vietnam and Thailand are overwhelmed with requests and are refusing to take orders from new customers. Infrastructure in most countries, such as roads, warehousing, airports and harbors isn’t anywhere close to what China has built over the past 25 years.

Often overlooked is the fact that a company’s supply chain will also need to move. Rebuilding sources and supply chains in a new country could take months or years.

Risk of IP theft in other countries. If a company is looking to run away from IP theft problems in China, it must beware of what it’s running toward. IP theft isn’t an isolated problem just in China. Many countries throughout the world have weak IP laws that won’t protect an American company. Counterfeit products come from countries throughout Asia, the Middle East, and more recently Africa.

If the company hasn’t registered its own trademark in China, take note. Many Chinese companies will register a company’s trademark and then use it after the company has left the country, and there really isn’t much anybody can do about it.

The manufacturing IP, tools and molds left behind will likely be used to continue the manufacturing of your company’s products when you leave China. It’s very difficult, if not impossible, to retrieve tools and molds from a Chinese manufacturing site—even if the company thinks they’re the rightful owner.

Simply because a company may have shut down production of its product, the Chinese factory will probably continue to produce it and sell it in domestic and international markets under a slightly different brand.

Risk of labor contracts and permits to leave.

Companies may be required to file for a permit from the Chinese government to close its manufacturing operations. This could take a number of months and also require the company to pay out all of the Chinese employees’ contracts before it can stop operations.

This is likely to be much costlier and lengthier than predicted. Sure, a company could turn off the lights, lock the doors and simply abandon its Chinese operations. But then the company should not expect to ever come back to China. Company executives are likely to not be granted a visa or even detained when trying to visit China in the future.

This is likely to be much costlier and lengthier than predicted. Sure, a company could turn off the lights, lock the doors and simply abandon its Chinese operations. But then the company should not expect to ever come back to China. Company executives are likely to not be granted a visa or even detained when trying to visit China in the future.

Risk of retaliation. Chinese manufacturers or suppliers may be angry that your company is leaving and they may try to retaliate. They might slow production or the fulfillment of orders, or simply refuse to ship at all, especially if there’s a balance due on your account.

In one case, a Chinese contract manufacturer of toys shipped several container loads for the holiday season to an importer/wholesaler in the United States. When the U.S. importer/wholesaler announced they were reshoring manufacturing to America in January, the Chinese contract manufacturer refused to release the containers from the Port of Long Beach.

Before you jump, consider all risks

Before leaving China and reshoring production to the United States, companies must identify all of the risks of a new location as well as those of leaving the current manufacturing site.

The ultimate decision to move to reshore production to America or move to a new country or change foreign suppliers ultimately comes down to the commercial and economic decision-making process. But now, after all the events the world has experienced over the last few years, risk has taken center stage together with cost.

Article Topics

Global Trade News & Resources

Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. Industry experts examine the impact of Baltimore bridge collapse on supply chains More Global TradeLatest in Logistics

Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources